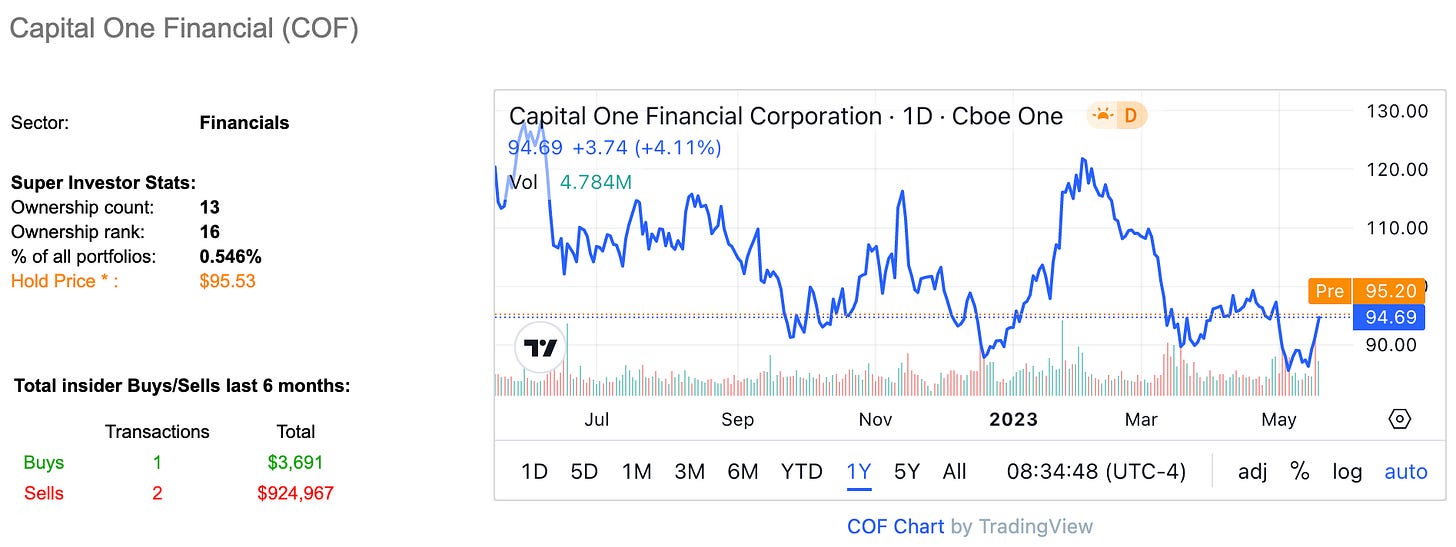

Buffett & Burry invested into a new bank stock Capital One in Q1/2023 (18May2023)

1 interesting name that came out during the recent Q1/2023 13F submissions is a bank by the name of Capital One Financials (COF).

From Dataroma, COF is listed as one of the top buys in Q1/2023 based on the latest 13F submissions from a list of 70+ superinvestors.

