Are the US banks doing ok after the recent Fed stress test? (09Jul2023)

(All) 23 banks passed the Fed’s stress test

As per the news screenshot above, all 23 banks have survived the recent stress test by The Federal Reserve.

Here are news extracts from this article dated 29 Jun 2023:

All 23 US banks that participated in a new Federal Reserve stress test would be able to withstand a severe global recession, demonstrating the strength of the biggest financial institutions at a time when the banking industry still is on uncertain ground.

Results released by the Fed Wednesday show that these banks would have enough capital on hand to absorb losses and continue lending even if unemployment were to hit 10% and the stock market were to plunge 45%.

Their projected losses would amount to $541 billion under that hypothetical scenario.

This year the Fed examined how 23 banks would fare under a severe global recession that included severe stress in commercial real estate. In such a scenario unemployment spikes to 10%, home prices and commercial real estate plunge about 40%, the stock market plummets 45%, market volatility jumps and corporate bond yields rise.

All 23 banks in aggregate would have lost $541 billion. Yet they would still have capital equal to 10.1% of total assets weighted by risk. Well above the 4.5% the Fed requires.

Bank of America has a $100B paper loss in the bond market

Source: https://www.ft.com/content/df4f343c-5666-43a2-ba01-ef315bfb119a

Here is the news extract:

Bank of America is bearing the cost of decisions made three years ago to pump the majority of $670bn in pandemic-era deposit inflows into debt markets at a time when bonds traded at historically high prices and low yields.

The moves left BofA, the second-largest US bank by assets, with more than $100bn in paper losses at the end of the first quarter, according to data from the Federal Deposit Insurance Corporation. The sum far exceeds unrealised bond market losses reported by its largest peers.

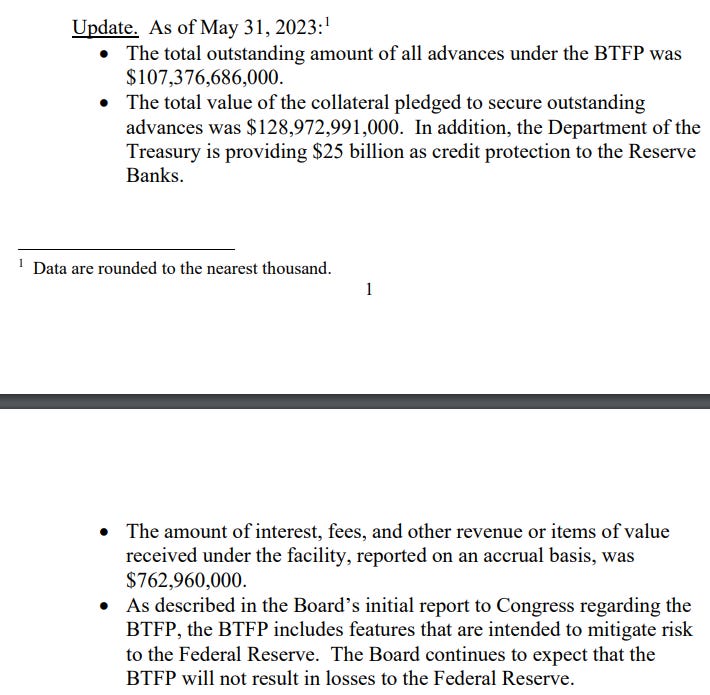

Bank Term Funding Program (BTFP) - are the US banks doing ok?

The Federal Reserve website defines BTFP as the following:

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

As of 31 May 2023, the total outstanding amount of all advances under the Bank Term Funding Program (BTFP) was $107,376,686,000. As of 30 April 2023, the total outstanding amount of all advances under the BTFP was $83,061,693,000. The increase is $24.3B.

If the banking sector is improving, we should see a downtrend in this BTFP facility.

My muse

When the Fed stress test success was announced, one of the expectations would be to give confidence to the public. It should serve as an assurance that the banking sector is able to withstand the various challenges (in the stress test).

While the 23 banks have done well, this may not represent the banking industry and some of the regional banks which are at risk. I would have preferred for this stress test to be conducted for a much bigger representation of the banks. In a banking collapse, it has a domino effect as banks support one another with deposits, cash flow and withdrawals.

My concern can be seen in the (monthly) withdrawals from BTFP. BTFP is set up so that the banks can have access to loans to “meet the needs of the depositors”. This BTFP withdrawal should be winding down. So long as there are withdrawals, there remain weaknesses in the banking sector.

This is evident when one of the biggest banks “Bank of America” announced their Q1 unrealized losses in bonds of $100B. With the recent rate hikes after Q1, their losses should deepen even more.

As the government oscillate between guaranteeing and not guaranteeing deposits, there is no assurance for the citizens. This remains an area of concern. Though 23 banks have done well in the stress test, this may not represent the industry especially when the regional banks have notable risk exposures to commercial real estate (CRE). This is a concern with expiring leases, high-interest rates and high office vacancies in some cities. The hybrid of working from home is not helping. With refinancing, the drain could be stressful.

Let us monitor this closely as a collapse in the banking sector will spread quickly to the rest of the industries.

Comments

Post a Comment