Companies with debts & risk of default - is Baxter ok? (13Jun2023)

My investing muse

I have been monitoring the debt situation and wonder if there are any companies at risk of default. With a 500 basis point interest rate surge in one year, interest expenses will be glaring in the books. With sticky inflation, the era of cheap financing looks to be over. For companies that require loans and overdrafts to get over business cashflow crunch, the surge in interest rate can eat into their margins. In fact, companies with many liabilities (debts) could be at risk. It is time for us to review our portfolio and look out for businesses with increased risk of default.

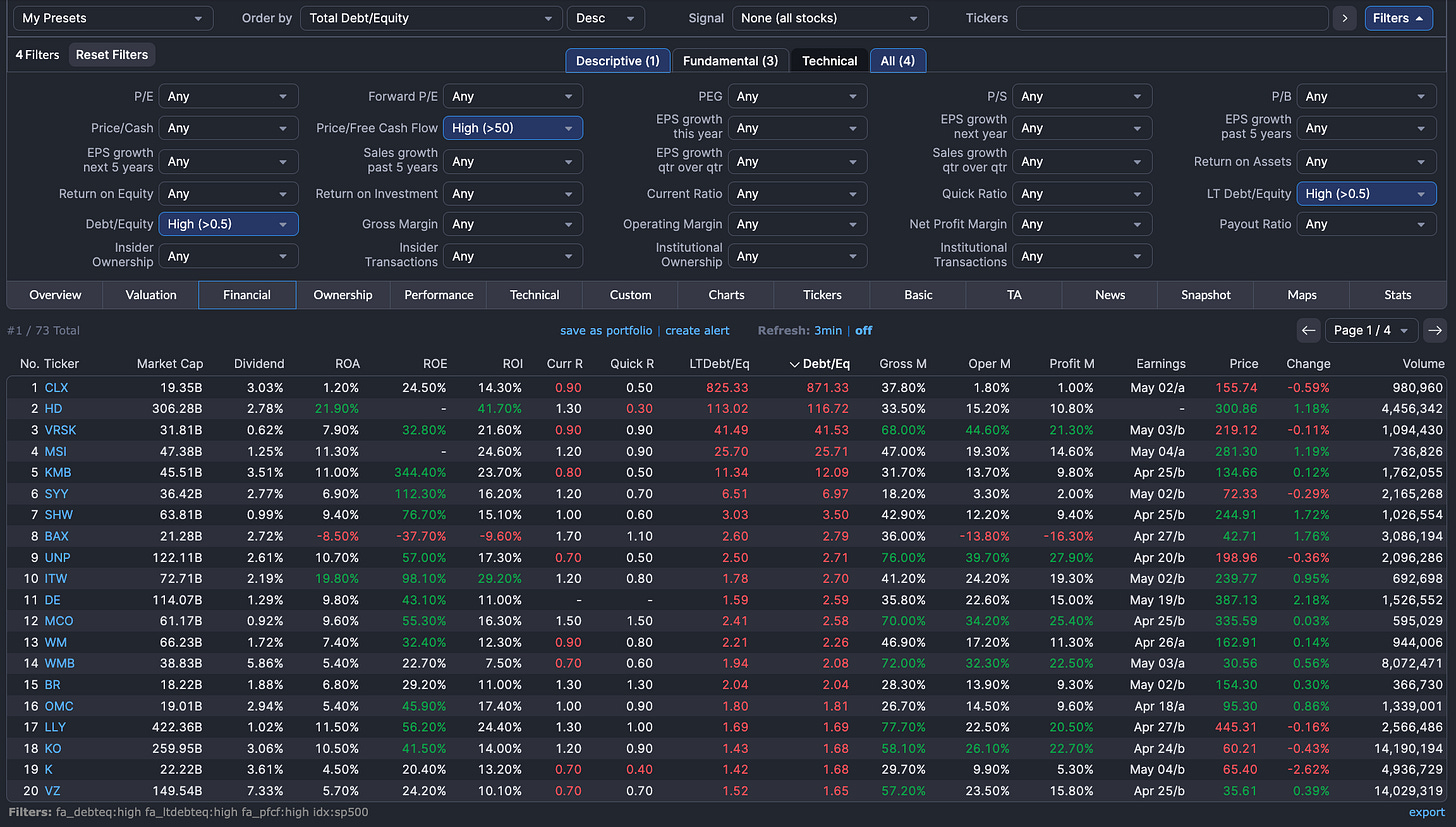

Thus, I have started to research and the above is the list of companies sorted by the main filter of Debt/Equity ratio. Clorox, Home Depot & Baxter caught my attention. Baxter has a high Debt/equity ratio and is in the red (net income loss), with negative ROA, ROE and ROI.