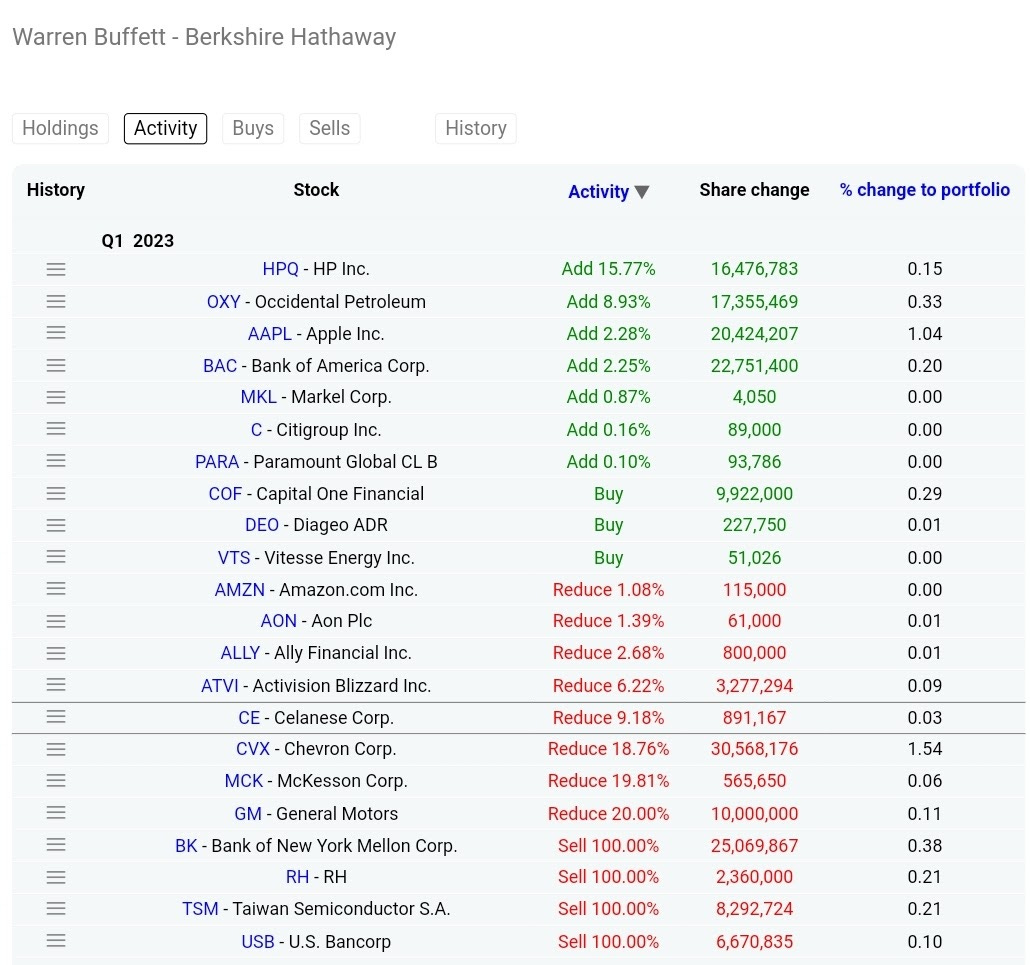

What intrigued me was that 2 of my favourite investors ~ Mr Warren Buffett and Mr Michael Burry have invested in this company for the first time.

This led me to reach out to Google Bard to deep dive into the performance of COF. I started by checking on the recent background of COF, the unique selling points of COF, the Q1/2023 performance and the earnings summary from 2017 to 2022. I have also asked for qualitative factors like an increasing pool of customers, increased loan originations and strong credit quality.

<The following section is extracted from Google Bard AI.>

Who is Capital One Financial Corp?

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the list of largest banks in the United States and has developed a reputation for being a technology-focused bank.

Capital One was founded in 1988 by Richard Fairbank and Nigel Morris. The company was originally called Signet Bank, but it was renamed Capital One in 1994. Capital One's initial focus was on direct marketing of credit cards, and the company quickly became one of the largest credit card issuers in the United States.

In the early 2000s, Capital One began to expand its product offerings beyond credit cards. The company acquired several banks and other financial institutions, and it began to offer a wider range of products, including auto loans, student loans, and home loans.

Today, Capital One is one of the largest banks in the United States. The company has over 755 branches and 2,000 ATMs. Capital One also has a large online presence, and it offers its products and services to customers in the United States, Canada, and the United Kingdom.

Capital One's industry focus is on consumer banking. The company offers a wide range of products and services to consumers, including credit cards, auto loans, student loans, and home loans. Capital One also offers a variety of online banking services, including bill pay, online transfers, and mobile banking.

Unique selling points of COF

Capital One's unique selling points include its use of data and technology to improve its products and services. The company uses data to target its marketing campaigns and to make lending decisions. Capital One also uses technology to improve its customer service and to make its products and services more convenient for customers.

As of 2023, Capital One has over 60,000 employees. The company's headquarters is located in McLean, Virginia. Capital One also has offices in the United States, Canada, and the United Kingdom.

Capital One is a publicly traded company. Its stock is listed on the New York Stock Exchange under the ticker symbol COF.

Here are some of Capital One's unique selling points:

Data-driven marketing: Capital One uses data to target its marketing campaigns and to make lending decisions. This allows the company to reach its target customers more effectively and to make more informed lending decisions.

Convenient online banking: Capital One offers a variety of online banking services, including bill pay, online transfers, and mobile banking. These services make it easy for customers to manage their finances from anywhere.

Excellent customer service: Capital One has a reputation for excellent customer service. The company offers a variety of ways for customers to contact customer service, including phone, email, and chat.

