Preview of the week starting 09 Oct 2023 - earnings season starts with the banks

Public Holidays

No public holidays in the coming week for Hong Kong, China, the USA & Singapore.

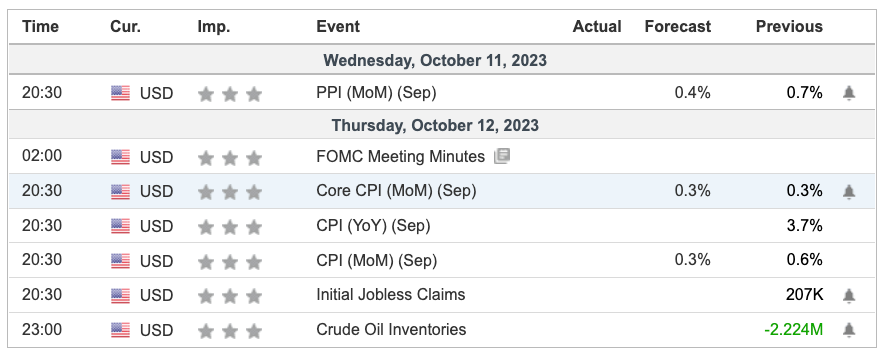

Economic Calendar (09Oct2023)

Notable Highlights

PPI. U.S. Producer Price Index (PPI) is the inflation that hits producers. Thus, this can be seen as a leading indicator for CPI which is the common reference for inflation. An increase in PPI can imply that the CPI may rise as producers pass their costs to their consumers.

CPI. The CPI is synonymous with inflation. This is what people reference coming to the cost of living. This will also be one of the items that the Fed incorporate for their coming interest rate decisions. This will be the most watched economic news for the coming week.

Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

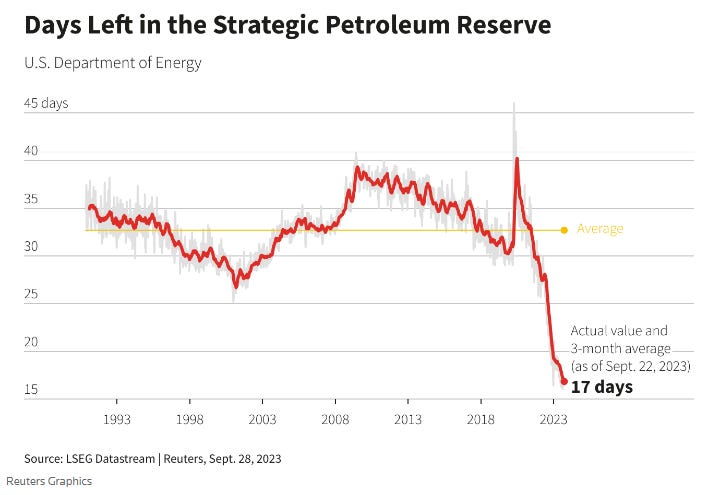

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

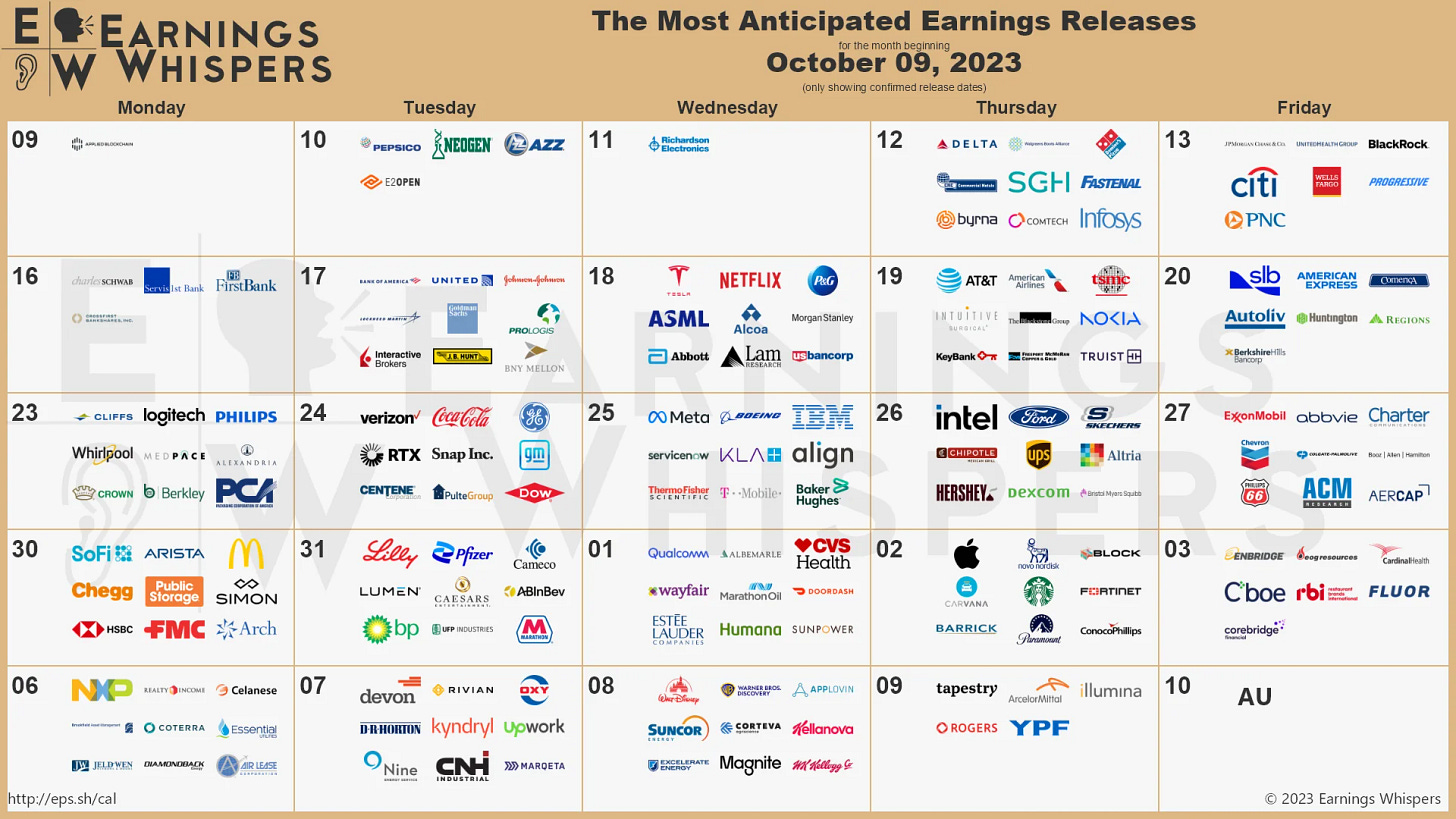

Earnings Calendar (09Oct2023)

