My investing muse - trading with inflation (12Feb2022)

Inflation was a hot term and has brought about much uncertainty in the market. What should we do with this increase in interest rates?

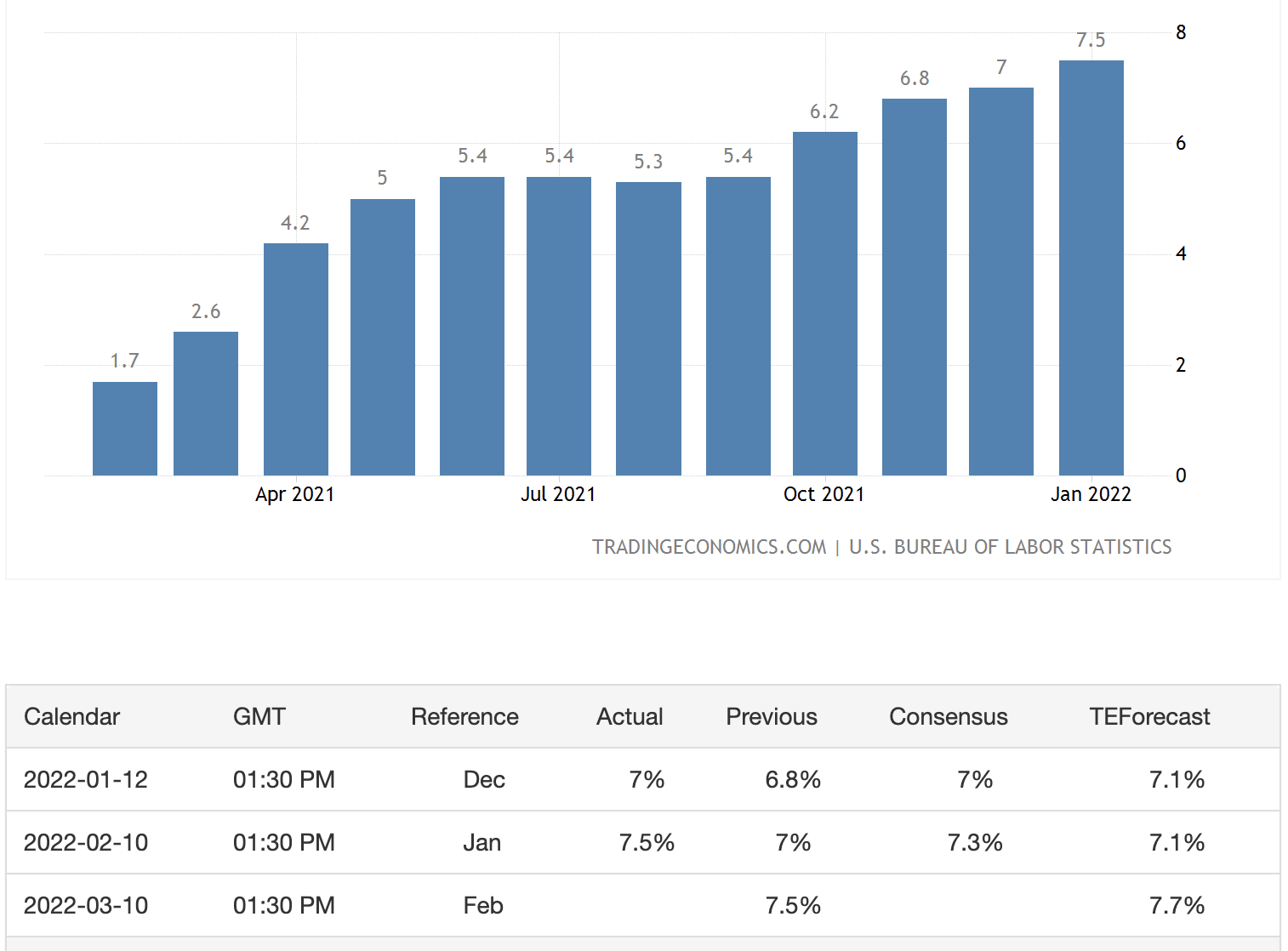

Source: U.S. Bureau of Labor Statistics

The annual inflation rate in the US accelerated to 7.5% in January of 2022, the highest since February of 1982 and well above market forecasts of 7.3%, as soaring energy costs, labour shortages, and supply disruptions coupled with strong demand weigh. Energy remained the biggest contributor (27% vs 29.3% in December), with gasoline prices surging 40% (49.6% in December). Inflation accelerated for shelter (4.4% vs 4.1%); food (7% vs 6.3%), namely food at home (7.4% vs 6.5%); new vehicles (12.2% vs 11.8%); used cars and trucks (40.5% vs 37.3%); and medical care services (2.7% vs 2.5%). Excluding volatile energy and food categories, the CPI rose 6%, the most since August of 1982.

For the next CPI inflation report due on 10 March 2022, the forecasted inflation rate stands at 7.7%, a further increase of 0.2% expected.

Fed's main tasks are to reduce unemployment and manage inflation using interest rates. Fed will use interest rates to manage the highest inflation experienced in the last 40 years. The Fed has not set any firm plans as they will need to implement the plans based on the unemployment and inflation rate. The next FOMC meeting is scheduled for 15-16 March 2022, after the announcement of the Feb 2022 CPI inflation rates on 10 March 2022. This will set the tone - the frequency (number of rate hikes) and degree (25 or more basis points). There are several speculations but the 10 Mar 2022 CPI data will help Fed conclude its plan.

