Weekly preview of the week (25 Dec 2023) - FOMO over Christmas?

Public Holidays

Here is wishing all a blessed Christmas. Let us end our year strong and may we have an awesome 2024.

Christmas holiday (25 Dec 2023) for Hong Kong, Singapore and the USA.

Boxing Day (26 Dec 2023) for Hong Kong.

No public holiday for China in the coming week.

Economic Calendar (25 Dec 2023)

Notable Highlights

- Initial Jobless Claims - This is a reflection on the impact of unemployment, a data point for the Fed’s interest rate decision.

- Pending Home Sales. This will bring more insights into the “heating-up” home sales.

Earnings Calendar (25 Dec 2023)

In the coming week, there do not seem to be any notable earnings.

Market Outlook - 25 Dec 2023

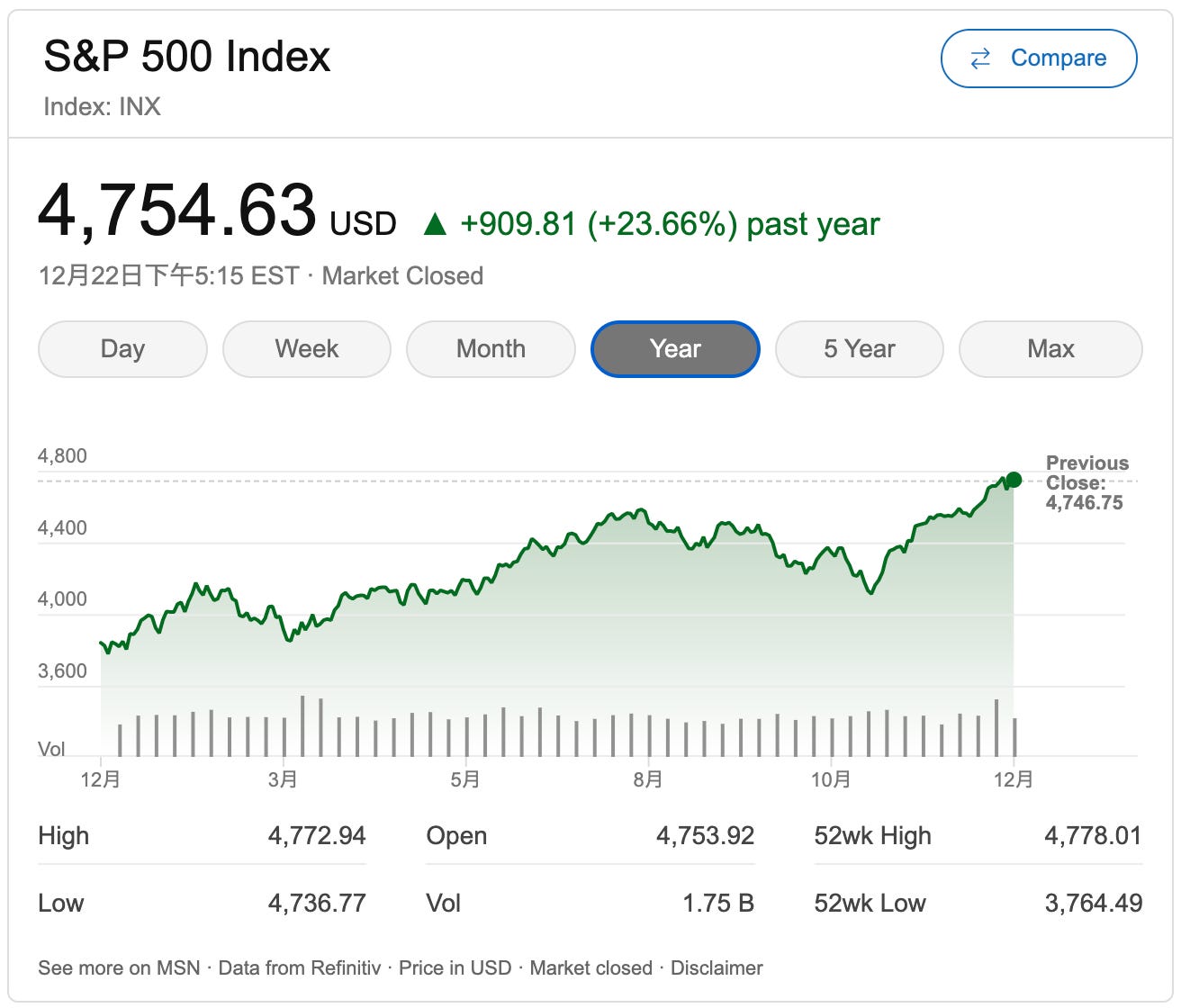

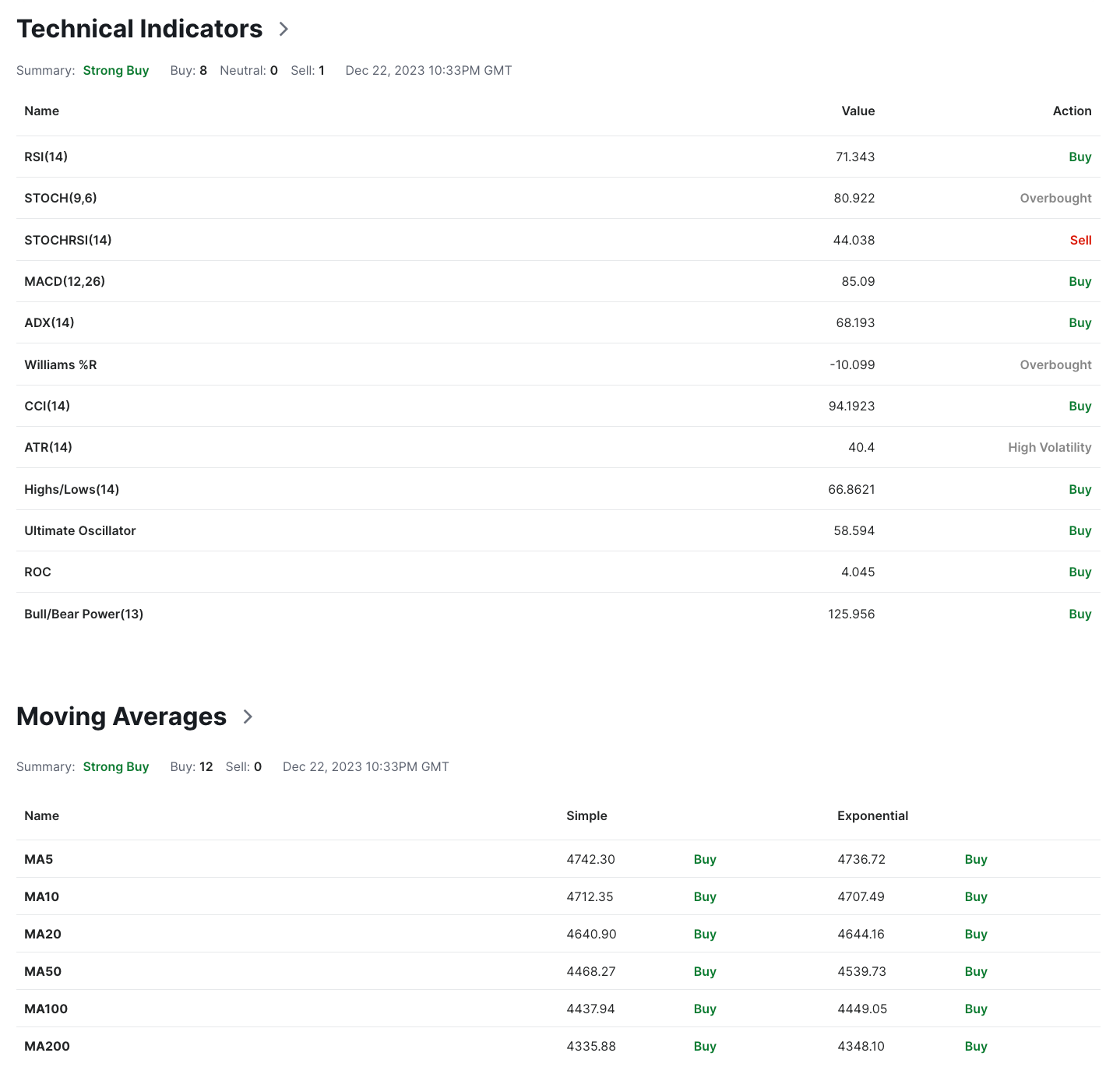

Technical observations of the S&P500 1D chart:

- S&P500 has grown 23.66% from 1 year ago.

The Stochastic indicator has completed a top crossover and should be on a downtrend.

The MACD indicator is about to complete a top crossover completed. We should expect a downtrend soon.

Moving Averages (MA). Both the MA50 line and the MA200 line are on an uptrend. The last candle is above both the MA 50 line and the MA 200 line. Thus, it could be read as bullish for the long-term and mid-term.

Exponential Moving Averages (EMA). All 3 EMA lines are moving upwards and thus, implying an uptrend.

From the 1D technical indicators above, there are a total of 18 (Buy), 2 (Sell) and 0 (Neutral). Investing recommends the “STRONG BUY” recommendation based on the technical indicators above (1D chart for S&P500).

From the data above, the market should expect some retracement in the coming days. Note that more indicators are showing “overbought” status for the S&P500.

News and my thoughts from the last week (25 Dec 2023)

