Total costs of ownership (TCO) - 08Apr2023

Total costs of ownership (TCO) have come up a few times recently. This is an important concept that we should bear in mind for our purchases, especially those big-ticketed items. It is not just about the ability to put in the deposit and service the monthly instalments. We should factor in items apart from the purchase price, interest rate changes impact and others.

Total costs of ownership

This is a good summary provided by TotalSense on TCO. The costs components comprise purchase, repairs, maintenance, upgrades, service, support, security & training.

There is a news article and a few Twitter posts that caught my attention.

Let us look at an example of a property in the USA using a great article from TheBalance.

This is the assumption used in the example by TheBalance:

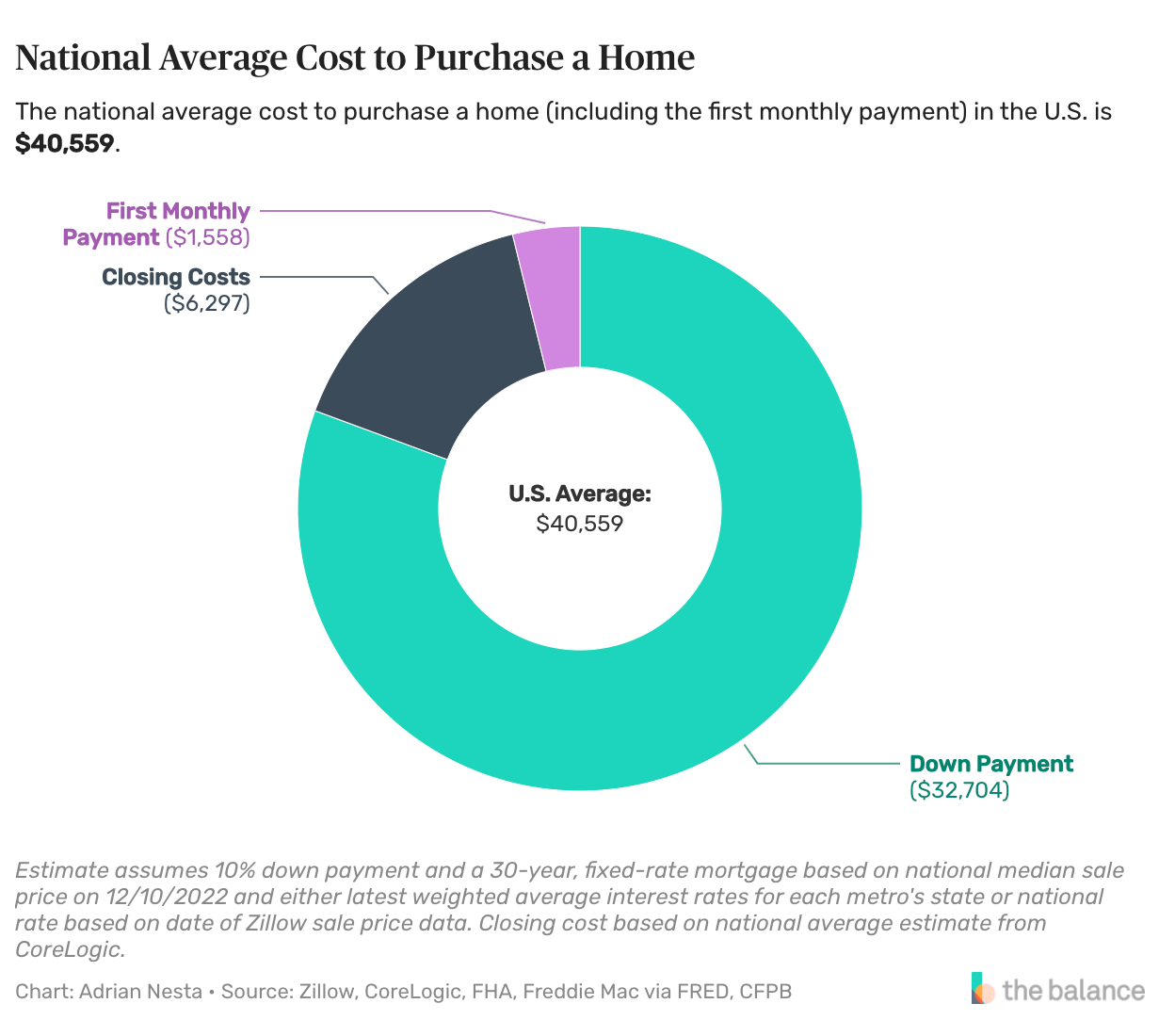

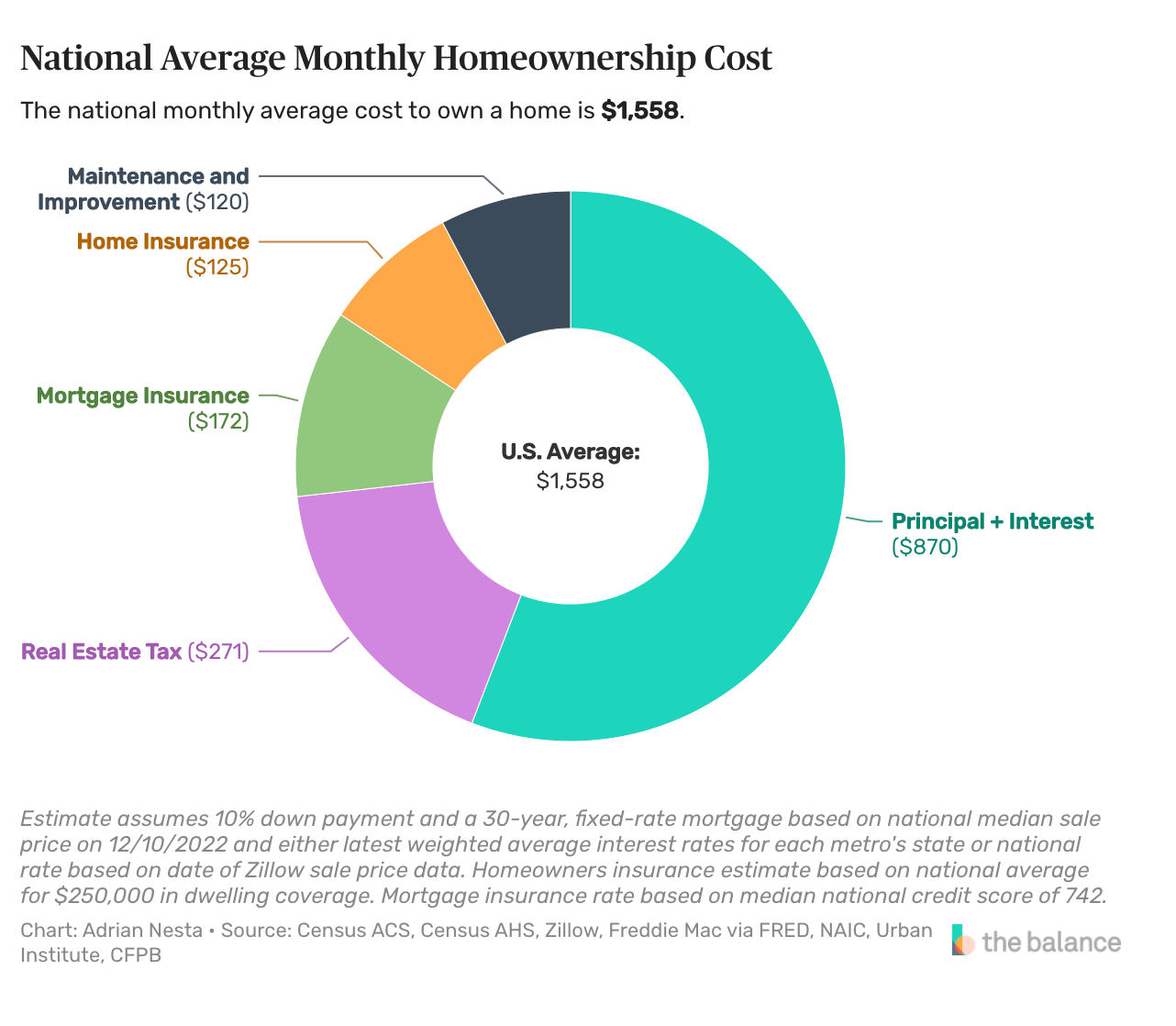

Estimate assumes 10% down payment and a 30-year, fixed-rate mortgage based on national median sale price on 12/10/2022 and either latest weighted average interest rates for each metro's state or national rate based on date of Zillow sale price data. Homeowners insurance estimate based on national average for $250,000 in dwelling coverage. Mortgage insurance rate based on median national credit score of 742.

