Preview of the week starting 25Sep2023 - Can Micron rise again?

Public Holidays

There are no public holidays for Hong Kong, Singapore & the US in the coming week.

China is closed on 29 Sep 2023 (Friday) for Mid-Autumn Festival.

Hong Kong will be closed on the following Monday (02 Oct 2023) for Mid-Autumn Festival.

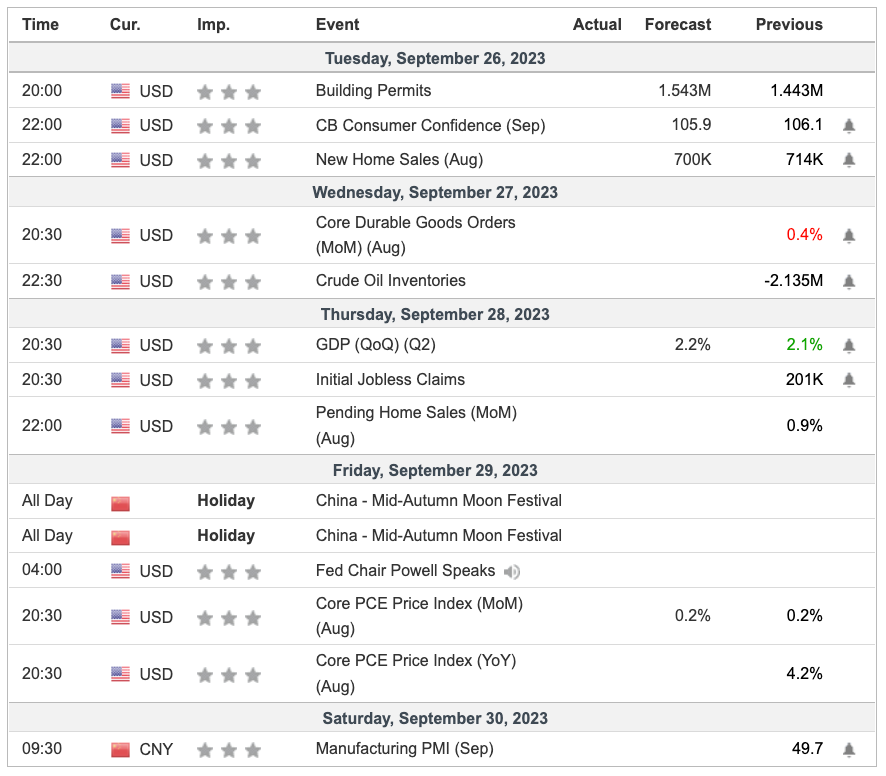

Economic Calendar (25Sep2023)

Notable Highlights

Fed’s Chair will speak on 28 Sep 2023. This speech could cause some volatility in the market.

GDP (QoQ) will be confirmed this week as we conclude the USA’s GDP for Q2.

CB consumer confidence and core durable goods orders present good reference for consumption.

PCE is the Fed’s preferred reference for inflation. This will be the most-watched economic indicator for the week. A higher-than-expected Core PCE can trigger concerns as this could strengthen the need for a more hawkish interest rate stand.

PMI - China’s manufacturing PMI will be released, a good barometer on the manufacturing sector for China and the demand for consumption of the rest of the world.

Building Permits, New & Pending Home Sales. These will reveal the demand for buildings in the USA as various ones have touted the real estate crash.

Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

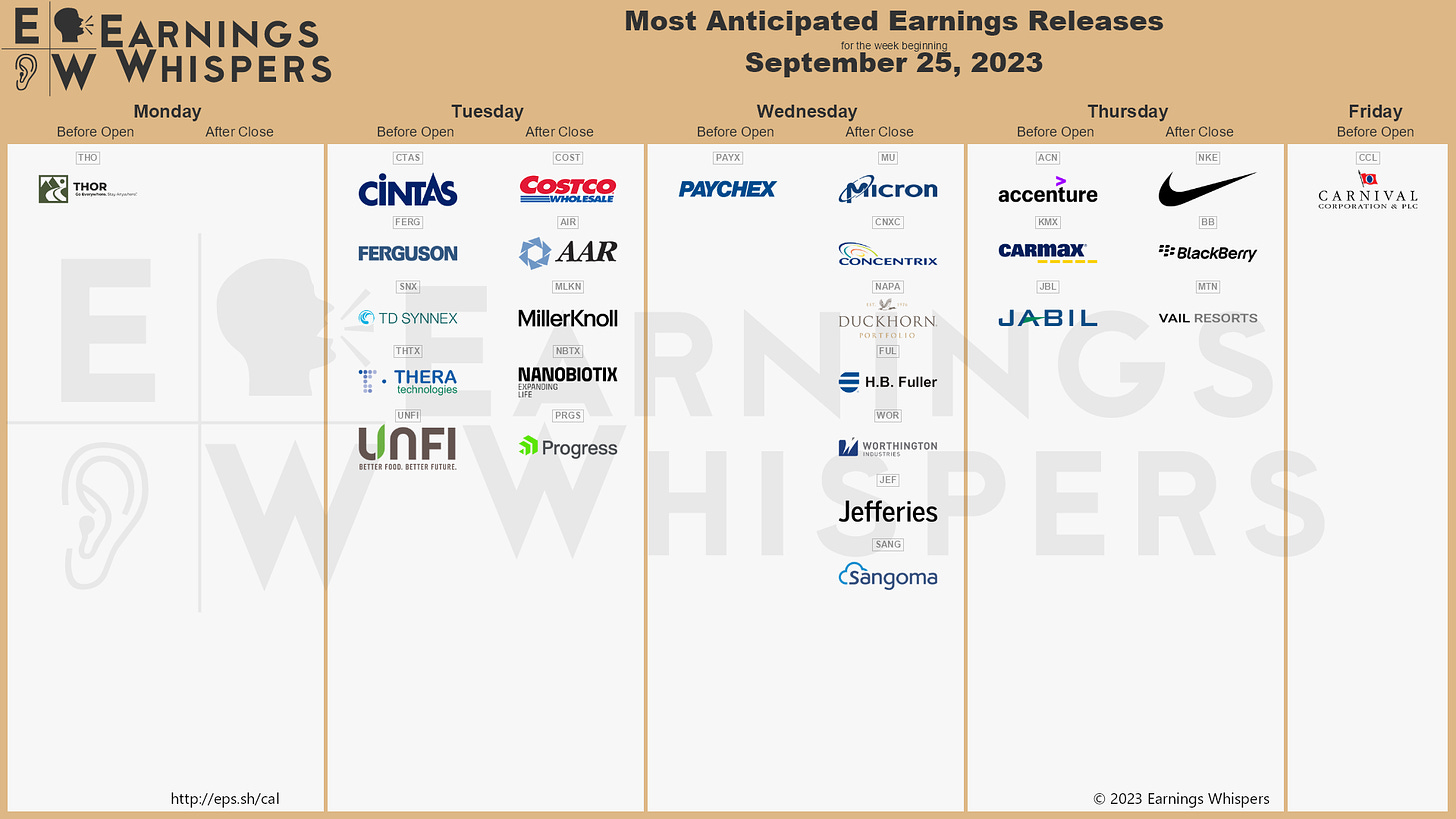

Earnings Calendar (25Sep2023)

This week will conclude the Q2/2023 earnings season. Personally, I am looking at the earnings of Costco, Micron, Accenture, Carmax and Nike with interest.

