How should we make sense of the latest CPI data? Will the Fed pause the interest rate hikes? 13Jul2023

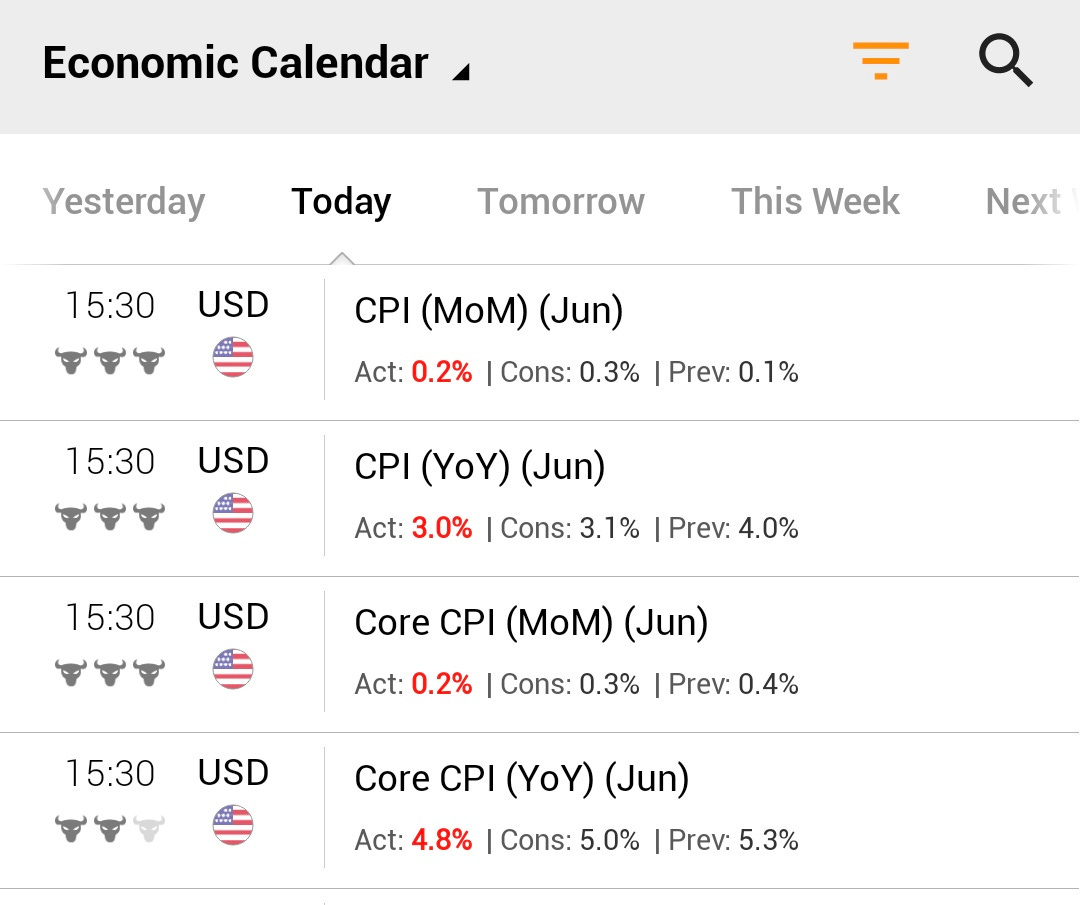

The latest CPI results were released on 12 July 2023:

<from investing dot com>

*U.S CPI 0.2% M/M, EXP. 0.3% *U.S. CPI CORE 0.2% M/M, EXP. 0.3% *U.S. CPI 3.0% Y/Y, EXP. 3.1%, *U.S. CPI CORE 4.8% Y/Y, EXP. 5.0%

When we look at CPI (YoY June), the CPI came out at 3.0% against the consensus of 3.1%. Following the good news, the market has ended on a green day.

From the recent peak of 9.1% to 3.0%, there is definitely success in bringing down inflation. Yet, a CPI of 3.0% means that we still have “sticky” inflation. This means that inflation exists but to a lesser magnitude.

