Bullish case for BYD (09Dec2021)

$BYD(01211)$, $BYD Co., Ltd.(BYDDY)$ offers great potential and opportunity going forward.

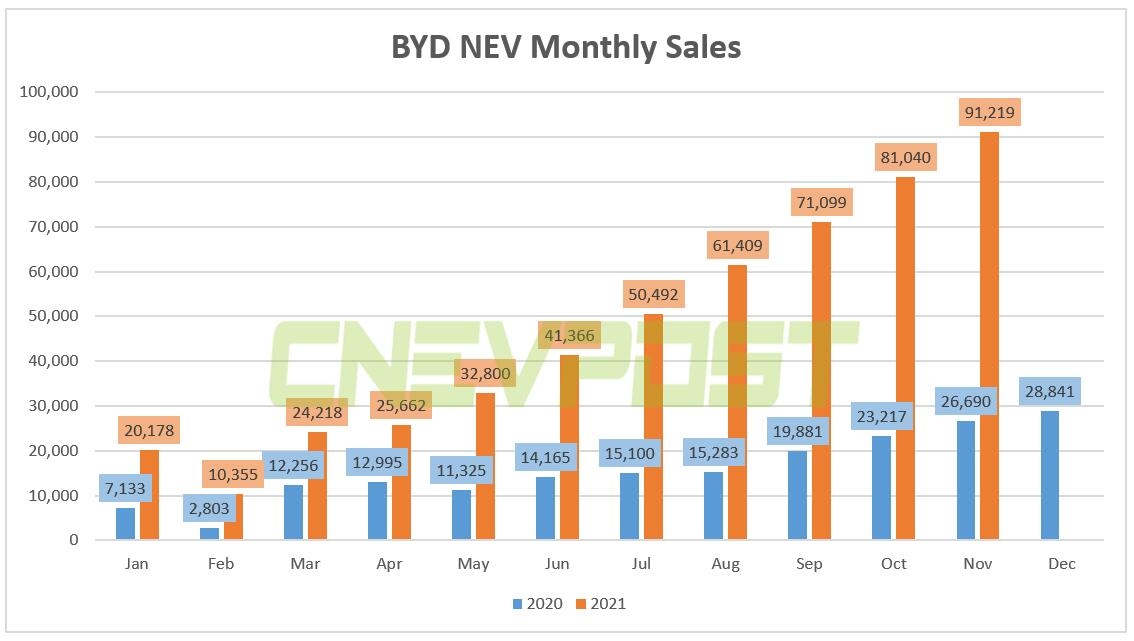

the company has been increasing their production and still, they are unable to meet the demand for their vehicles. for Nov, BYD is again the top EV sales with 91,219 new energy vehicle (including plugin) units it was estimated that they have 200,000 pre-orders that they have yet to fulfil. this has led to BYD management apologising for the delays in deliveries. to meet the increasing demand, the company has been investing in land to build new factories.

BYD has officially started construction on an RMB 15 billion ($2.4 billion) new energy auto parts industrial park in Xi'an, Shaanxi province in northwest China, paving the way for the company to further expand its vehicle production capacity.

at the same time, BYD has overtaken Volkswagen in terms of market capital recently. being the only fully integrated EV manufacturer, they would be least affected by battery and chip supplies. for international sales, they have been delivering buses to various countries in Europe. for batteries, they are the top 3 battery makers in the world. despite the case of vehicle fire of EV from Chevrolet, BYD's LFP battery is one of the safest and least expensive in the market - as they supply to other players like Ford for some of their Mustang Mach E. they are also selling their battery to other automakers too.

this is one of the gems of future EV, one that is invested by Mr Warren Buffett of Berkshire.

please do your research before adding this to your portfolio.

Comments

Post a Comment