The above is the monthly calendar for the new Q3/2023 season. For the coming week, there are a few earnings of interest that include Pepsico, Delta, Domino’s Pizza, Citi, BlackRock, Wells Fargo, JP Morgan and United Health.

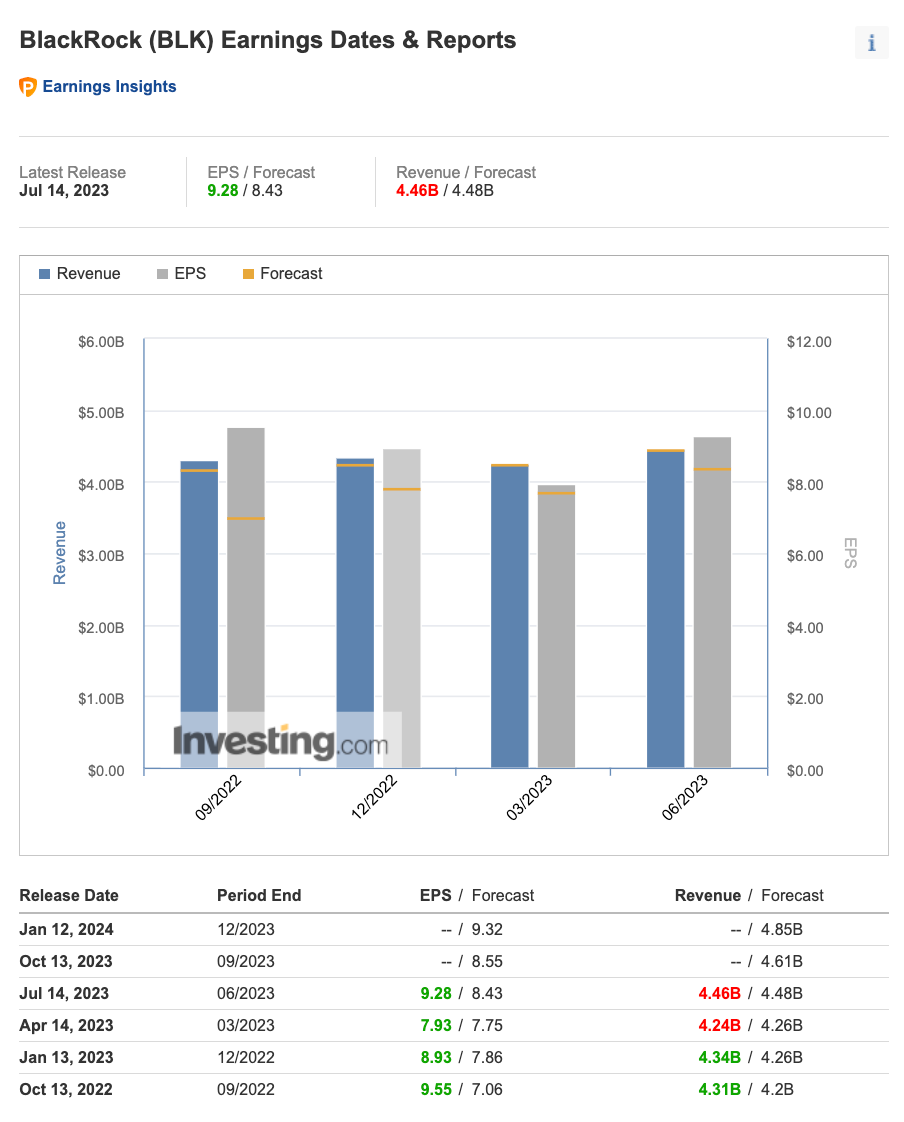

Let us look at the recent performance of BlackRock.

