My investing muse - Impact of war and geopolitical events on stock market (15Feb2022)

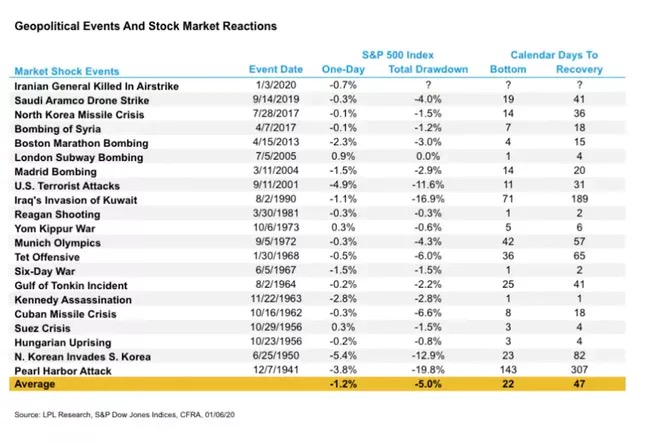

More investors have sounded their concerns on the impact of war, geopolitical events on the stock market. I have compiled some of my thoughts on this matter.

The above summary is extracted from www.investopedia.com and here is the article:

https://www.investopedia.com/solving-the-war-puzzle-4780889

Note that the 1990 invasion of Kuwait caused total drop of 16.9% where the market hit the bottom after 71 days but recovered in 189 days (slightly more than 6months). But what is more of concern for me is the murmur of the potential market crashes. Here are few to note:

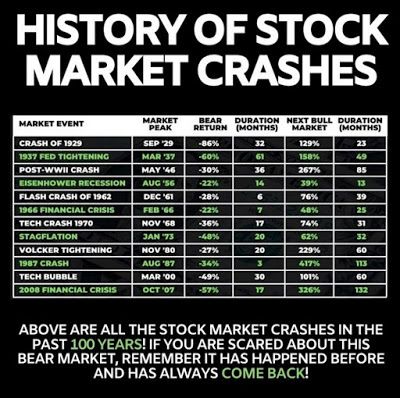

The above are some of the major crashes in the market where crashes ranged from 22% to 86%. Peter Lynch gave a fantastic summary of the market (based on his observation of 93 years in the market). In every 2 years, the market will drop 10% and more and in every 6 years, the drop will be more than 25%. But the market always recovers.

We should anticipate these and do not sell in panic.

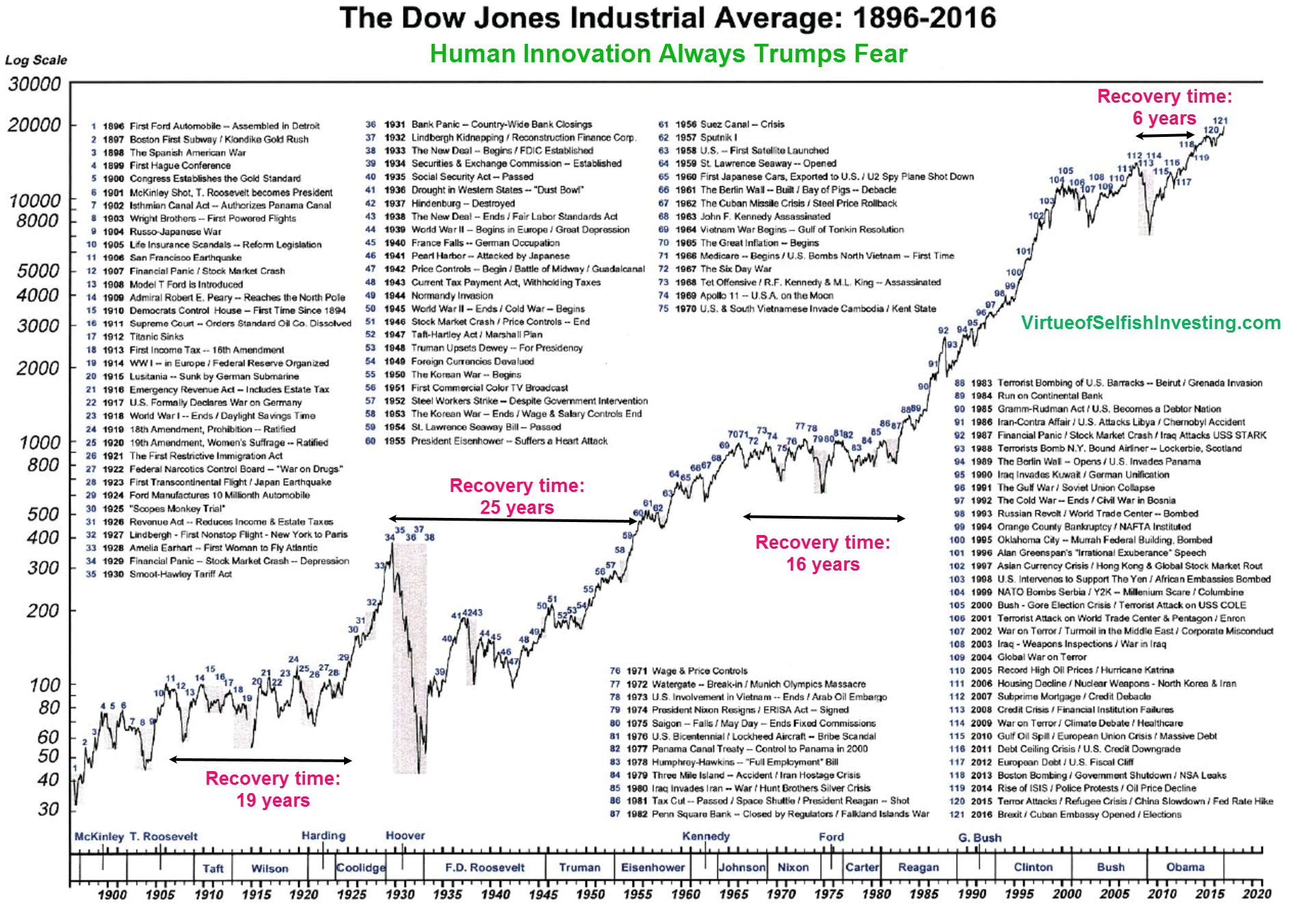

The above chart showed the timeline of the recovery and various key geopolitical events that affected the market.

The key takeaway is not about the crashes but rather the market will eventually recover and go to greater heights..

Time in the market is more important than timing the market.

The key remains that we need to invest in good companies with sound finances, good growth, good management and being able to navigate their way amidst the various technological breakthroughs and market downturns. We need to look out for companies with durable competitive advantages and to pay for these at reasonable (discounted) prices.

These good companies will likely be the ones who are able to recover faster from the various downturns. If you wish to look for these, look no further than the companies who did well or recover well during the recent Covid19 pandemic. Of course, there would be certain sectors that stand to benefit more from different crises and thus, let us not forget to do our research accordingly.

Let us research for the best so that we can be prepared for the worse. :)

Every downturn is a chance for us to grab these great companies at discounts.

Comments

Post a Comment