Asset Classes and their recent growth (13Jun2023)

We have investments in different asset classes. The below is a good summary provided by The Motley Food.

Investing is a good way to grow our net worth and hopefully, provide us the means to achieve a certain lifestyle. For most of us, we are fortunate to be living in a place we can call our own. Some of us can still be servicing the mortgage but real estate is an asset class that has been “compounding” value over the years for me. Personally, my biggest and best returns asset class are through my real estate with a reasonable rental yield and asset capital appreciation.

With the US government issuing bonds after raising the debt limit, I am curious to know how this can impact and attract liquidity in the market. Thus, I started researching with Google Bard to understand the different asset classes in play.

Most of us (who read this article) are probably investing in equities. However, do we know that the bonds and real estate market are bigger than the equities market? Yet, the equities market has had the biggest growth of 15% in the last 3 years followed by real estate with a 3-year growth of 10%.

Let us try to avoid leverage coming into investing. For me, the first home is for habitat and not for investments. Let us consider the review of all asset classes that we hold as we rebalance to tackle the coming (volatile) market.

<The following section is extracted from Google Bard>

The biggest asset classes in the world are:

Real estate: Real estate is the largest asset class in the world, with a total value of $228 trillion. This figure is more than 12 times the GDP of the United States and 18 times the GDP of China. Real estate is a valuable asset class because it is a tangible asset that can provide both income and capital appreciation.

Equities: Equities, or stocks, are another large asset class, with a total value of $70.1 trillion. Equities are a popular investment because they have the potential to generate high returns over the long term. However, equities are also a risky investment, as their prices can fluctuate significantly in the short term.

Bonds: Bonds are a type of fixed-income investment, which means that they pay a fixed interest rate over a set period of time. Bonds are considered to be a lower-risk investment than equities, but they also offer lower potential returns.

Cash and cash equivalents: Cash and cash equivalents are the most liquid asset class, meaning that they can be easily converted into cash. Cash and cash equivalents are a good choice for investors who want to preserve their capital or who need to access their funds quickly.

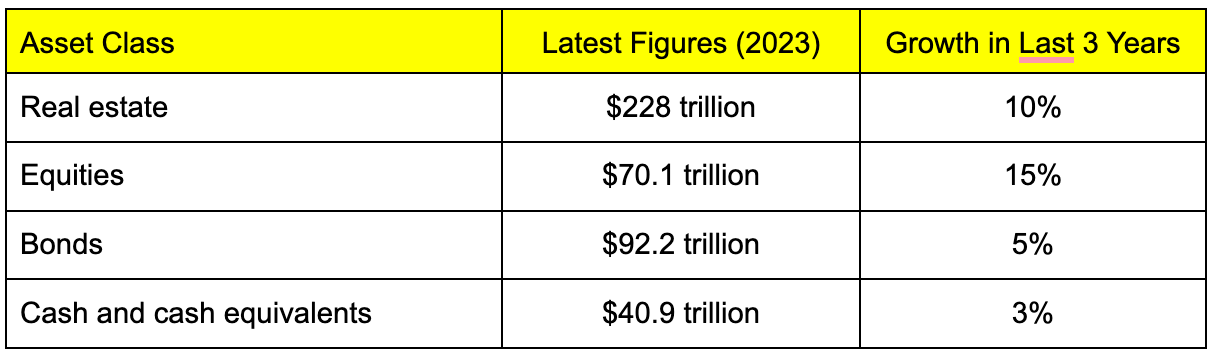

The following table shows the latest figures and the growth in the last 3 years for the biggest asset classes in the world:

As you can see, the biggest asset classes in the world have all grown in value over the past 3 years. However, the growth has not been uniform across all asset classes. Real estate has seen the strongest growth, followed by equities and bonds. Cash and cash equivalents have seen the slowest growth.

The growth in asset prices over the past 3 years has been driven by a number of factors, including low interest rates, strong economic growth, and increased investor confidence. However, it is important to remember that asset prices can also decline, and investors should always be aware of the risks involved in investing.

Comments

Post a Comment