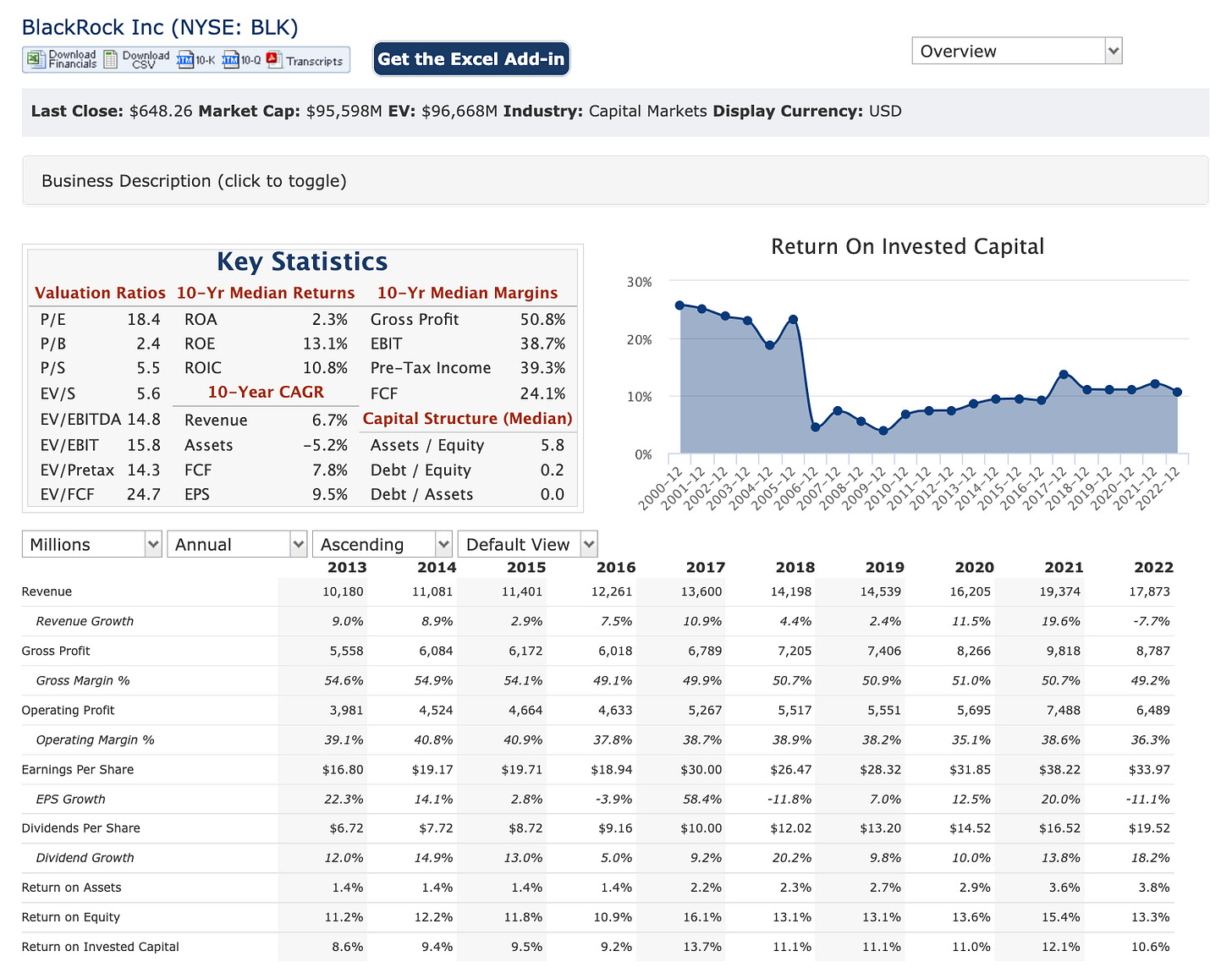

The Performance of BlackRock (BLK) - will BlackRock continue to sink?

The above is the 10-year performance of BLK. It has an impressive 10-year median of 50.8% Gross Profit, 39.3% for pre-tax income and 24.1% FCF.

Though there was a dip in annual revenue from 2021 to 2022, the business remains highly profitable and remains one of the biggest financial institutes in the world.