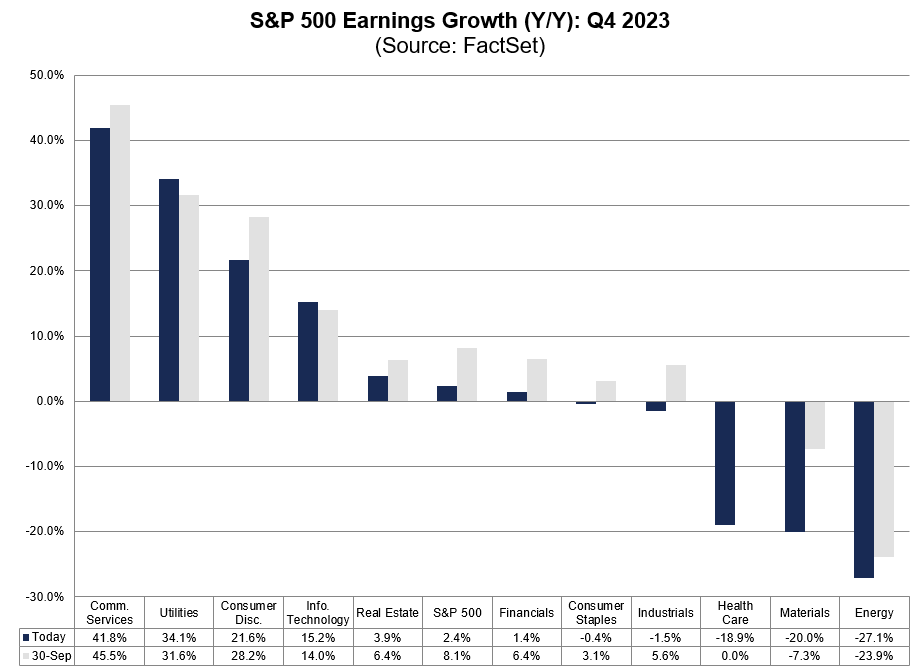

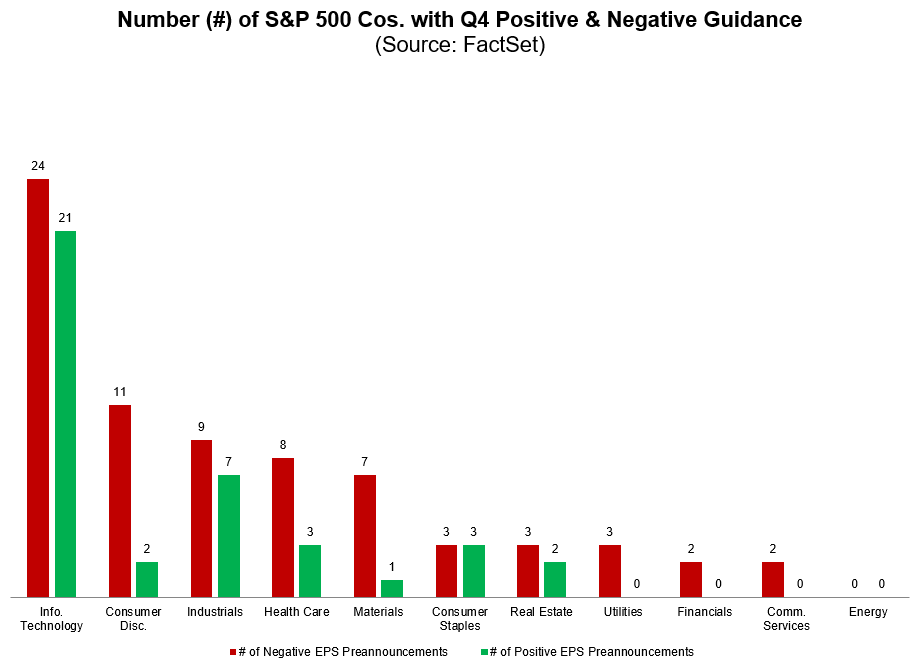

$SPX is expected to report Y/Y earnings growth of 2.4% for Q4 2023, which is below the estimate of 8.1% earnings growth on September 30. - FactSet

72 $SPX companies have issued negative EPS guidance for Q4 2023, which is above the 5-year average of 57 and above the 10-year average of 62.

- indicators like negative temporary employment growth and negative trucking industry job growth point to a recession. - Business Insider

FedEx shares fell close to 10% after the global delivery firm cut its outlook for the year as its largest Express business saw the demand drop from the US Postal Service - Reuters

Supply chain can be seen as a lagging indicator. Let's be watchful. The market can be bullish but the fundamentals are of concern.

More than 100 container ships have been rerouted around southern Africa to avoid the Suez canal, in a sign of the disruption to global trade caused by Houthi rebels attacking vessels on the western coast of Yemen. - The Guardian

The Iranian-backed group is using drones to attack vessels that they believe are delivering goods to Israel, forcing shipping companies cancel routes passing through the Red Sea. This should add costs and delay. - Visual Capitalist