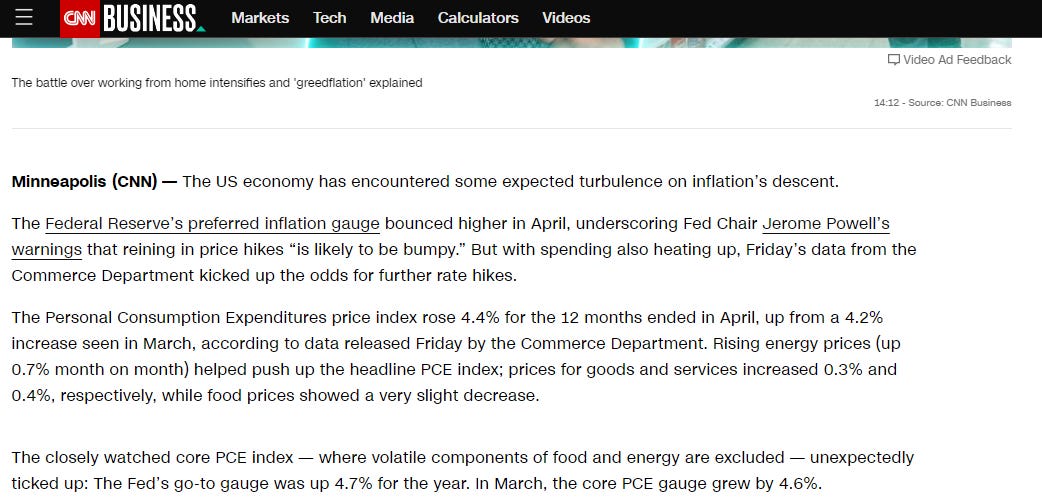

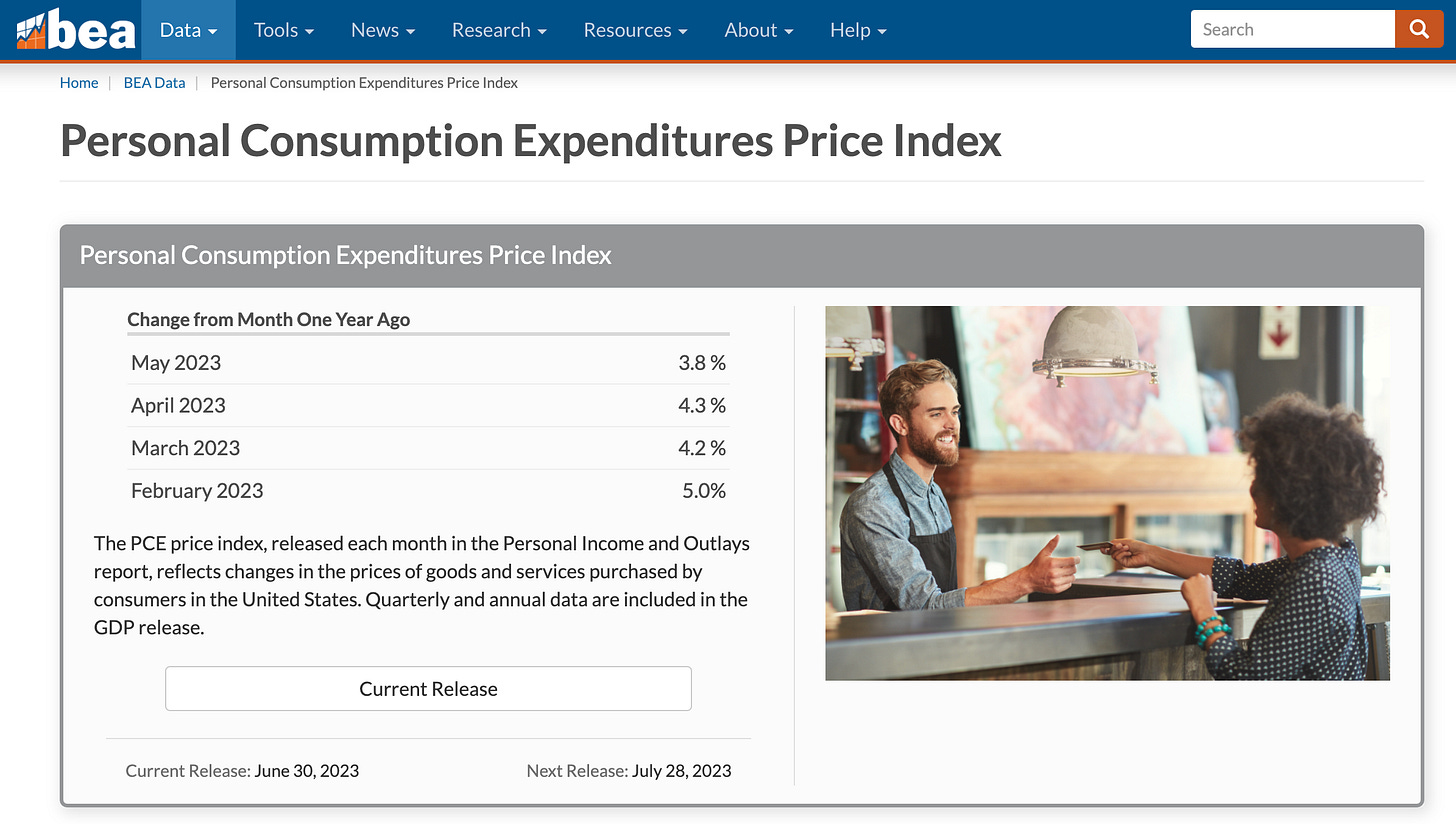

While most of the market celebrates this, the Fed’s preferred inflation gauge is Personal Consumption Expenditure (PCE) as per the CNN news article above. Thus, the Fed gives more weightage to PCE than CPI data. This does not invalidate the data but we should also be considering Fed’s preferred data sources.