The average upfront cost to buy a new home in the U.S. is $40,559. However, this varies from the city. It could be close to $120K in San Francisco and $71K in New York City.

Apart from the initial cost comprising of a 0 to 20% downpayment, there is a first monthly payment and closing fees (that range from 2 to 5%).

Other expenses

There are other cost components that are not captured in the above. There could be other expenses related to purchasing new furniture & household appliances, disposal of old household items, renovation costs, relocation expenses related to schools & work, change/relocation of family vehicle (especially if the relocation is far away), application for new utility service providers (water, sewage, electricity, internet and mobile plans). Note that this list is not comprehensive.

The national average monthly homeownership costs typically include maintenance and improvement, home insurance, mortgage insurance, real estate tax, and principal + interest payment.

Phases of life

As we move into different phases of life, the expenses we incur change. It could be preparation for kids or having relatives and friends staying over for a season. This could add up to the household expenses. If we need to care for aged relatives, we may need to invest in making our place more elderly-friendly. This would apply to make our home child-friendly when we are planning for kids.

Home Affordability

TheBalance recommends the following as a good way to view home affordability.

One way to measure home affordability is to calculate the ratio of housing expense to income—the housing expense ratio. A housing expense ratio of less than 30% is considered affordable; a ratio greater than 30% is considered unaffordable.