*UBS ANALYSTS SEE S&P 500 FALLING TO 4100 IN THE FIRST HALF OF 2024, CALLING CURRENT RALLY A 'BULL TRAP' - Investing

My investing muse - FOMO

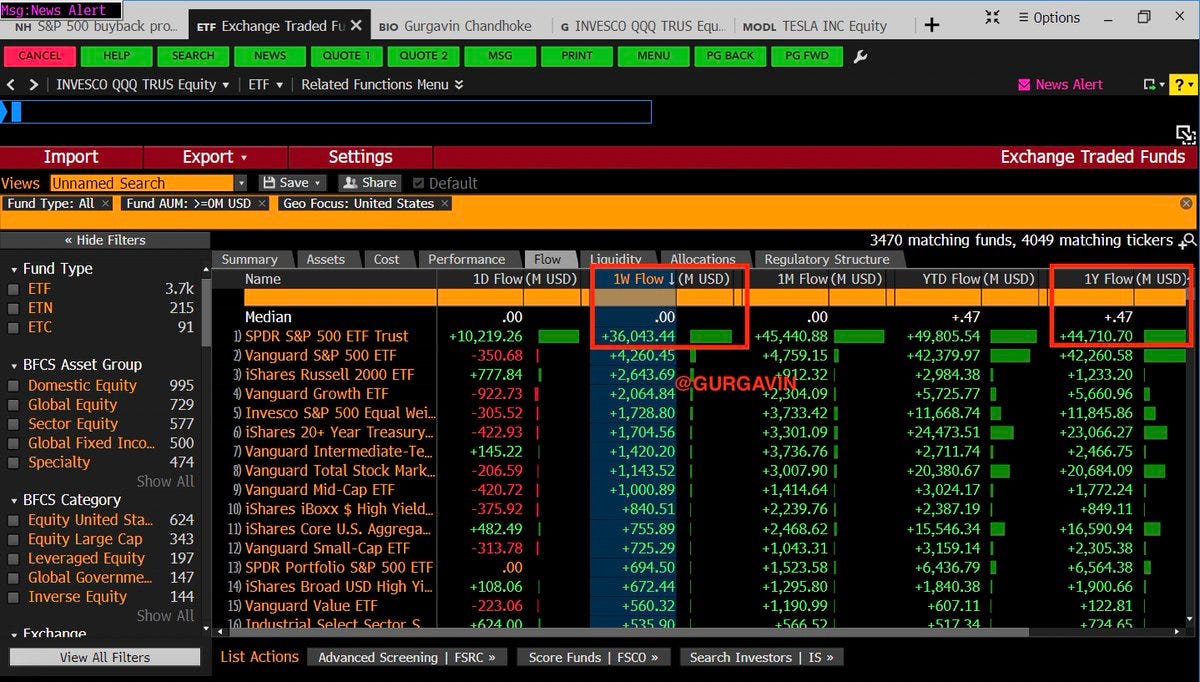

From Twitter user GURGAVIN

OVER THE LAST 1 YEAR INVESTORS HAVE POURED $44.7 BILLION DOLLARS INTO THE S&P 500 ETF SPY 0.00%↑ OVER 80% OF THAT AMOUNT CAME IN JUST THE LAST WEEK. OVER THE LAST WEEK INVESTORS POURED IN OVER $36 BILLION DOLLARS WHICH IS THE HIGHEST AMOUNT FOR ANY ETF IN HISTORY. FOMO?

FOMO is a part I guess. I hope that it is not Hotel California. As per my posts, technicals pointed to ATH but the fundamentals are of concern.

Ray Dalio mentioned that averages could mask up some of the fundamentals coming to macro data. Some deep dive into the different demographics would help. For those who can afford to invest, there could be a lesser cost of living crisis. It does not mean this cost of living crisis is absent for the other income groups. The market can hit an all-time high (ATH) and fundamental issues can happen concurrently. What we do not know is the tipping point.

Who can save the Fed when they fail? It is not a bailout of AIG or Lehman. Though the regional banks are still shaky. We can still make money from the current bull run but we do not know when the floor is giving way.

Let us monitor BTFP for banking, LEI for the overall economy and LMI for the supply chain. The supply chain is a leading indicator for the economy and it does not look too positive.

The credit card debt update should happen on Jan 24. So, you can continue your trade but do consider hedging. Over $10K credit card debt for the average US household as per last quarter's update at the current 21% average credit card interest rate. We have a gap as people turn to BNPL and these amounts are not seen by the credit bureau or shared amongst BNPL companies. The US is addicted to debt. So let us be careful. When the US cannot borrow, they print and with this inflation follows. This could be the 1930s again.

Conclusion

Core PCE and CPI have remained well above the 2% target. Let's monitor. It could be months before the drop but if there are black swans, all these can change.

Living via credit card is never sustainable.

Let us spend within our means, avoid leverage and invest with what we can afford to lose.

Comments

Post a Comment