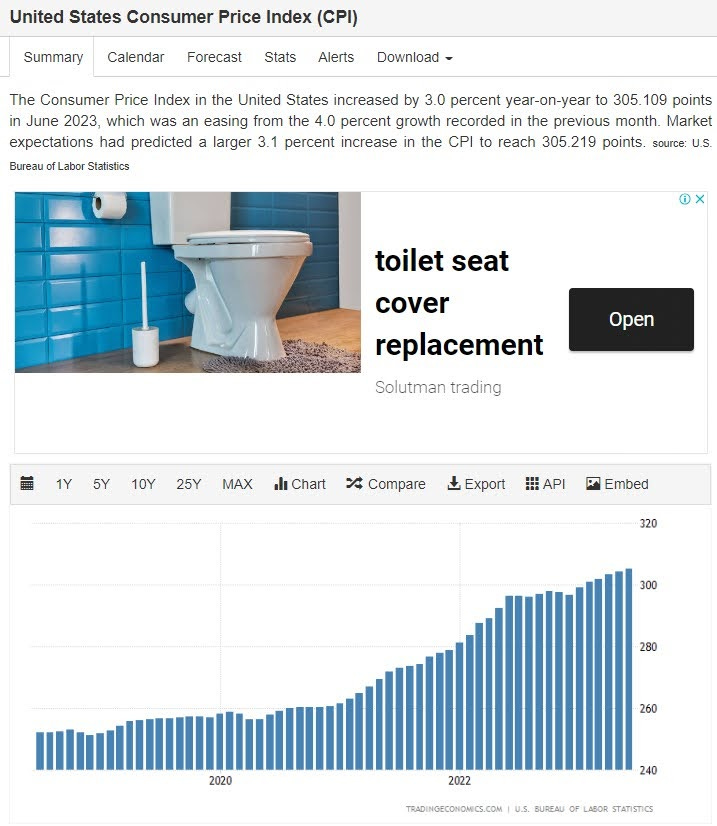

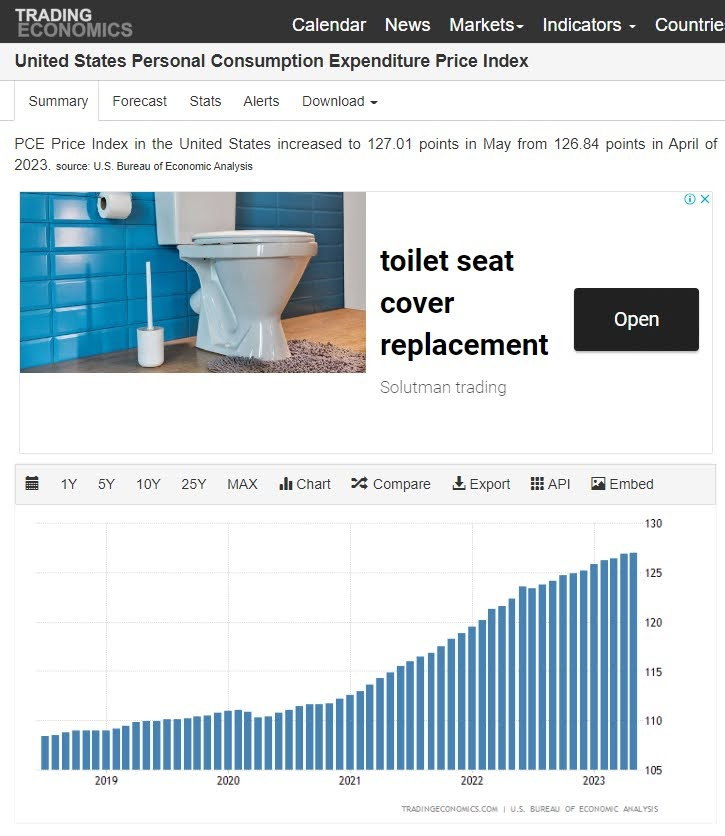

If we look at the CPI chart (from the last 5 years) above, we can notice that inflation remains on an uptrend. Now, let us look at the Fed’s preferred chart of PCE (from the last 5 years).

From Fed’s preferred inflation indicator (PCE), the uptrend remains evident.

Conclusion

The Fed reckons that a growing economy (GDP) should be matched by reasonable inflation of 2%+/- and low unemployment. The Fed would hope to see an uptrend of CPI & PCE (preferred) with an approximately 2% YoY growth. In our case, the magnitude of inflation is still higher than the Fed’s target. The last reported PCE data is 3.8% (YoY).

Given both CPI & PCE remains on a clear uptrend at a bigger magnitude, it seems reasonable for the Fed to raise the interest rates. We are still a distance away from the PCE inflation target of 2%. The next PCE data will be announced on 28 July 2023.

Comments

Post a Comment