An lesser known oil & gas player in US - Evolution

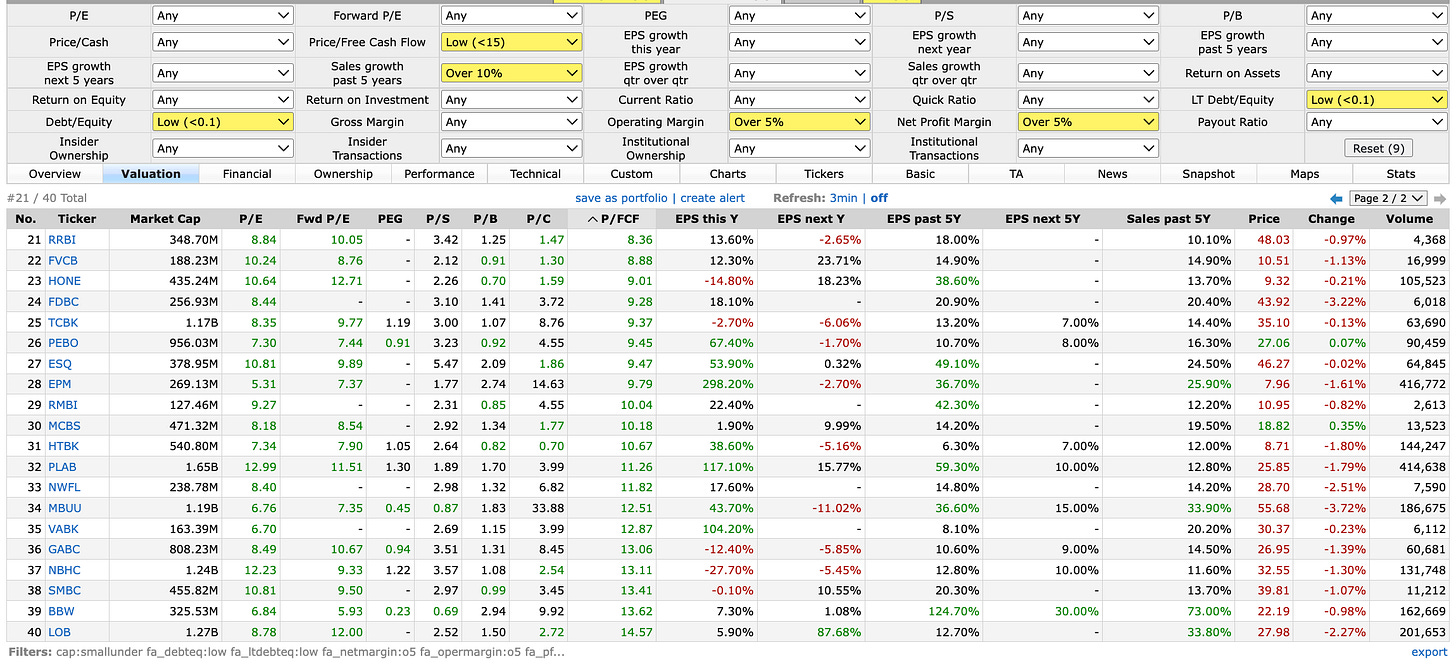

A stock screener was set to comb through small/nano-cap businesses in the US.

The criteria include:

- Low Price/Free Cash Flow (less than 15)

- Sales growth past 5 years (more than 10%)

- Low Debt/Equity (less than 0.1)

- Low LT Debt/Equity (less than 0.1)

- Operating margin (over 5%)

- Net Profit margin (over 5)%

The above criteria is a quick overview covering income statement, balance sheet & cash flow statements. This is just a quick overview and more detailed scrutiny is needed to give us better confidence in the business.

From the screened stock list, one stock caught my attention (as the list is largely dominated by regional banks).