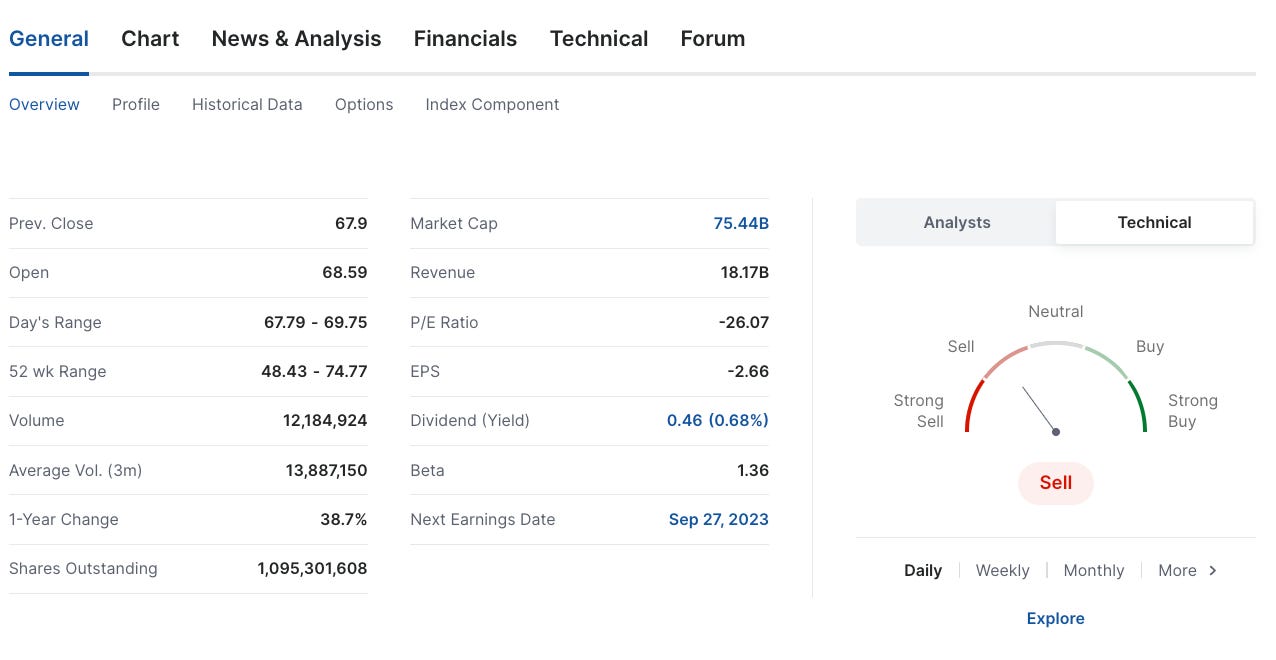

Performance of Micron

The above is the chart of Micron for the last 5 years.

Micron has gained 38.7% in a year and currently has a “Sell” rating from investing.

For the coming earnings, the forecast is -1.18 and 3.89B for the EPS and revenue respectively. Micron has been making a loss since Q4/2022 despite raking in billions of quarterly revenue. Will Micron gain or drop following the earnings?