From investopedia:

ROE and ROA are important components in banking for measuring corporate performance. Return on equity (ROE) helps investors gauge how their investments are generating income, while return on assets (ROA) helps investors measure how management is using its assets or resources to generate more income.

The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The interest coverage ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) by its interest expense during a given period.

I have reached out to Google Bard to help to research this using the S&P500. My search starts with debt/equity ratio which should be as low as possible. I will also look into other components such as cash flow, liquidity and profitability. If the business is not making profits, incurring more debts and has cash flow issues, the risk of default increases significantly. Interestingly, some of the companies with (high) risks of default include Occidental (which was invested by Mr Buffett), Marathon, and Phillips 66 ~ most of these are from the oil/gas. Looking at the Debt/equity and interest coverage ratio is just the start. Let us look into the financials in detail and do not forget qualitative components such as branding.

It is time for us to review the debt incurred by our investments and take profits or stop losses for assets with deteriorating fundamentals.

I have reached out to Google Bard who has provided the following.

Research from Google Bard

There are a number of financial data points that can be used to identify risks of default. Some of the most important include:

Debt to equity ratio: This ratio measures the amount of debt a company has relative to its equity. A high debt to equity ratio is a sign of financial risk, as it indicates that the company is relying on debt to finance its operations.

Credit rating: A credit rating is a measure of a company's ability to repay its debts. A low credit rating is a sign of financial risk, as it indicates that the company is considered to be a high default risk.

Interest coverage ratio: This ratio measures the amount of income a company has available to cover its interest payments. A low interest coverage ratio is a sign of financial risk, as it indicates that the company may be unable to make its interest payments.

Cash flow: Cash flow is the amount of money a company generates from its operations. A negative cash flow is a sign of financial risk, as it indicates that the company is spending more money than it is bringing in.

Profitability: Profitability is a measure of how much money a company makes after expenses. A low profitability is a sign of financial risk, as it indicates that the company may not be able to generate enough income to cover its debt payments.

Liquidity: Liquidity is a measure of how easily a company can convert its assets into cash. A low liquidity is a sign of financial risk, as it indicates that the company may not be able to meet its debt payments if it needs to.

It is important to note that no single financial data point can definitively predict whether or not a company will default. However, by looking at a company's financial data as a whole, investors can get a better understanding of the company's financial health and its risk of default.

In addition to the financial data points listed above, investors may also want to consider other factors that could increase a company's risk of default, such as:

Industry risk: Some industries are more prone to default than others. For example, the energy industry is cyclical, which means that it is subject to periods of boom and bust. During a bust, energy companies may experience declining profits and cash flow, which could increase their risk of default.

Economic conditions: Economic conditions can also impact a company's risk of default. For example, a recession can lead to declining profits and cash flow for many companies, which could increase their risk of default.

Political risk: Political risk is the risk that a company's operations could be disrupted by political instability or government intervention. This type of risk can be particularly high in developing countries.

By considering all of these factors, investors can get a better understanding of the risks involved in investing in a particular company.