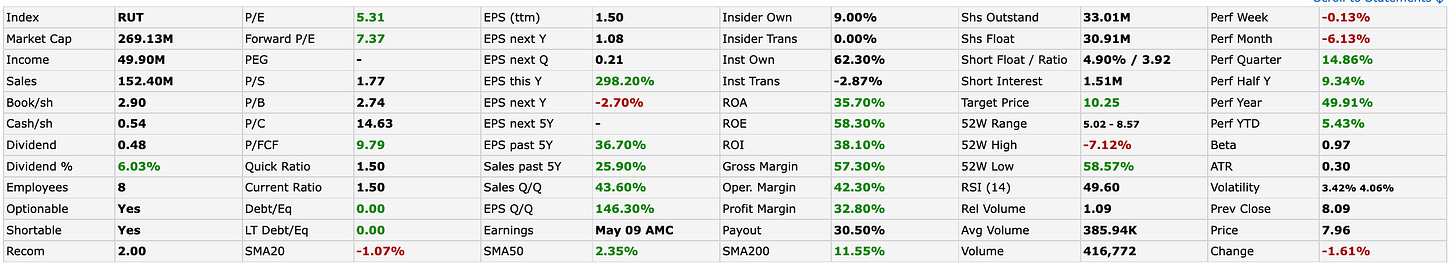

Company of interest - EPM 0.00%↑ Evolution Petroleum (EPM)

Apart from the criteria above, EPM has displayed good financial fundamentals as per the table above.

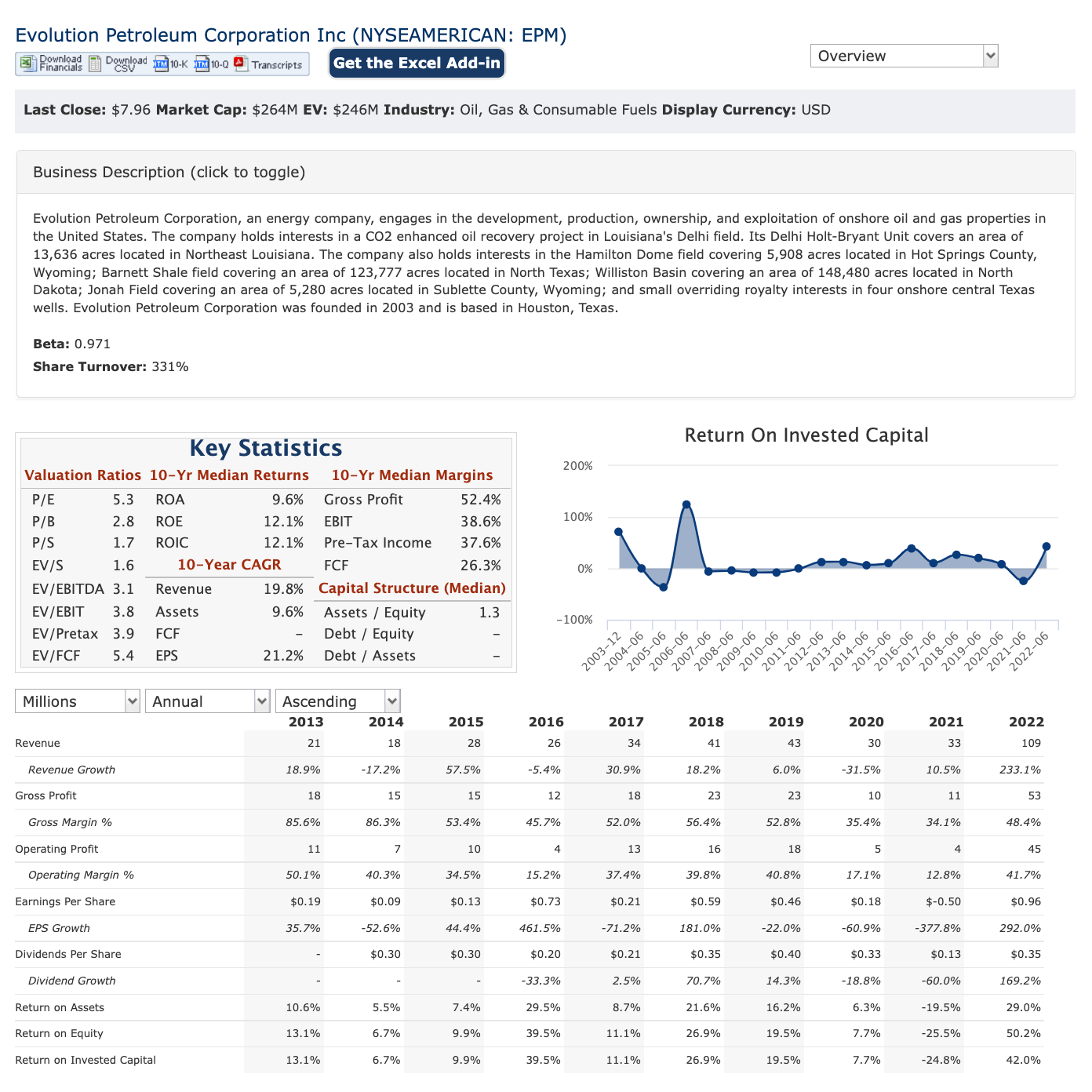

Let us look at the past performances of EPM

Overview of EPM:

Record revenue in 2022 (which is aided by the sky-high oil prices) at $109M

Operating profit is $45M at an operating margin of 41.7%.

There is a strong growth of EPS at 292% to $0.96

At P/E of 5.3, EPM looks to be good bargain

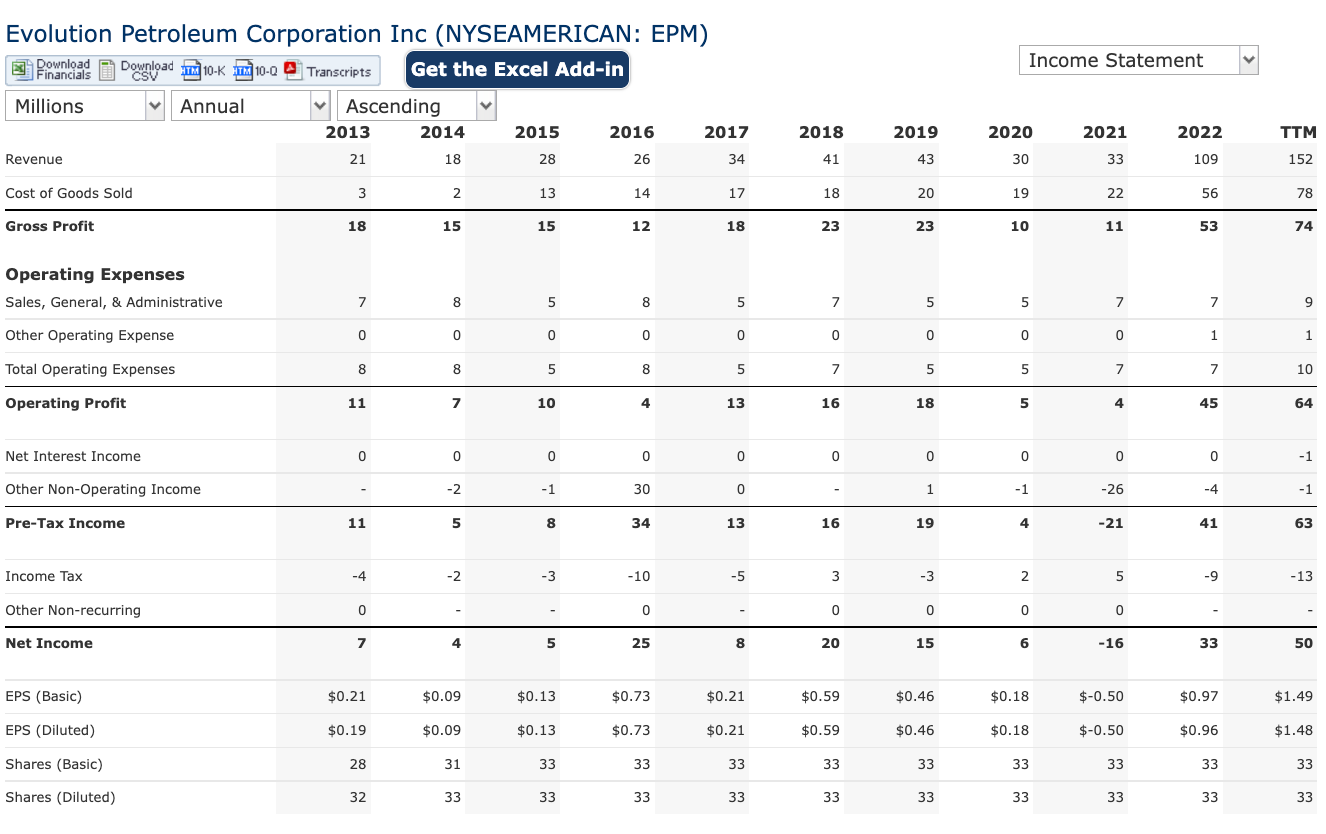

Observations from the income statement:

TTM revenue hits a record of $152M

TTM revenue hits $50M (compared to $33M for the calendar year of 2022)

There is good growth of EPS from $0.97 (2022) to $1.49 (TTM), a good 50+% growth.