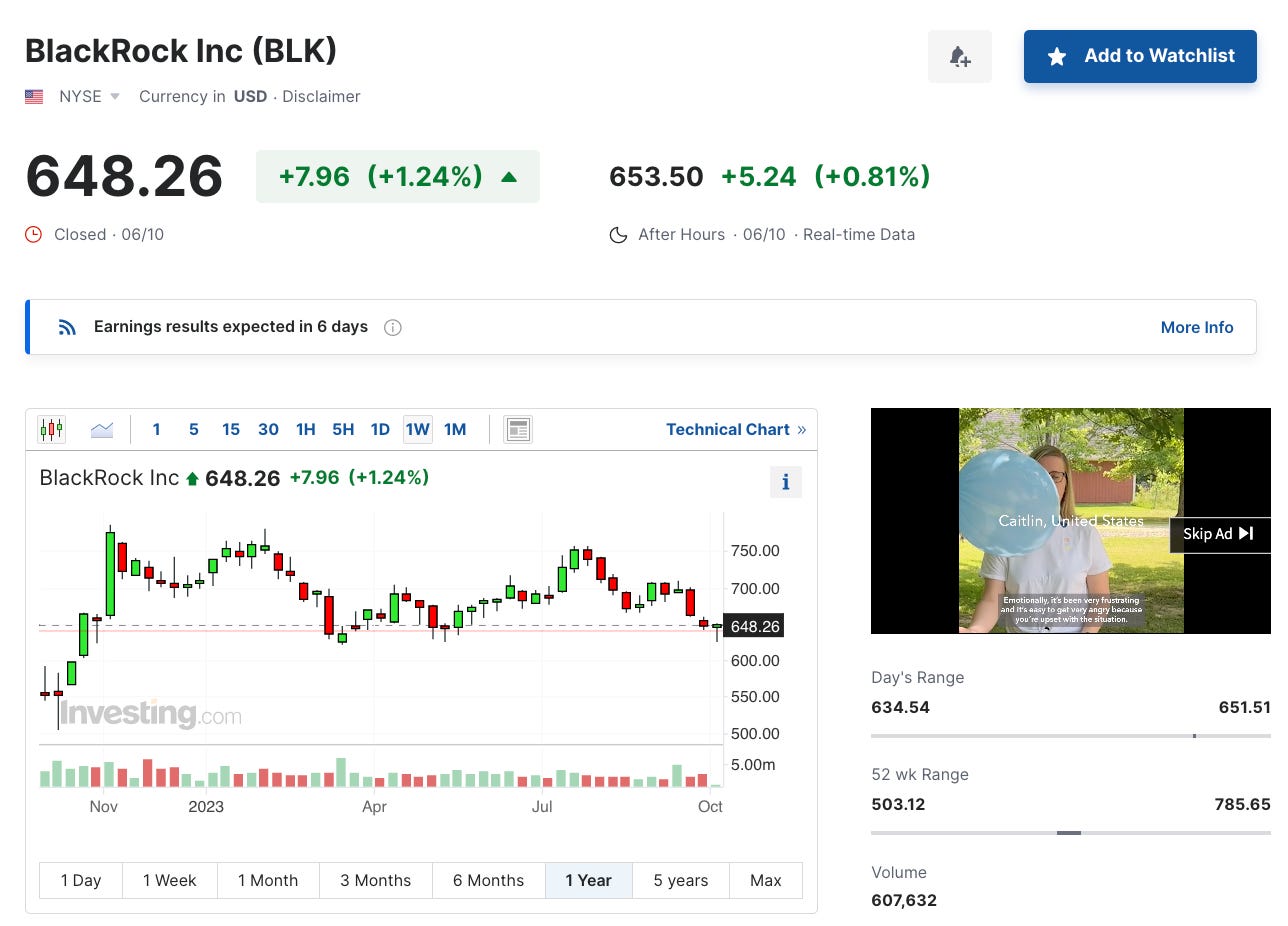

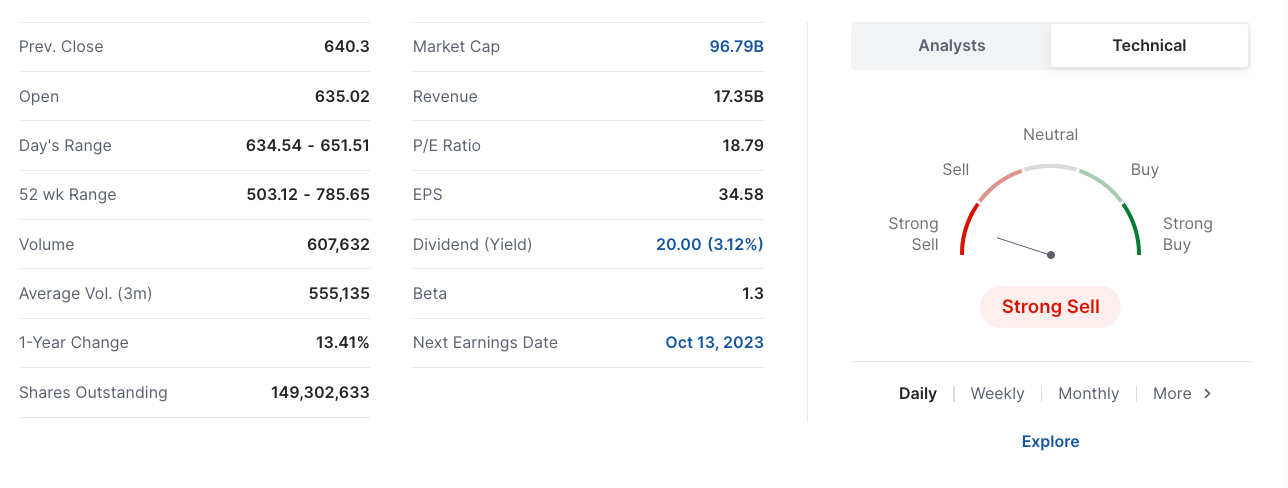

The above shows the 1-year performance of BLK and it was on a recent downtrend after hitting a 52-week high of 785.65.

The stock has gained 13.41% from a year ago and has an attractive P/E of 18.79.

For the coming earnings, investing has a forecast of 8.55 and 4.61B for its EPS and revenue respectively. Will BlackRock be able to surge once again?

Market Outlook - 09Oct2023

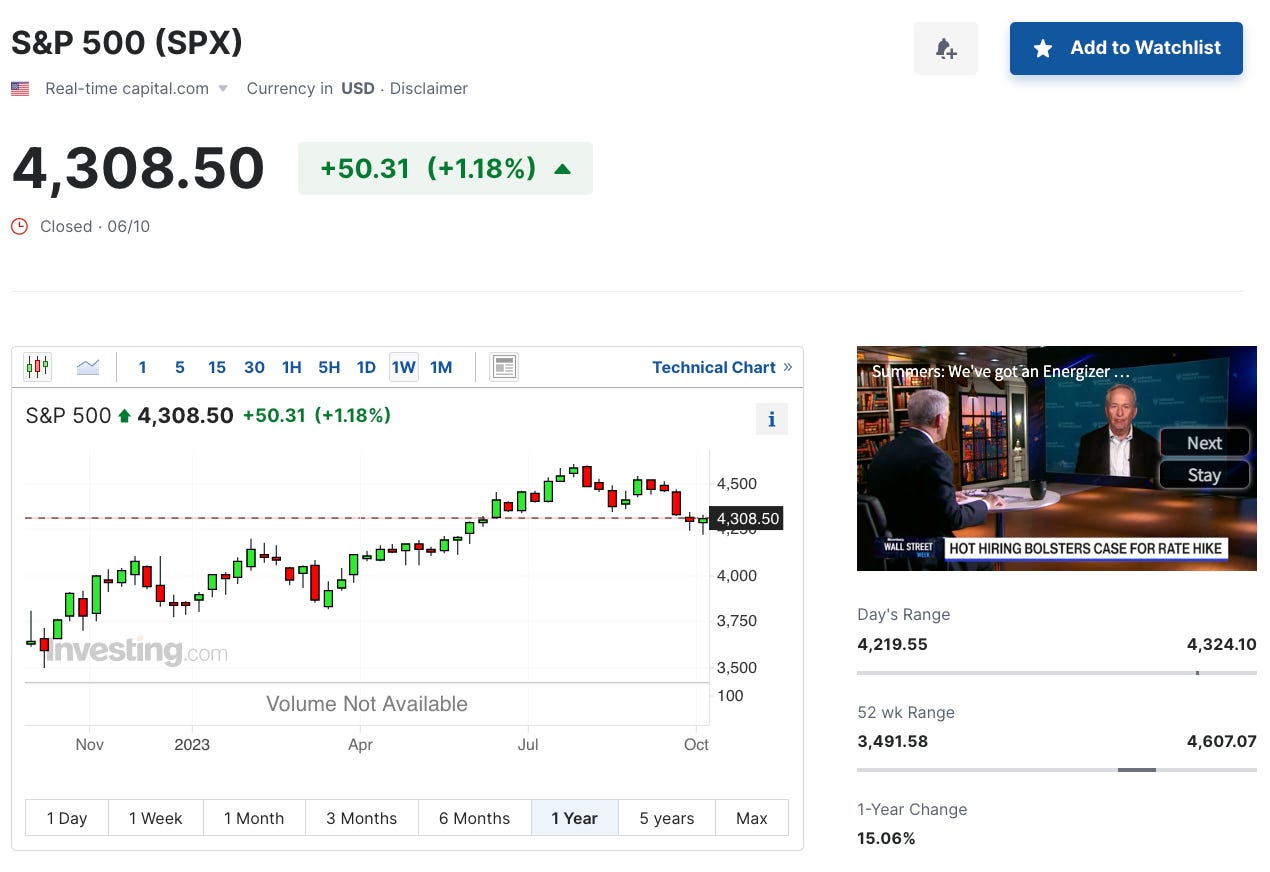

From the 1 year chart above, the S&P500 is on a downtrend.