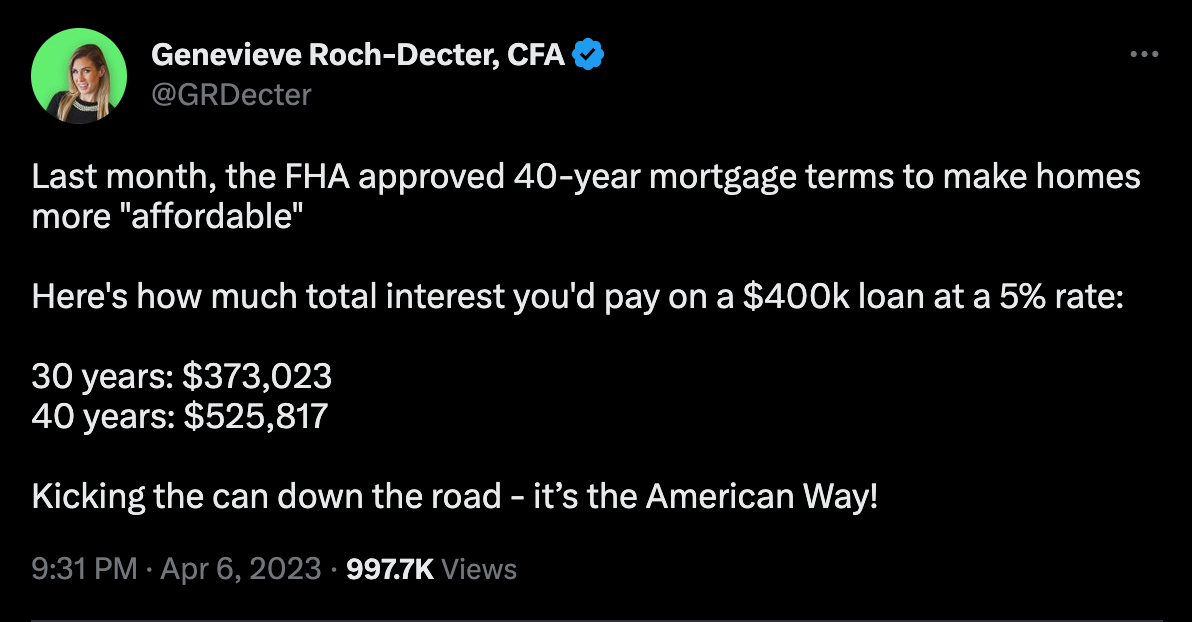

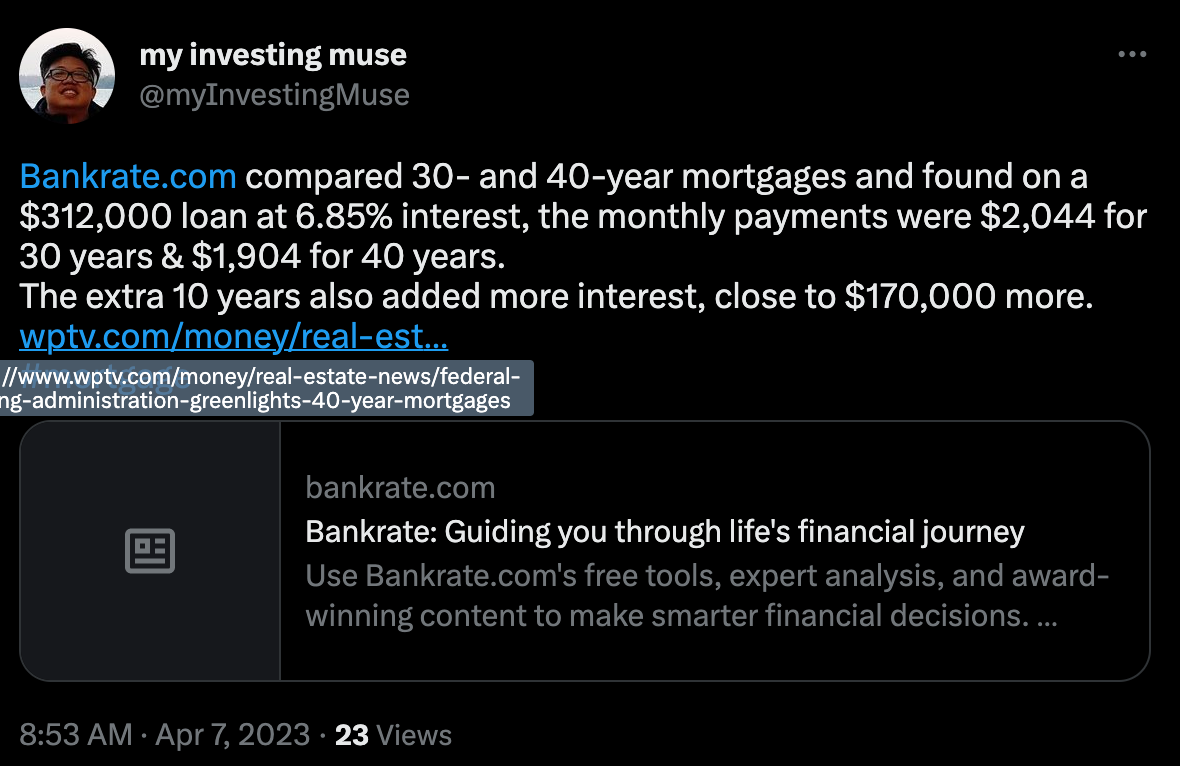

In the example above, there are some differences coming to 30- and 40-year mortgages.

This is based on a $312,000 loan at an interest rate of 6.85%. The monthly payments amounted to $1,904 and $2,044 for 30 and 40-year mortgages respectively. The difference works out to be about $140 per month. This extension works out to be $170,000 extra being paid to stretch the mortgage by another 10 years.

If this is within the means of the household, paying the higher monthly payment ($140) could lead to savings of $170,000 worth of interest. The household may also wish to consider if they should consider other options if they need to pay the longer mortgage, leading to more paid interest. If the higher monthly payment is out of reach for the household, it is good to be aware of the extra that we are paying for.

Conclusion

By looking at the total possible expenses (using TCO as a guide), it empowers us to make decisions coming to our expenditures and review the options that are before us. This can be incorporated as part of our considerations for our expenses (like buying a vehicle or going on holidays).

Personally, the first house we own should be for our residence, not an investment.

Hopefully, an understanding of TCO can help us to be financially aware and empowered to make better decisions in the future.

Comments

Post a Comment