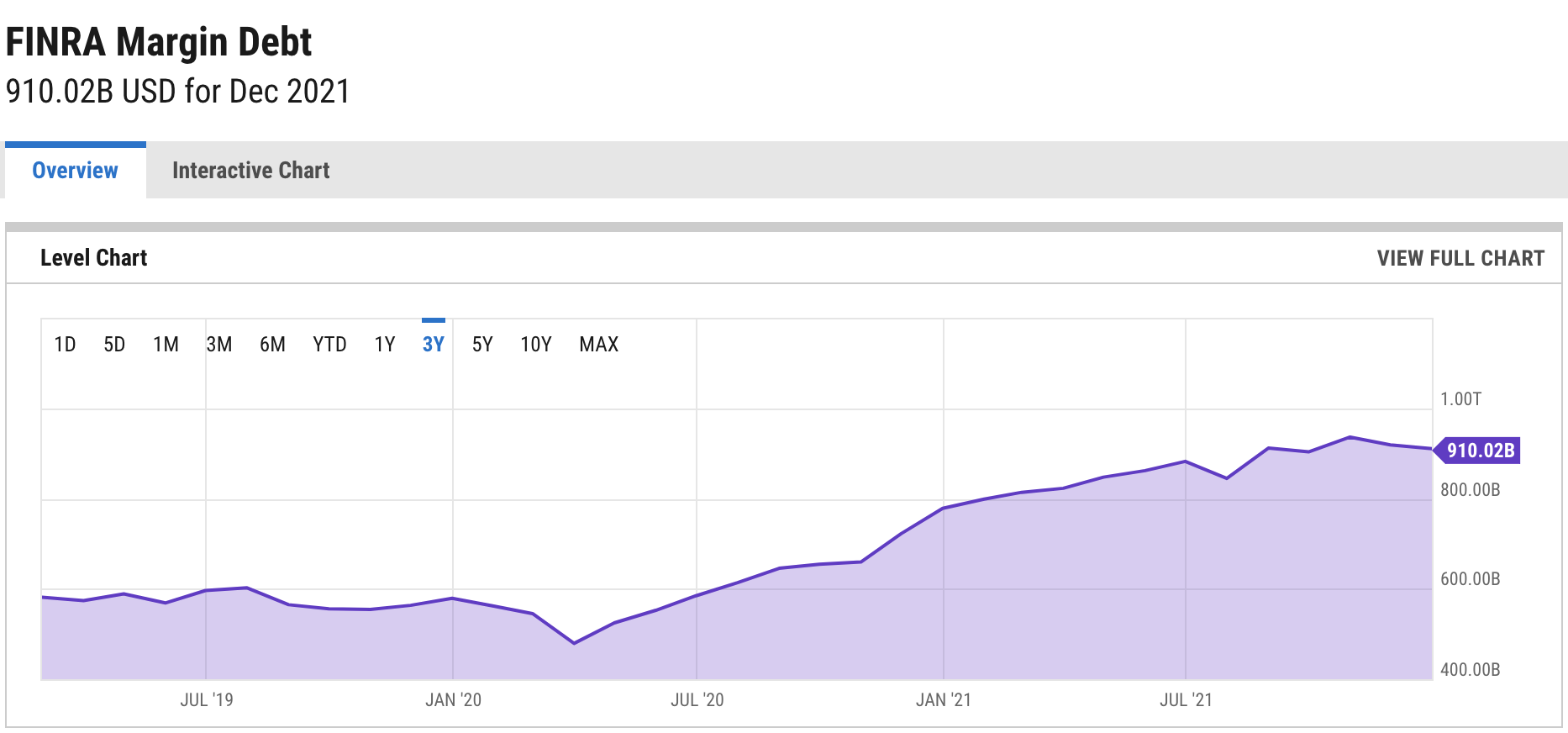

The Fed will exercise care as the margin debt of the US (borrowing of money to invest) has almost doubled since the pandemic started in 2020. It will be a fine balancing act to manage without causing panic or a market crash. Given Powell's approach to the "transitory" inflation, this should be applied with prudence, pending on the unemployment and inflation rate.

The market has been "well informed" of Fed's intent - what is missing is but the tone (in frequency and degree of a rate hike). Thus, we can expect most investors have already priced in the coming rate hikes. With higher interest rates, borrowing will become more expensive and inversely, savings will become more beneficial. With the current inflation rate of 7.5%, we need to look beyond bonds as our real spending power is eroded by inflation. With an increase in energy & fuel costs, we can also expect more of these costs will be absorbed by consumers over time - a vicious cycle.

How to invest with such inflation

The sector that will stand to benefit directly will be the banking sector. There may be some opportunities for us to include some banks into our portfolio if there are good stocks available at a "reasonable" price. Personally, I am invested into $Citigroup(C)$ & $HSBC Holdings PLC(HSBC)$ few months back in anticipation of this. It is important to invest in companies with strong branding & pricing power as they can "pass" the inflationary costs to consumers eg $Apple(AAPL)$ . In essence, the market is turning towards companies who are able to do well in such conditions and have annual returns (inclusive of dividends over 8%) that will at least beat the inflation rates. Companies that promise future earnings will continue to fall out of favour during this rotation from high growth to value stocks.

Comments

Post a Comment