Wide range of products and services: Capital One offers a wide range of products and services to consumers, including credit cards, auto loans, student loans, and home loans. This allows the company to meet the financial needs of a wide range of customers.

Capital One is a leading provider of consumer banking products and services in the United States. The company's use of data and technology, convenient online banking, excellent customer service, and wide range of products and services make it a popular choice for consumers.

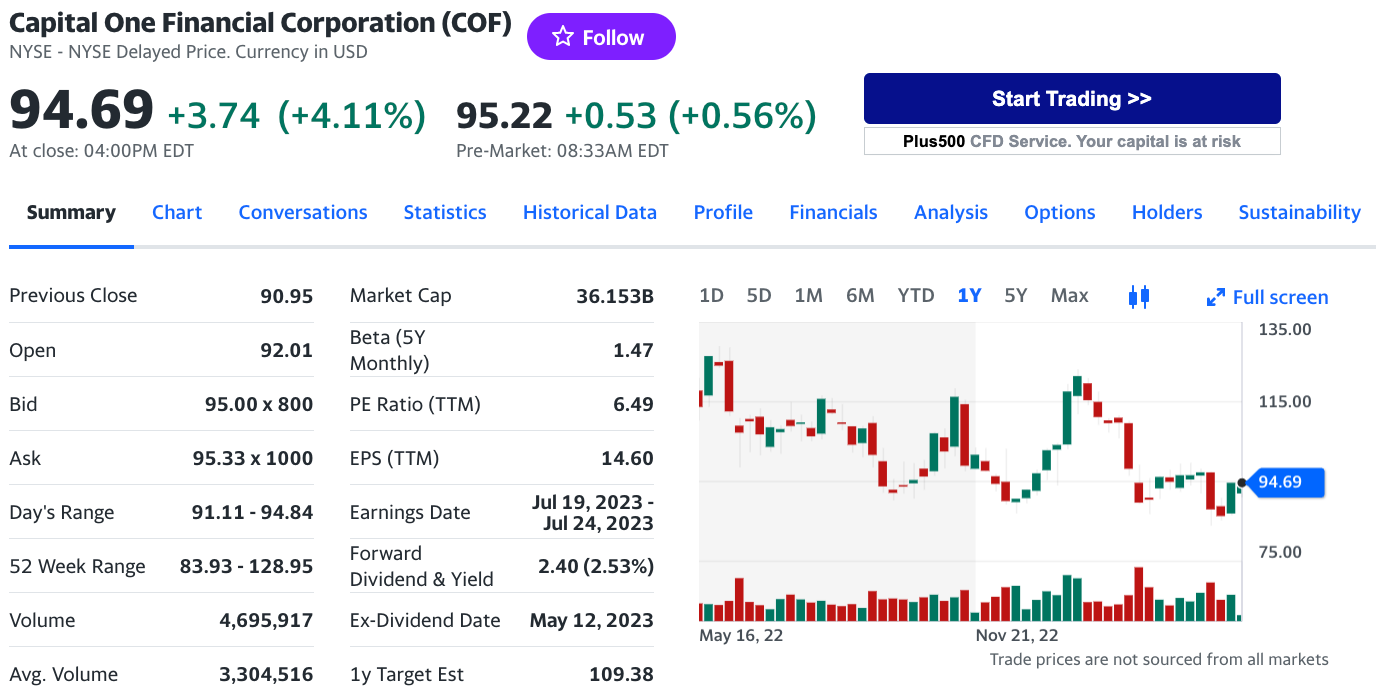

Performance of COF

Here is a summary of Capital One's latest earnings figures in revenue, net income, total deposits, total assets, total liabilities, FCF, debt to equity ratio, and retained earnings:

Metrics Value

Revenue ~ $41.28 billion

Net Income ~ $17.91 billion

Total Deposits ~ $300.8 billion

Total Assets ~ $457.8 billion

Total Liabilities ~ $398.2 billion

Free Cash Flow ~ $13.4 billion

Debt to Equity Ratio ~ 1.04

Retained Earnings ~ $114.6 billion

(Please note that these figures are for the most recent quarter, which ended in March 2023.)

COF’s financial health

Capital One's latest earnings figures show that the company is in good financial health. The company's revenue and net income are both up year-over-year, and its total deposits and total assets are also up. Capital One's debt to equity ratio is slightly above the industry average, but it is still within a healthy range. The company's free cash flow is also strong, which means that it has the financial resources to invest in its business and return capital to shareholders.