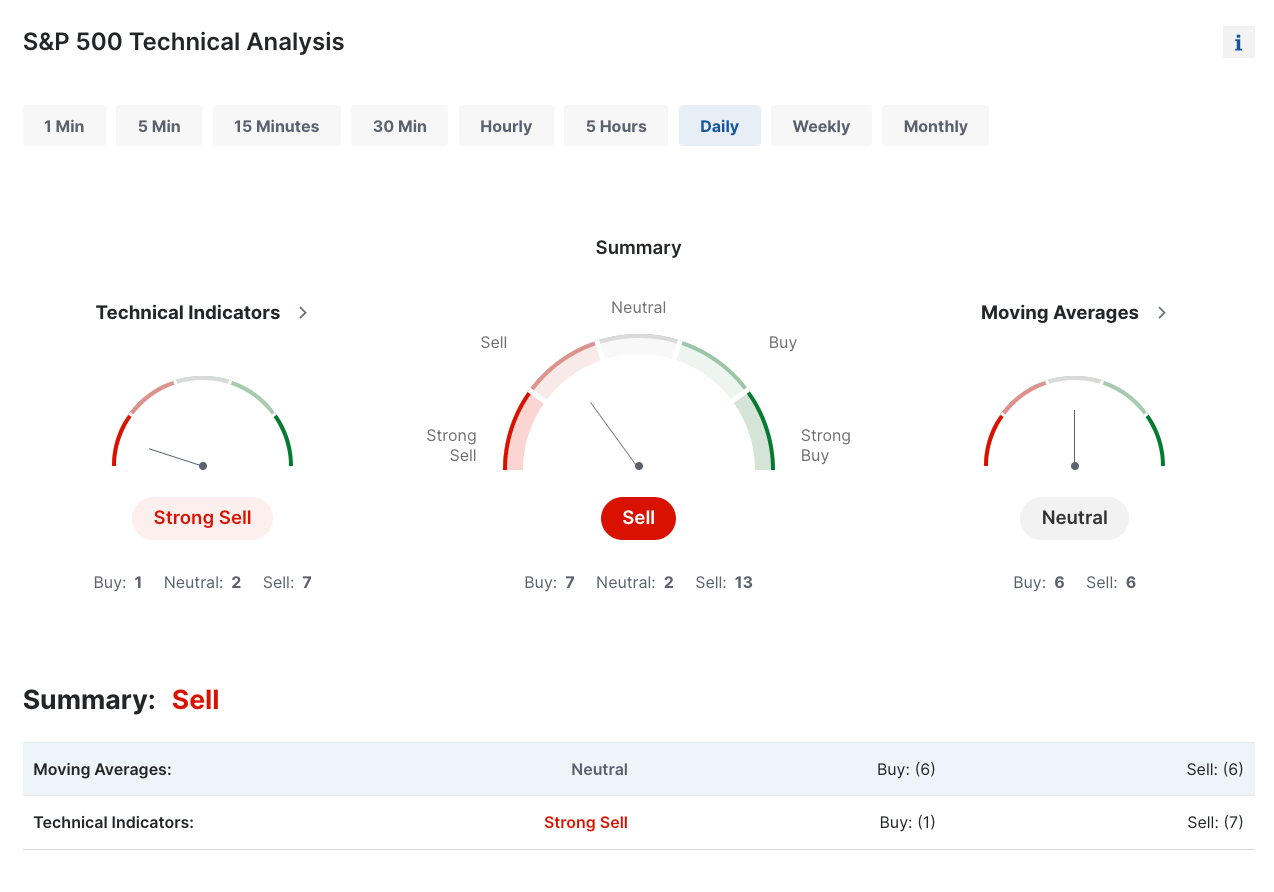

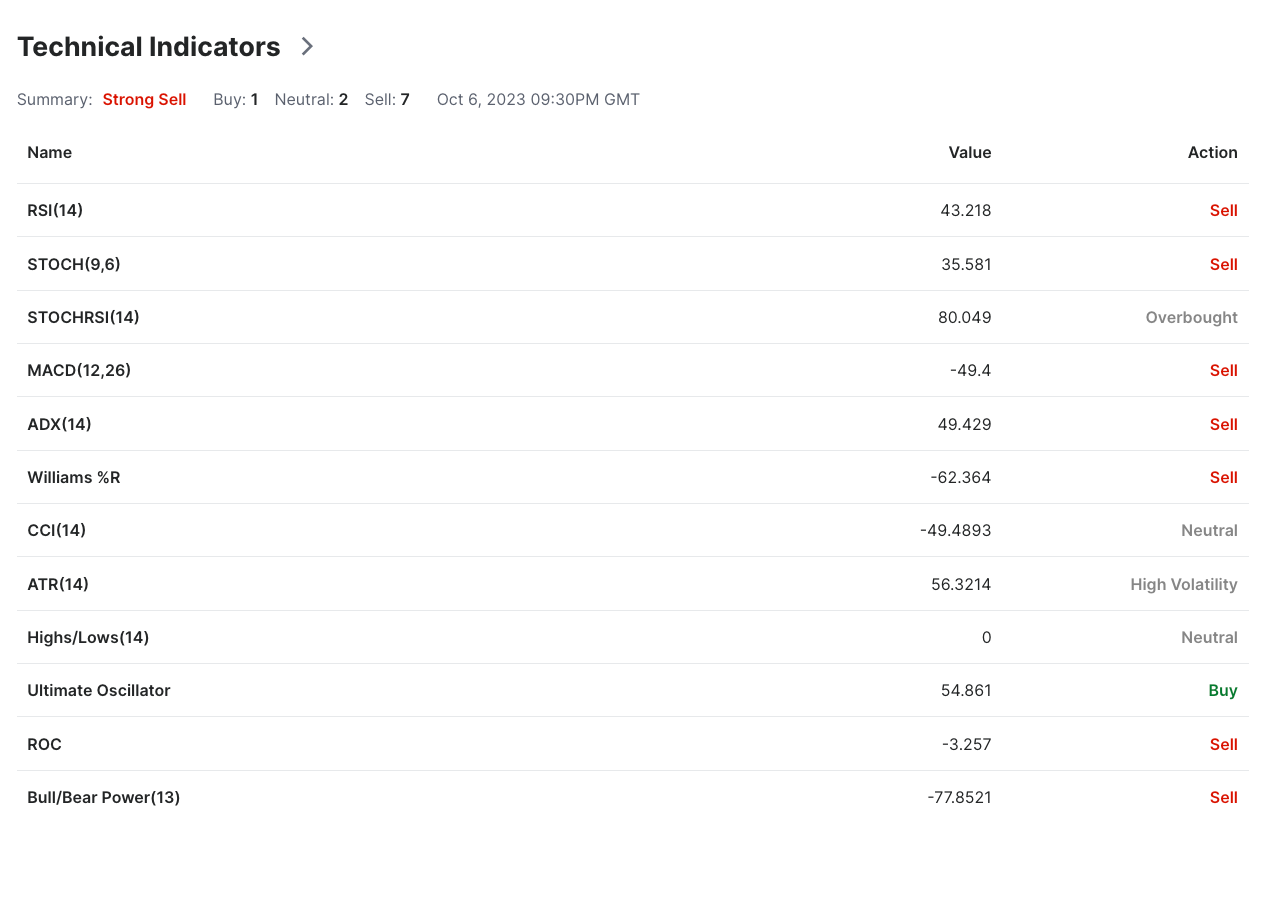

Technical observations of the S&P500 1D chart:

The Stochastic indicator is on an uptrend.

The MACD indicator is on a downtrend but we should expect a bottom cross-over soon. This implies that there is a chance of the S&P500 turning to an uptrend in the coming days. For the MACD indicator, the reversal is yet complete as the bottom cross-over is yet to be completed.

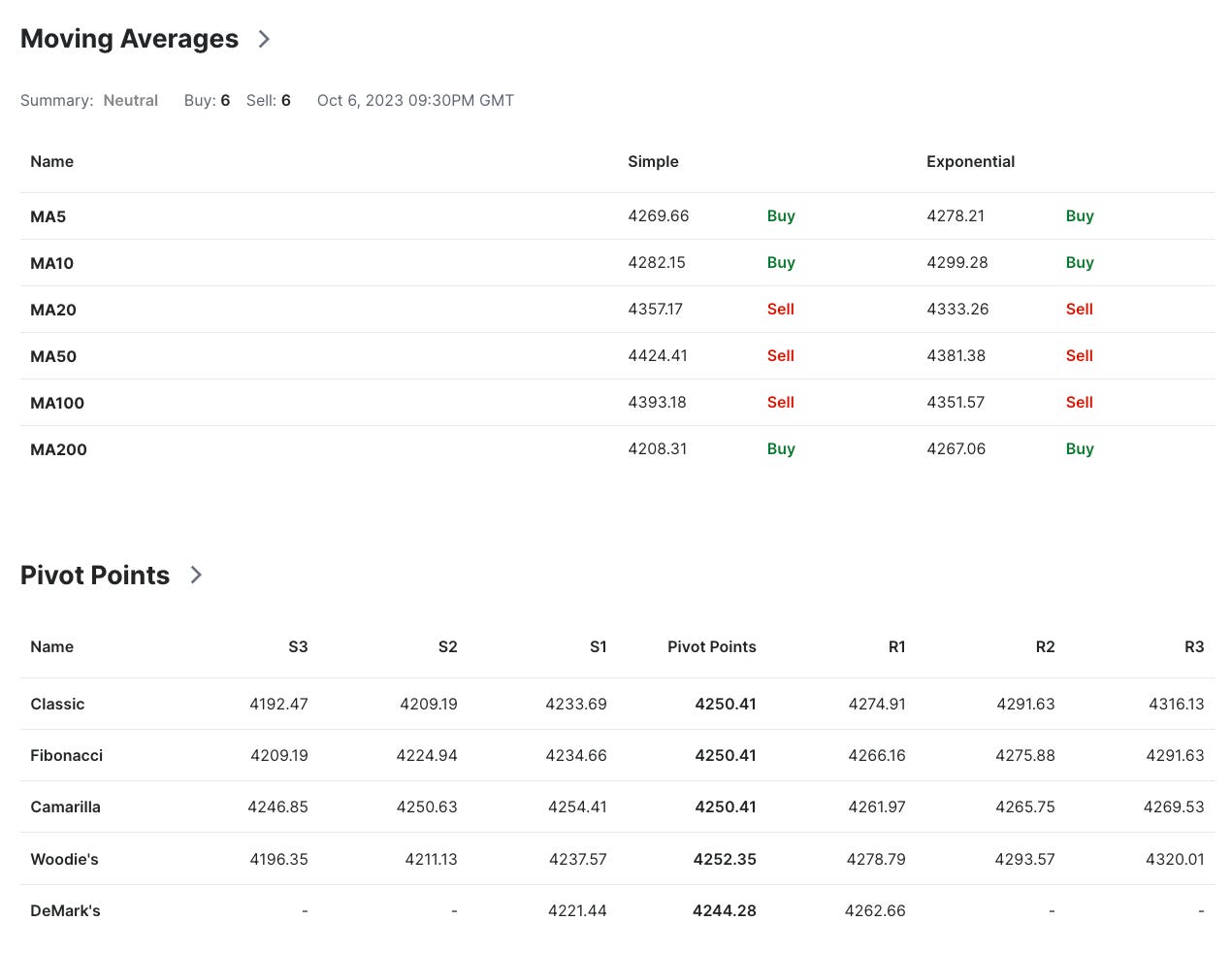

Moving Averages (MA). The MA50 line has started a downward trend and the MA200 line is on an uptrend. With the last candles below the MA50 line and above the MA200 line, this can be interpreted as an uptrend in the long term. For the mid-term, it is on a downtrend. As the 2 lines move closer, there is a chance of the formation of a death cross - typically, a bearish indicator. This will take weeks before this death cross is formed and changes are possible.

