Has the US plotted its own downfall with the rise of the debt ceiling? (09July2023)

Has the US signed its own downfall with the rise of the debt ceiling?

Extract from the NY Times news article dated 7 June 2023:

The government is expected to borrow around $1 trillion by the end of September, according to estimates by multiple banks. That steady state of borrowing is set to pull cash from banks and other lenders into Treasury securities, draining money from the financial system and amplifying the pressure on already stressed regional lenders.

Source: https://www.nytimes.com/2023/06/07/business/economy/debt-ceiling-borrowing-binge.html

According to the NY Times article, the US needs to raise $1T by the end of September 2023. Thus far, the Debt Ceiling is over $32T (compared to the $31.4T limit). The US can issue bonds to fund the debt but who is willing and able to buy them? What could follow is the printing of USD, more inflation and followed by more interest rate hikes to bring down inflation.

Bank Term Funding Program (BTFP) - are the US banks doing ok?

The Federal Reserve website defines BTFP as the following:

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

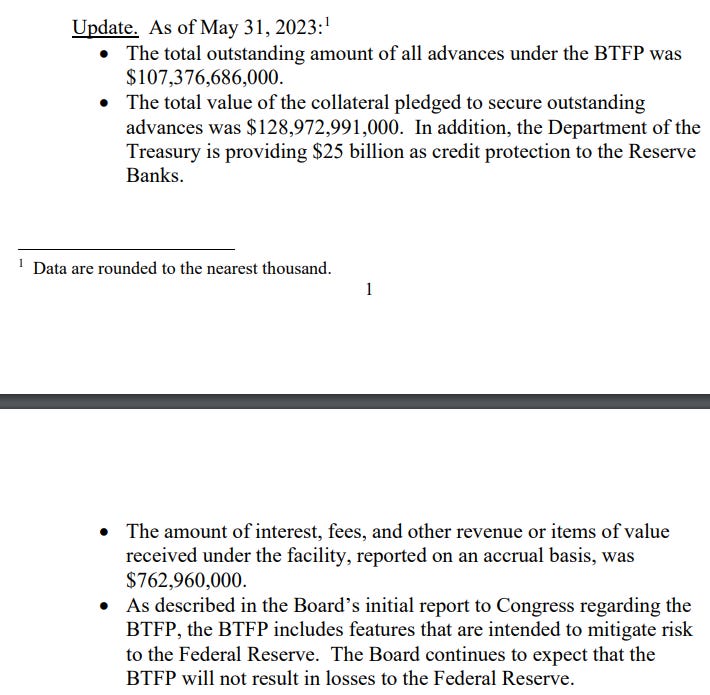

As of 31 May 2023, the total outstanding amount of all advances under the Bank Term Funding Program (BTFP) was $107,376,686,000. As of 30 April 2023, the total outstanding amount of all advances under the BTFP was $83,061,693,000. The increase is $24.3B.

If the banking sector is improving, we should see a downtrend in this BTFP facility.

Fiscal Deficit

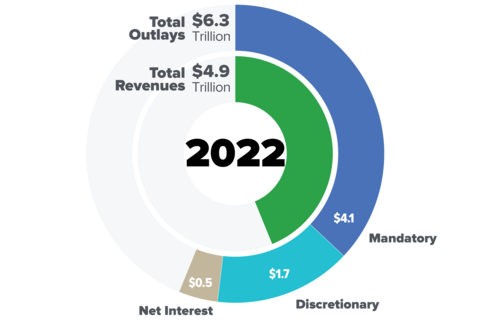

As of 2022, Federal revenue was $4.9T and the Federal outlays were $6.3T. This leaves us with a Federal deficit of $1.4T for 2022. The US Federal government is unable to spend within its means (revenue).

We are at $1.2T (of Federal Deficit) in the first 8 months of Fiscal Year 2023 and borrowing over the past year is over $2T. At the recent 5% interest rate, $2T of borrowing alone is translated to an estimated $100B per year in interest payment alone.