Overall, Capital One's latest earnings figures show that the company is in good financial health and is well-positioned for continued success in the future.

Capital One Financial Corporation (COF) is a diversified financial services holding company headquartered in McLean, Virginia. The company offers a wide range of financial products and services, including credit cards, auto loans, student loans, and home loans.

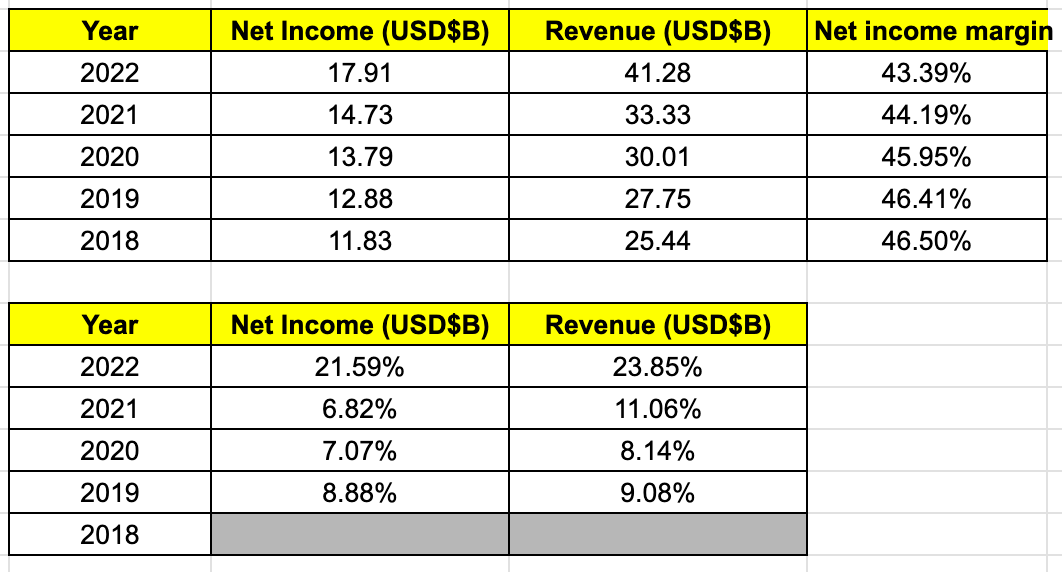

Capital One has been performing well financially over the past five years. In 2022, the company reported net income of $17.91 billion, an increase of 21.7% from 2021. Revenue for the year was $41.28 billion, an increase of 24.95% from 2021.

Capital One's strong financial performance is due to a number of factors, including:

- A growing customer base: Capital One has been adding new customers at a steady pace over the past five years. In 2022, the company added 12.3 million new customers, bringing its total customer base to 104.4 million.

- Increased loan originations: Capital One has been increasing its loan originations over the past five years. In 2022, the company originated $141.2 billion in loans, an increase of 20.1% from 2021.

- Strong credit quality: Capital One has maintained strong credit quality over the past five years. The company's net charge-offs as a percentage of average loans were 1.3% in 2022, down from 1.5% in 2021.

Capital One is well-positioned for continued financial success in the years to come. The company has a strong customer base, a growing loan portfolio, and strong credit quality. Capital One is also investing in new technologies and products, which will help the company to grow its business in the future.

Here is a table summarizing Capital One's financial performance over the past five years:

My investing muse

Google Bard has provided a good framework justifying the qualities of COF with well-rounded financial figures compilation from the income statement, balance sheet and also cash flow. On top of this, they have also provided factors justifying the unique selling points of the bank. The bank has a good regional presence and has demonstrated strong growth over the recent 6 years.

Overall, I am pleased with the research done by Bard as this has allowed me more time to analyze and strategize. Based on the data above, COF looks to be strong and has been showing good growth.

From the 13F summary of Mr Buffett (Berkshire), he has also exited from several bank stocks like USB and BK. With his additional buys into other banks, this implies that some of the banks may still have some risks or concerns.

COF bank stock ranged between 86.84 to 123.09 in Q1/2023. In a typical value investing fashion, we can expect Mr Buffett to apply a good margin of safety to the stock price. Thus, the current price of 90+ does look attractive. Personally, I think that the banking crisis is yet to be over. I do not understand banks and their operations adequately, thus, I prefer to stay away from banking stocks till things are better.

As always, let us research before investing.

Comments

Post a Comment