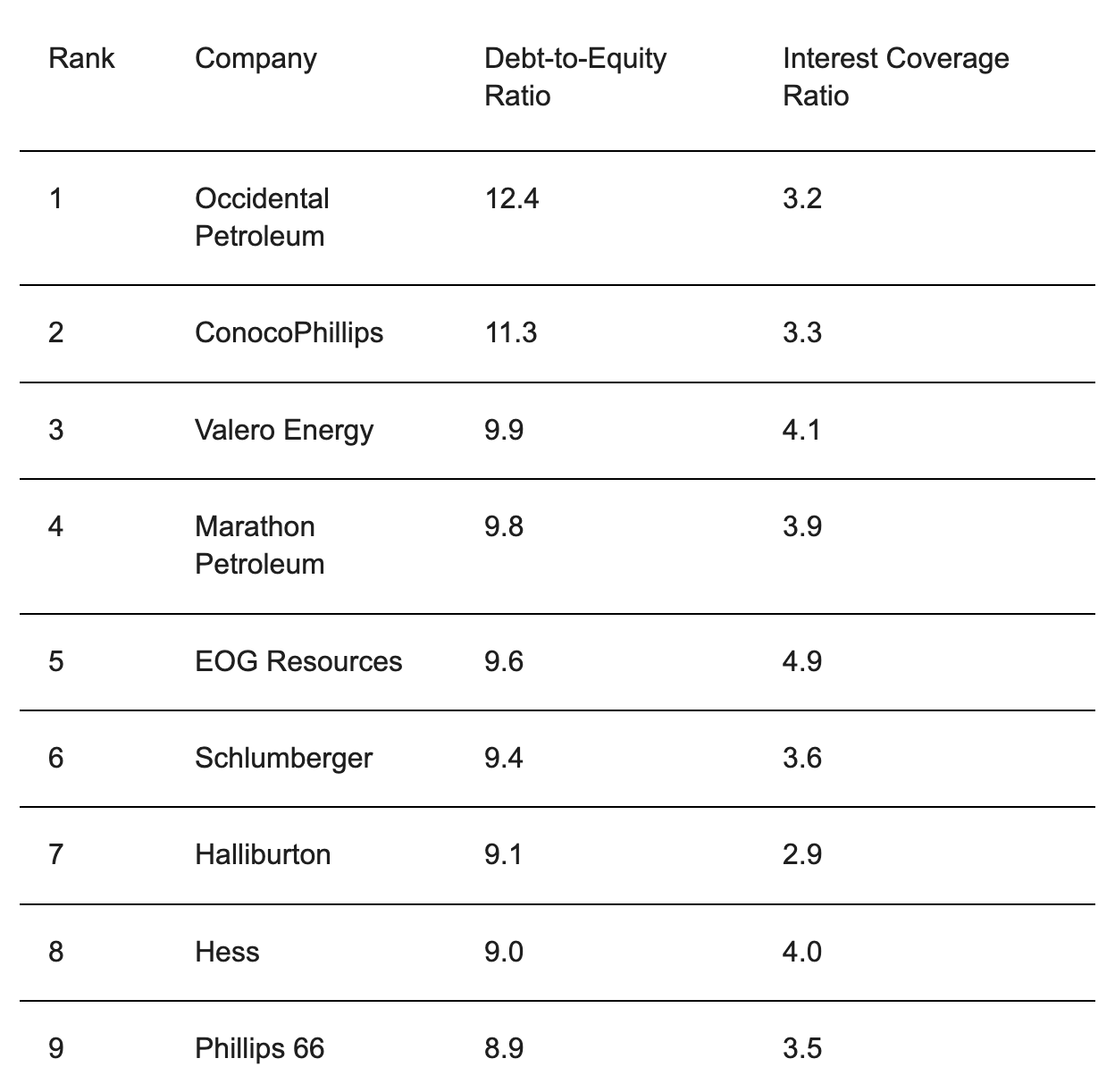

Here is a list of the top 10 S&P 500 companies that are running the risk of default, backed with financial data or ratios:

These companies are all facing significant financial challenges, including high debt levels, low interest coverage ratios, and declining cash flow. As a result, they are at risk of defaulting on their debt.

Here is a brief explanation of each of the financial ratios used to determine the risk of default:

Debt-to-equity ratio: This ratio measures the amount of debt a company has relative to its equity. A high debt-to-equity ratio indicates that a company is heavily indebted and may be at risk of default.

Interest coverage ratio: This ratio measures how easily a company can afford to pay its interest payments. A low interest coverage ratio indicates that a company may have difficulty making its interest payments and may be at risk of default.

It is important to note that these are just a few of the factors that can contribute to a company's risk of default. Other factors, such as the company's industry, its management team, and the overall economic environment, can also play a role.

Investors should carefully consider all of these factors before investing in any company that is facing financial challenges.

Comments

Post a Comment