Palantir Q4/2021 earnings review 18Feb2021

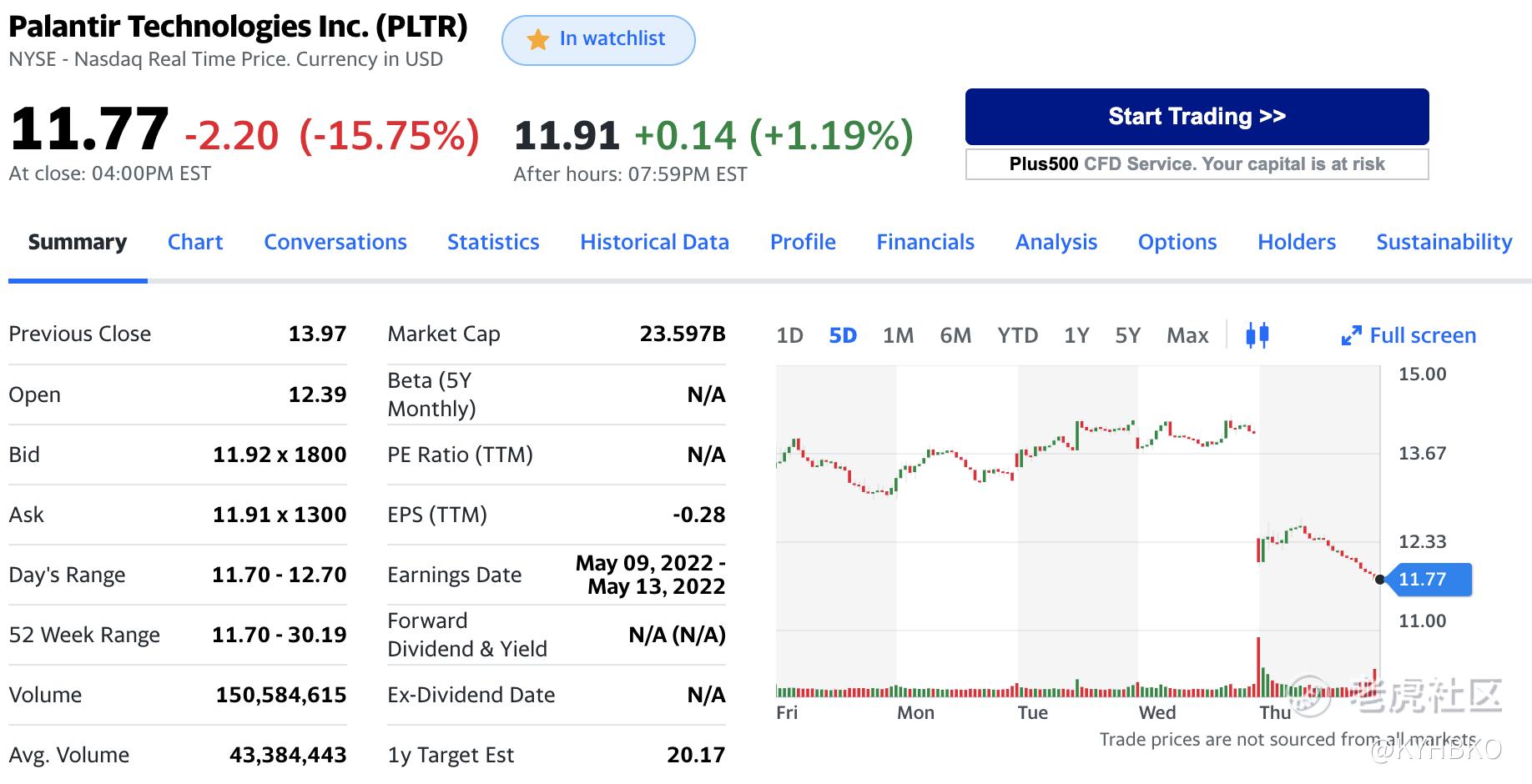

Palantir's earnings report was released on 17 Feb 2022 and the stock fell by 15% following the news.