Exponential Moving Averages (EMA). All the 3 EMA lines have indicated a downtrend.

From the 1D technical indicators above, there are a total of 7 (Buy), 13 (Sell) and 2 (Neutral). Investing recommends a “SELL” recommendation based on the technical indicators above (1D chart for S&P500).

This week should be a downtrend for the S&P500 though a reversal is possible.

News and my thoughts from the last week (09Oct2023)

Would AI end up with the creation of more jobs?

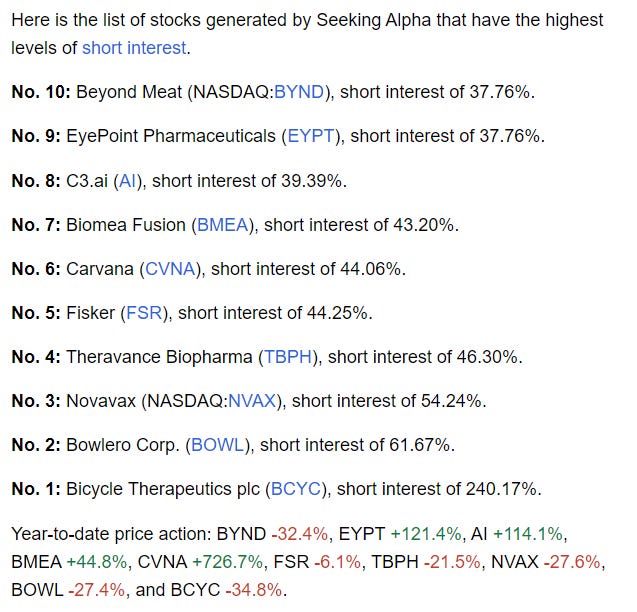

Growth in revenue does not always translate to growth in net profits. Watch the debts as they are expensive. Monitor the cash flow. The above are the screeners I propose over a period of years, 5 and more if possible.

$LYMUY 1D chart just saw a death cross, a typically bearish signal. Yet, Stochastic & MACD indicators may imply a reversal once the reversal is completed. Would you consider a buy, watch or abstain view this company that owns Louis Vuitton amongst other luxury brands.

Goldman Sachs has advised on liabilities set to mature in the coming 2 years. Together with record bankruptcies filed in 2023, it could get challenging for the regional banks.

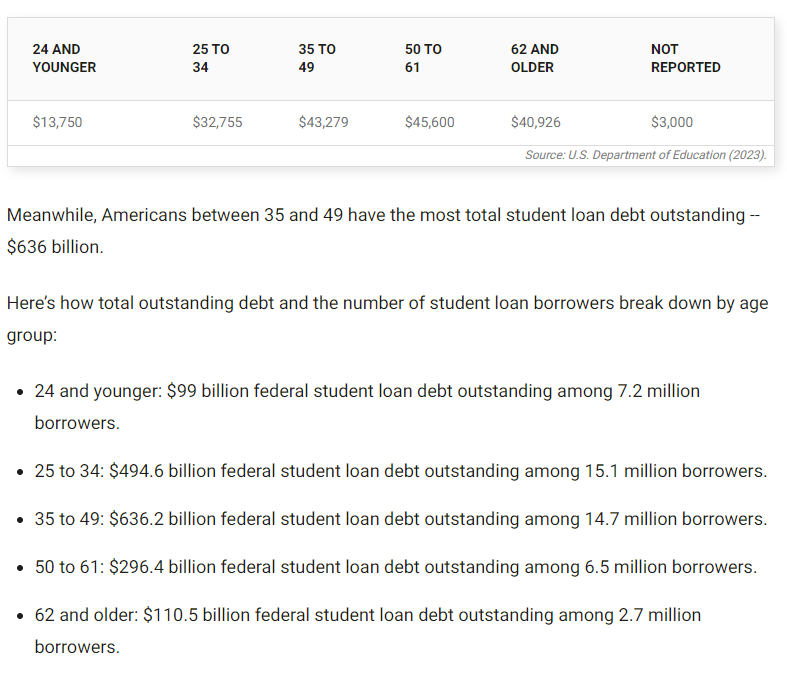

Student loan debt totals $1.78 trillion and is held by about 43.5 million Americans, with the average monthly payment amounting to $337. How will this affect household spending and credit as payment resumes?

Watcher Guru > BRICS vision for 2030 plans to take on the US dollar with oil, gold, and local currencies. The financial order could see a paradigm shift in the coming years as BRICS will stop using the US dollar.

For innovations, they should make things and processes better, more affordable, more sustainable and more productive.

30 banks have been acquired in Q3/2023. Will we be left with the big banks eventually?

Yahoo Finance > Chairman Mark Liu said in July that TSMC faces challenges at the US facility, including a shortage of skilled workers & expenses running higher than in Taiwan. The company is shifting some employees to Arizona to help with the development.

What does this say of the market? Is DCA into ETFs and indices playing a part in this? The magnificent 7 accounts for 80% of the gain and if they disappoint, the magnitude of decline could be similar.

Business Insider > The cost of servicing the US's pile of debt is on track to hit a new record in 2025, Goldman Sachs said.

That's due to higher interest rates pushing up borrowing costs for public and private debts.

BBC > Drug overdoses killed a record of more than 100,000 people across the country in one single year. More than 66% were tied to fentanyl. In 2010, less than 40,000 people died from a drug overdose across the country.

CNBC > jump from the prior period, according to the FDIC. Of that total, held-to-maturity Treasurys, which caused much of the turmoil this year, totaled $309.6 billion.

Business Today > Tech layoffs are still going on as Meta plans to introduce a fresh round of job cuts.

CNBC > ADP reported that private job growth totaled 89,000 for the month, down from an upwardly revised 180,000 in August & below the 160,000 estimates. Job gains came almost exclusively from services, which contributed 81,000 to the total.

WSJ > Bond Selloff Threatens Hopes for Economy’s Soft Landing

Growth prospects and concern over government debt are driving long-term interest rates higher

CNBC > Ofcom is concerned that “hyperscalers” like Amazon Web Services and Microsoft Azure are limiting competition in the cloud computing market. AWS and Microsoft Azure account for roughly 60% to 70% of total cloud spend.

