Invest in proven history and not just a hopeful future

All of us love a good story that paints great value in the future. Making predictions is complex as there are too many unknown variables. However, research in the business's history can gain us conviction and confidence for what lies ahead.

Extract from WSJ:

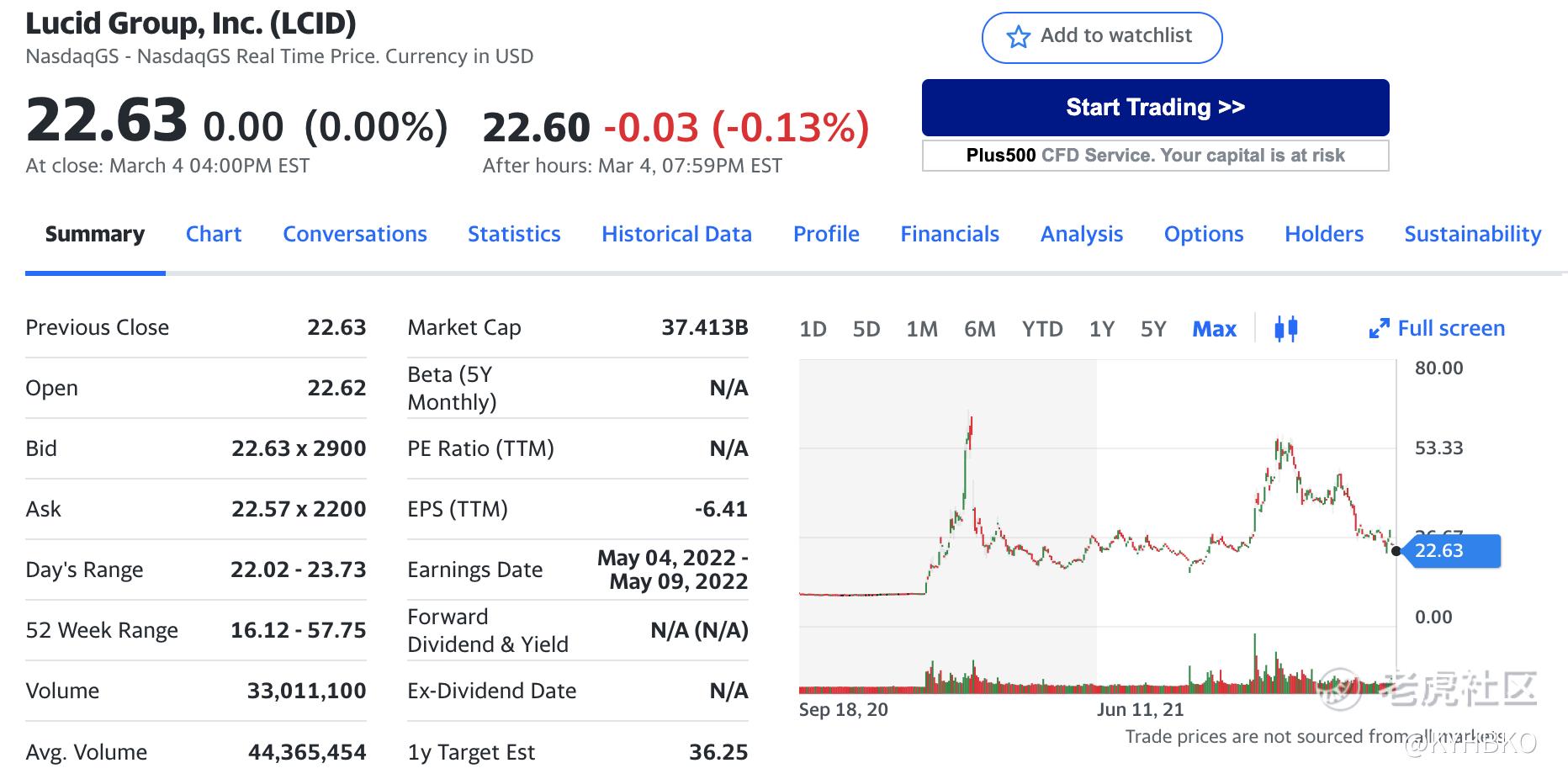

Rivian Automotive $Rivian Automotive, Inc.(RIVN)$ and Lucid Group $Lucid Group Inc(LCID)$ had terrible weeks on the stock market. Rivian shares fell 25% after the company cancelled price increases imposed on customers who had already ordered its truck, issuing a grovelling apology. Lucid cut its anticipated output for 2022 to between 12,000 and 14,000 vehicles from 20,000. The shares fell 14% for the week.

The main reason that I could not invest in both companies after their listing is their absence of a proven track record (history). Buying based on "a hopeful future" should not form a basis for investing. A proven track record over a period of years would give us confidence that the business has survived in both good and trying times. Anyone can do well during good times. Its recovery during tough times would hint at durable competitive advantages. It also highlighted the quality of management who navigated the company out of the woods. Senior management changes would be red flags that we should monitor.

Without history, it will also be difficult for us to establish a "fair" or intrinsic value of the business. Without a guide of the valuation of the business, how can we establish a price with a margin of safety for entry?

While there are potential gains that could be from new listings, the risks for downside are significant too. I would rather invest "late" with lesser profits than take a sufficient loss because I could not wait for time to provide a history. Time will tell if the business is worth our attention and investment.

Comments

Post a Comment