Market Outlook - 25 Sep 2023

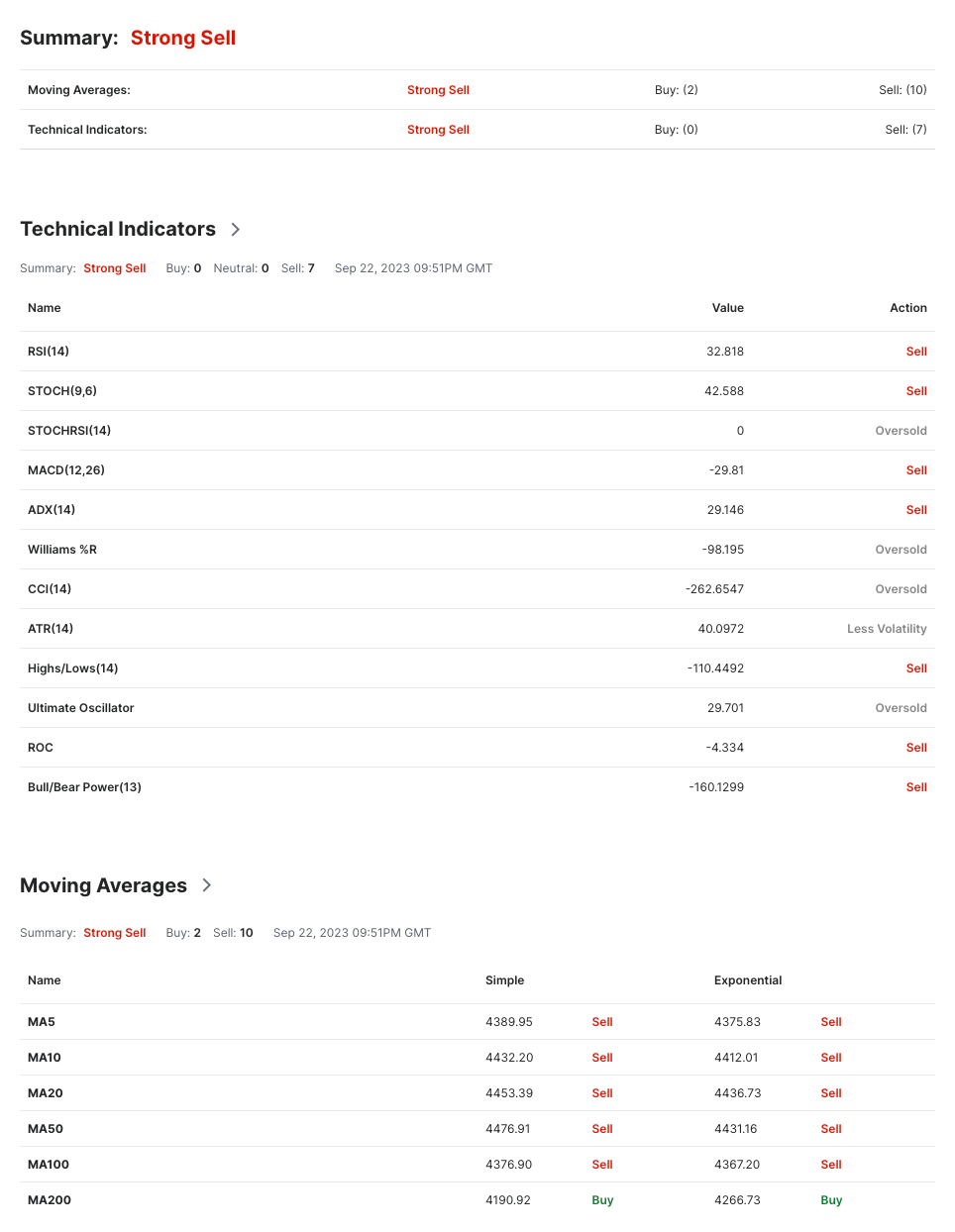

Technical observations of the S&P500 1D chart:

The Stochastic indicator is on a downtrend.

The MACD indicator is on a downtrend.

Moving Averages (MA). Both MA50 & MA200 lines are on an uptrend. The MA50 line may start a downward trend soon. With the last candles below the MA50 line and above the MA200 line, this can be interpreted as an uptrend in the long term. For the mid-term, it is on a downtrend. Should the MA50 line start to point downwards, this can imply a downtrend soon.

Exponential Moving Averages (EMA). All the 3 EMA lines have converged and this confirms the reversal into a downtrend.

From the 1D technical indicators above, there are a total of 2 (Buy), 17 (Sell) and 0 (Neutral). Investing recommends a “STRONG SELL” recommendation based on the technical indicators above (1D chart for S&P500).

This week should be a downtrend for the S&P500 but much hinges on the PCE data and the tone of the Fed Chair.

News and my thoughts from the last week (25Sep23) - earthquakes, UAW & defaults

Watcher Guru > India purchased 1 million barrels of oil from the UAE in Rupee. India purchased gold worth $1.7 million from the UAE. India and Saudi Arabia are discussing ways to conduct business without USD.

There have been: (M1.5 or greater) 93 earthquakes in the past 24 hours 614 earthquakes in the past 7 days 3,589 earthquakes in the past 30 days 52,143 earthquakes in the past 365 days The biggest earthquakes today: 6.3 in Hirara, Okinawa, Japan

A death cross has formed for BTC on the 1D chart. Is there another decline on the card? MACD is showing an uptrend.

WSJ > We need a win-win outcome for both workers and the companies. There will be a group of non-UAW suppliers and partners who would suffer too.

NY Times > U.S. National Debt Tops $33 Trillion for First Time

The fiscal milestone comes as Congress is facing a new spending fight with a government shutdown looming.

CNBC > Amazon is adding 250K workers for the holidays peak, up from 150K from last year. This is good news for the market.

Reuters > Autoworkers strike has extended to Canada.

4th Insider sale by Nvidia CEO. Should you be concerned? 1 reason to buy, a million to sell.

Craig Fuller > The top ten ocean container carriers have more marketshare over the global container market than OPEC has over global oil supplies. And they are exempt from US anti-trust regulations. They are also all foreign owned. If you think they won’t do everything to keep rates from the gutter, you are mistaken.

The Kobeissi Letter > JUST IN: According to Apollo, a new default cycle has already started and default rates are skyrocketing. Default rates on all US corporate bonds have nearly tripled from their lows of ~1% in 2021. Since the Fed started raising rates, the default rate on all US corporate bonds is up to 3%. On speculative grade bonds, default rates have gone from 1.5% to 5% in just over a year. If the Fed can avoid a recession here, it would be incredible. History says a recession is due.