Yahoo Finance > "The next speaker is likely to be under even more pressure to avoid passing another temporary extension — or additional funding for Ukraine — than former Speaker McCarthy had been," Goldman's economics team wrote.

My investing muse - Israel declares war, CPI & Earnings

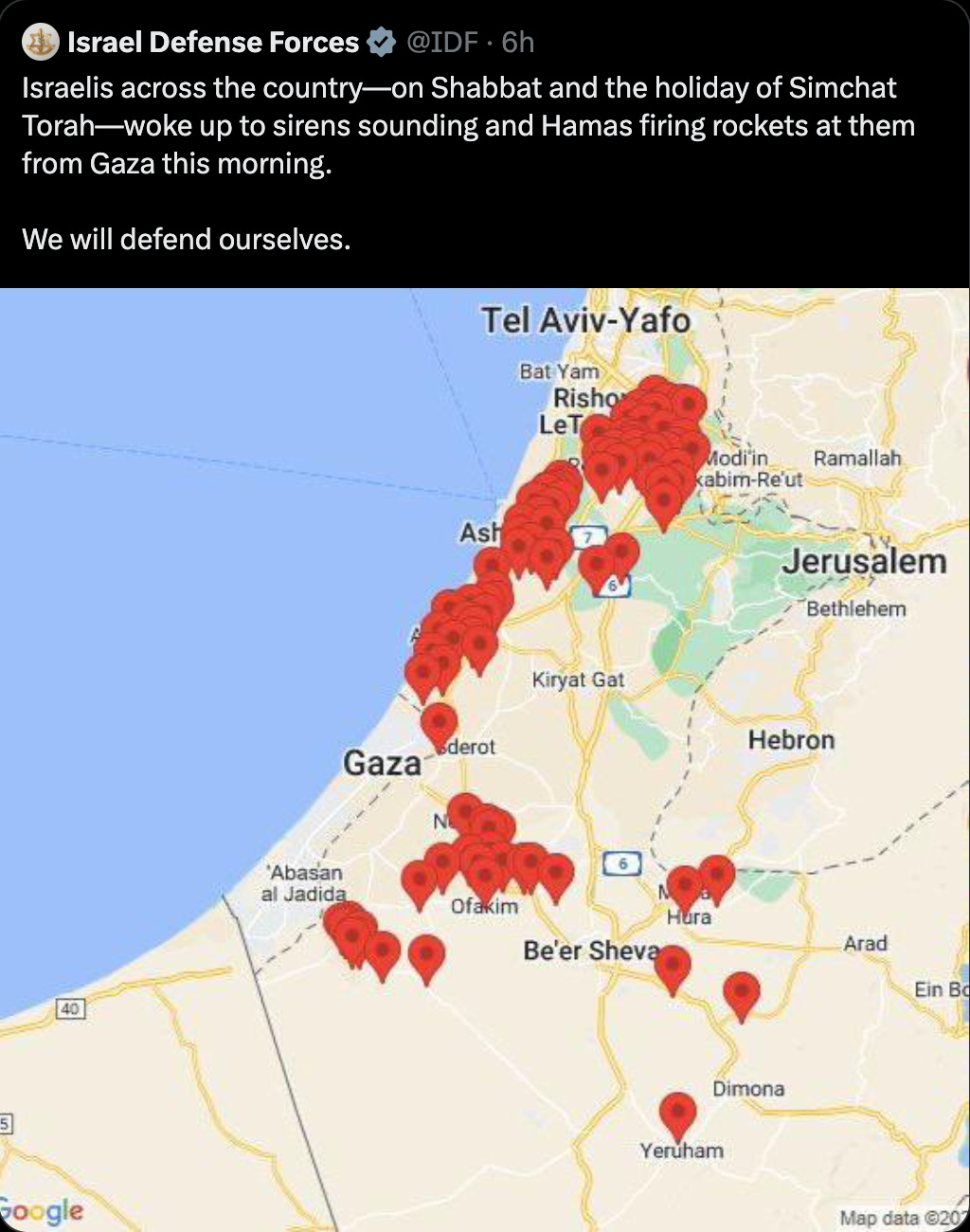

As I was penning this weekly post, the news of war in Israel flooded my social media feed. The most anticipated event for the coming week prior to this news was the CPI announcement.

Israel declares war after Hamas launches surprise attack

Breaking news reported that 22 were killed.

As of this point, I understood that HAMAS had launched 5,000 rockets into various parts of Israel. Israel called for an emergency meeting and declared war on HAMAS. Will this lead to an all-out confrontation? We can expect this to affect the wider markets. How would this affect the price of oil, international business and the supply chain?

CPI

This was supposed to be the most anticipated announcement for the coming week along with the beginning of the Q3 earnings season. Will the inflation remain sticky? Will the inflation rise or fall? What would be the Fed’s response to this with regard to the coming interest rate decision?

Strikes & layoffs

Before the UAW strike could end, healthcare workers joined in a strike to seek better packaging. CNBC reported that more than 75,000 workers strike at hundreds of Kaiser Permanente health facilities across the U.S.

As the negotiation continues, Ford Motor and General Motors have laid off an additional 500 workers combined, knock-on effects from the United Auto Workers’ ongoing strike (as per WSJ).

The ongoing United Auto Workers (UAW) strike, led by President Shawn Fain, has resulted in significant layoffs and threatens to tip the economy into recession. The UAW strike goes way beyond the automakers. In the end, will these legacy automakers emerge in a stronger position or just a step closer to implosion?

The US lost its House speaker

This news broke after McCarthy brokered a deal with the Democrats to keep the government open. This seems to largely favour the Democrats with the exception of support for Ukraine. Some GOP senators felt shortchanged as they did not get the notion required to secure the Southern border and control the federal deficit.

This would set the expectation for the next Speaker, a seat that is being contested.

Conclusion

The coming earnings season would set the tone for the economy. Will we see the earnings compression expected previously? Will the Magnificient 7 be able to continue its charge, leading the S&P500 to new heights? Will AI be the driving force again?

Let us consider hedging and spending within our means as the earnings unfold.

Comments

Post a Comment