The following is the summary extracted from Palantir's earnings report:

Q4 2021 Highlights

- Total revenue grew 34% year-over-year to $433 million

- Commercial revenue grew 47% year-over-year

- US commercial revenue grew 132% year-over-year

- Government revenue grew 26% year-over-year

- Added 34 net new customers in Q4 2021

- Loss from operations of $(59) million, representing a margin of (14)%, up 3500 basis points year-over-year and 900 basis points sequentially

- Adjusted income from operations of $124 million, representing a margin of 29%

- Cash from operations of $93 million, representing a 22% margin

- Adjusted free cash flow of $104 million, representing a 24% margin

- Closed 64 deals of $1 million or more, of which:

- 27 deals are $5 million or more

- 19 deals are $10 million or more

- GAAP net loss per share, diluted of $(0.08)

- Adjusted net earnings per share, diluted of $0.02

FY 2021 Highlights

- Total revenue grew 41% year-over-year to $1.54 billion

- US revenue grew 53% year-over-year to $879 million

- Commercial revenue grew 34% year-over year to $645 million

- US commercial revenue grew 102% year-over-year

- Government revenue grew 47% to $897 million

- Commercial customer count tripled to 147 customers year-over-year

- US commercial customer count increased 4.7x to 80 customers year-over-year

- Total net dollar retention of 131%

- US commercial net dollar retention of 150%

- Government net dollar retention of 146%

- Cash from operations of $334 million, representing a 22% margin

- Adjusted free cash flow of $424 million, representing a 28% margin

Despite the 41% revenue growth (YoY) to $1.54 billion, they still incurred a GAAP net loss per share (diluted) of $0.08. There are some areas of improvement and some areas of concern. Unfortunately, the concerns have probably affected the market sentiments much more than the good news.

My takeaways

34 new customers added in Q4 leading to 64 new deals inked (with 27 worth more than $5 million and 19 worth more than $10 million). This definitely put them in line with the 30% or annual growth through 2025 target set by Alex Karp (CEO).

I am pleased to see good revenue growth and good efforts to reduce expenses. Despite the increase in revenue, we see a drop from cost of revenue and total operating expenses. Total operating exoenses comprise of Sales & Marketing, Research & Development, General and Admin, and stock-based compensation expenses (SBCE) - a major topic that I will re-visit later.

There seems to be loss of $75.415 million arising from (I assume) investing for whole of 2021 as per the item "other income (expense), net" that is 14.49% of the net loss incurred for 2021. Total net loss incurred is $520 million meaning net loss per share of $0.27 for year ending 31 Dec 2021 or loss of $0.08 per share for Q4/2021. Yet the market receives more attention from the EPS of 0.02 in Q4.

For the balance sheet, I am glad to see an increase in total assets from $2.69 billion (2020) to $3.247 billion (2021) as per 31 Dec 2021 and there is a drop in total liability from $1.167 billion (2020) to $0.956 billion (2021). We also own a healthy ratio current ratio of 4.33 - meaning no concern for liabilities repayment in short term.

Free Cash Flow (FCF) has seen good improvement from -$271 million (2020) to $424 million (2021) year ending 31 December 2021.

Major areas of concerns - SBCE and share dilution

SBCE dropped to $778.215 million (whole year 2021) from $1,270.702 million (whole year 2020). For 2020, it is shocking that the SCBE expenses were higher than 2020's revenue generating $1,092.673 million. It is good to see the efforts to bring this SBCE component down in 2021. But, 2021's SBCE remains high at 48.23% of the total operating expenses. This is my main concern and I hope that the company will continue to manage this better. I walk away with the feeling that the company ends up making their own staff rich, instead of investors.

In 2021, we ended with 2.027 million common shares compared to 1.792 million in 2020. Share dilution means that I end up owning lesser of the company. This stems from the SBCE arrangement.

Conclusion

Palantir remains on track for their 30% annual growth rate but stock based compenstation expenses remain a concern together with shares dilution. Given the current trajectory, we hope that the business can start enjoying profits in 2022. I will maintain a "hold" position and not add to my holdings till they achieve profitability. Using 1 Day technical indicators, I would expect downtrend for the next few days.

Comments

Post a Comment