Default rates are expected to hit 4.5% in the United States by June 2024 from 3.5% in July 2023, and to increase to 3.75% in Europe by June 2024 from 3.1% in July 2023 - Reuters

U.S. Philadelphia Fed Manufacturing Index. In the last 12 months, there was only a month of growth in August 2023. For the rest of the 11 months, Philadelphia manufacturing was contracting

CNBC > Investors grew increasingly concerned throughout the day that a government shutdown would cut into Q4 GDP & it would undermine global confidence in the United States’ ability to keep its own government open & operating.

CNBC > Foodpanda confirms layoffs and talks to sell part of Asia food delivery unit

The company says the plan will help improve profitability and synergies by focusing on fewer business areas and regions. Offshore wind and OSVs will be its two core business areas going forward.

$18.9 billion in US Treasuries Dumped by BRICS Members China, Brazil, India and UAE in One Month

My investing muse - UAW strike, US Freight, Panama Canal

UAW Strike News

The United Auto Workers union on Friday sent another 5,600 members out on strike at General Motors and Chrysler-parent Stellantis, widening the impact of its work stoppage and extending it to parts-distribution centers that supply dealerships

NEWS: Canada's Unifor auto workers union is set to go on strike against Ford tonight for the first time in 32 years. This will be a total strike. All 5,600 Ford workers in Canada will go on strike. This means Ford would face strikes in the US & Canada at the same time. Unifor's contract with Ford ends tonight at 11:59 PM ET.

NBC News > General Motors idles another auto plant, sending 2,000 workers home as UAW strike deepens

For every 1 worker on strike, there will be about 5-6 non-auto workers who will be affected. This includes supply chain (transportation, warehouse), suppliers, partners, etc.

At the same time, those who are on UAW strike will be receiving a limited payout during this time. Do not forget that Ford laid off 600 non-striking workers in Michigan about a few days ago. Some of these partners/suppliers have tight cash flow and can be deadly with the current interest rate. If their supply chain is compromised, more jobs can be lost and businesses may fold eventually. For those living paycheck to paycheck (61% in the USA), this may force them to turn to credit. This cannot be well.

If the union insists on its stand, some of these plants may end up in operating losses and are forced to shut down eventually.

Panama Canal

This is reported by Open Democracy pertaining to the Panama Canal drought.

Panama Canal drought: Rolling ecological crisis is raising prices everywhere. Climate change and El Niño are causing global shortages of everything from Barbie dolls to natural gas

Floods in the Balkans and North Africa have killed thousands, wildfires have raged across much of the Mediterranean, India’s rice crop has been hit by drought and Canada’s wheat harvests by floods. Meanwhile, in Central America, the driest weather in decades is menacing one of the most important transport arteries on earth.

A massive 40% of the world’s cargo passes through the Panama Canal, which ties together the two great oceans in the eastern and western hemispheres.

This is one event that will have an impact on the global supply chain.

Here are some specific examples of the savings brought by the Panama Canal as per Google Bard:

A ship traveling from New York City to Los Angeles can save up to 15 days of sailing time by using the Panama Canal.

The average cost of transporting a container from New York City to Los Angeles is about $2,000 cheaper using the Panama Canal.

The Panama Canal saves the global economy about $8 billion per year in shipping costs.

The Panama Canal reduces global greenhouse gas emissions by about 16 million tons per year.

The Panama Canal is a vital part of the global transportation system, and it plays a major role in reducing the cost of goods and protecting the environment.

US freight

FreightWave > The imbalance of import & export-led to an increase in exporting "empty containers" from the USA. Only 39% of export containers leaving the USA are laden with cargo. Is this not a concern?

More than 60% of the containers leaving US ports are empty. This needs to be done as there is greater demand for containers out of the USA. Ideally, each container should be carrying cargo so that there is revenue generated for the shipping lines. However, there are non-revenue trips. Do you think that the shipping lines will allow these costs to be borne by the shipping lines themselves?

Conclusion

Inflation is here to stay, higher and longer. From the data trend, the current interest rates are unable to bring inflation under control. Thus, there are more rate hikes expected and the Fed pivot has been pushed back further. For the Fed, they are guided by the inflation, GDP and unemployment data. Yet the oil prices, gasoline prices and the supply chain and union issues form causes for the rise of inflationary pressures.

Let us continue to be prudent and consider some hedging for our portfolios.

Comments

Post a Comment