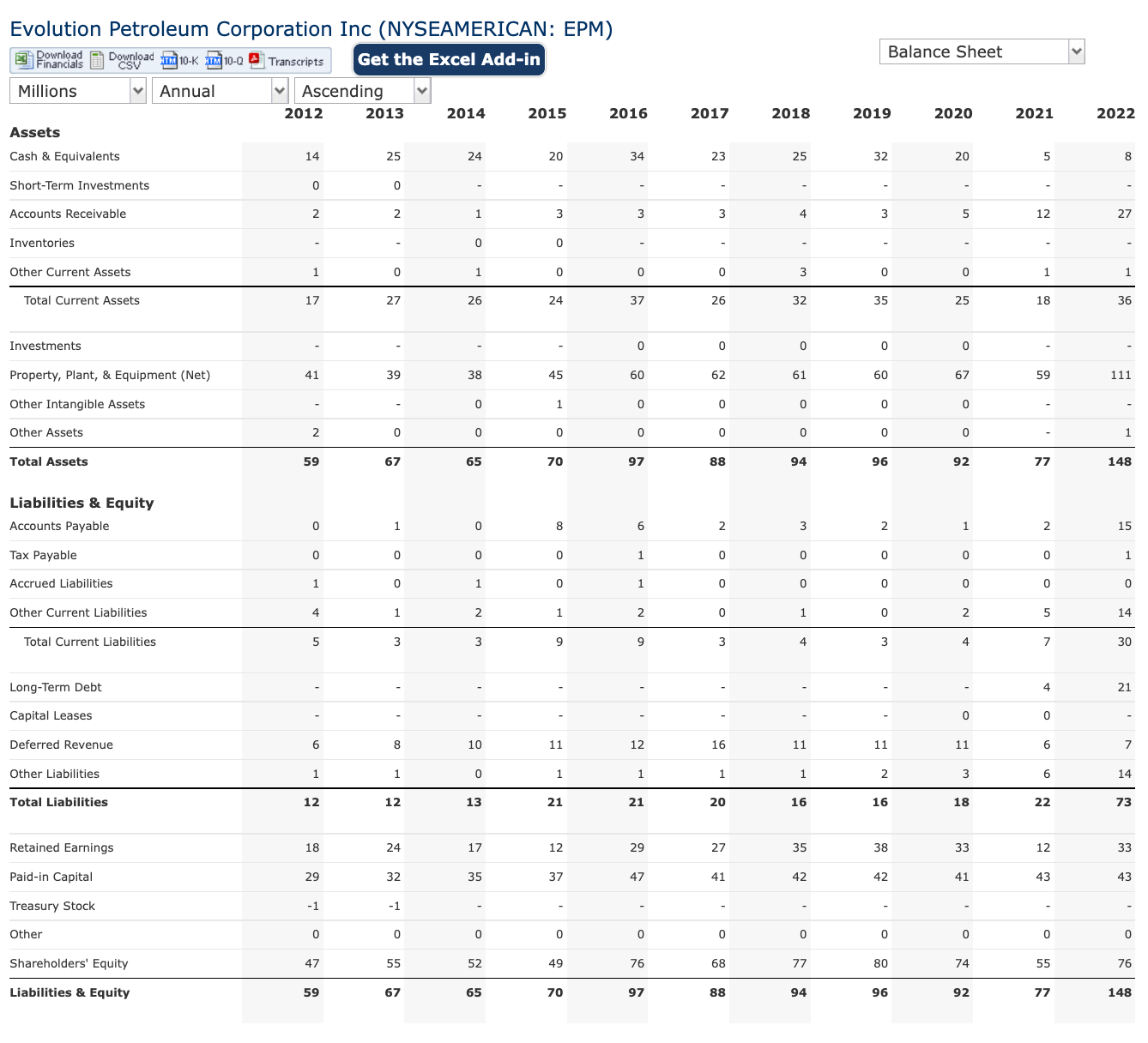

Observations from the Balance Sheet:

There is growth in both total assets and total liabilities. However, the magnitude of growth for total liabilities is bigger than that of total assets.