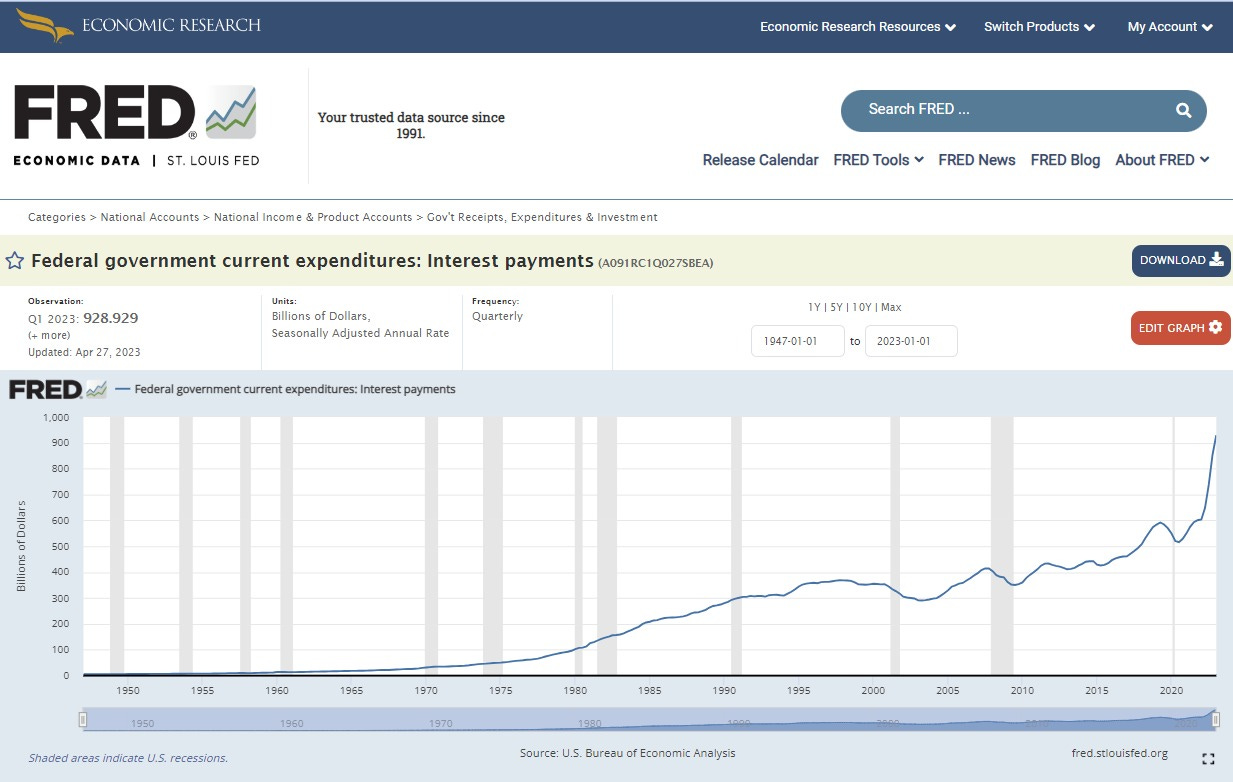

Source: https://fred.stlouisfed.org/series/A091RC1Q027SBEA

As of 27 Apr 2023 (before the rise of the debt ceiling), the amount that the US pays as interest to service these debts reached $928B. This amount paid to service US debts is already bigger than the entire US defence budget.

CBO’s current projections show a federal budget deficit of $1.5 trillion for 2023. The deficit will grow as the US re-finances up to 40% of its expiring bonds. Given the surge of new bonds following the rise of the Debt Ceiling, we should expect the interest paid to be even more. Should we be surprised that this interest paid to debts exceeds $1T in the coming months? This amount of money can serve the country better when directed to healthcare, education and infrastructure.

Is the US raising new debts to pay off the interests of the existing debts? Is this sustainable?

My muse

If the USA continues its current fiscal spending, it would not be the subprime or another “Lehman brothers” who bring down the economy. One of the reasons for the economic collapse should be “Fiscal Mismanagement” by spending what the Federal government cannot afford. But there is still time to turn things around.

I believe that the global economy is able to get past the various challenges when the 2 biggest economies (the US & China) work together. It is not the time for more sanctions. It is time for more collaborations. I understand that there are some conflicting issues but we should work together for the greater good, based on the areas that we can agree upon.

The update above sounds contrary to the bull market we see in NASDAQ and the recent surge in S&P500. Despite the rally, I recommend hedging, avoiding leverage and researching before investing. The market sits on uneasy fundamentals and caution is advised.

Comments

Post a Comment