It is good to Total current assets are more than total current liabilities.

Retained Earnings reach $33M in 2022.

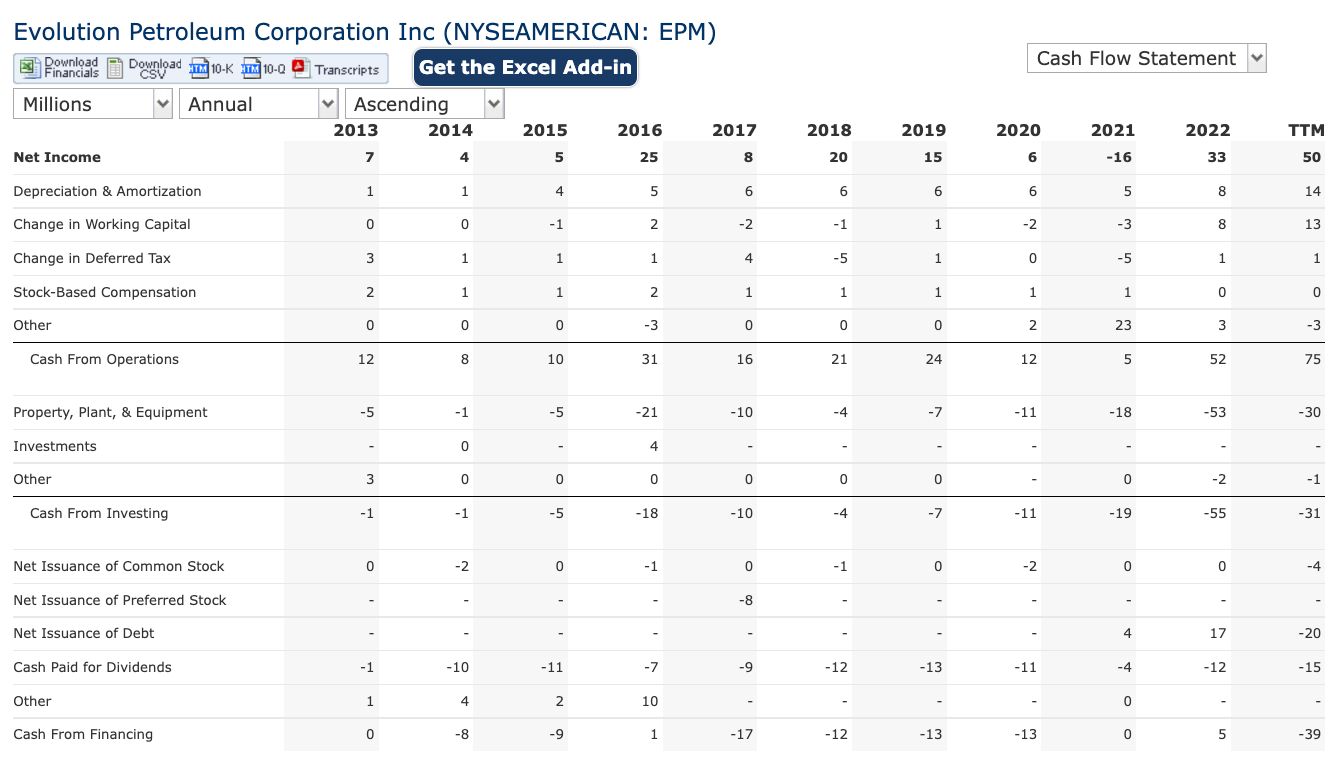

Observations from cash flow statements:

Good to see that TTM FCF is back to positive ($45M compared to 2022’s -$1M).

Good to see an increase in dividend payout (TTM)

Good to see the redemption of $20M in debt (TTM), compared to incurring of $17M in debt.

Conclusion

It is to note that there were years of non-satisfactory performance. 2022 is a year of high oil prices. 2021 was the only year with a net loss. Thus, I would prefer to monitor the stock closely and the development pipelines. 2021 & 2022 were years of negative free cash flow (FCF) and thus, are of concern. Hopefully, EPM is able to put up a few quarters of good performance.

This will be one stock of interest and stock that may make it to the shortlist given its low P/E.

Comments

Post a Comment