Macro - Employment, inflation & signs from the various asset classes (12Apr2023)

A strong job report implies that inflation is not coming down soon.

Strong job reports imply that people find employment. With employment comes spending. The spending typically supports the demand & indirectly the inflation. We can look at 3 primary macro data - Gross Domestic Product (GDP), inflation & unemployment.

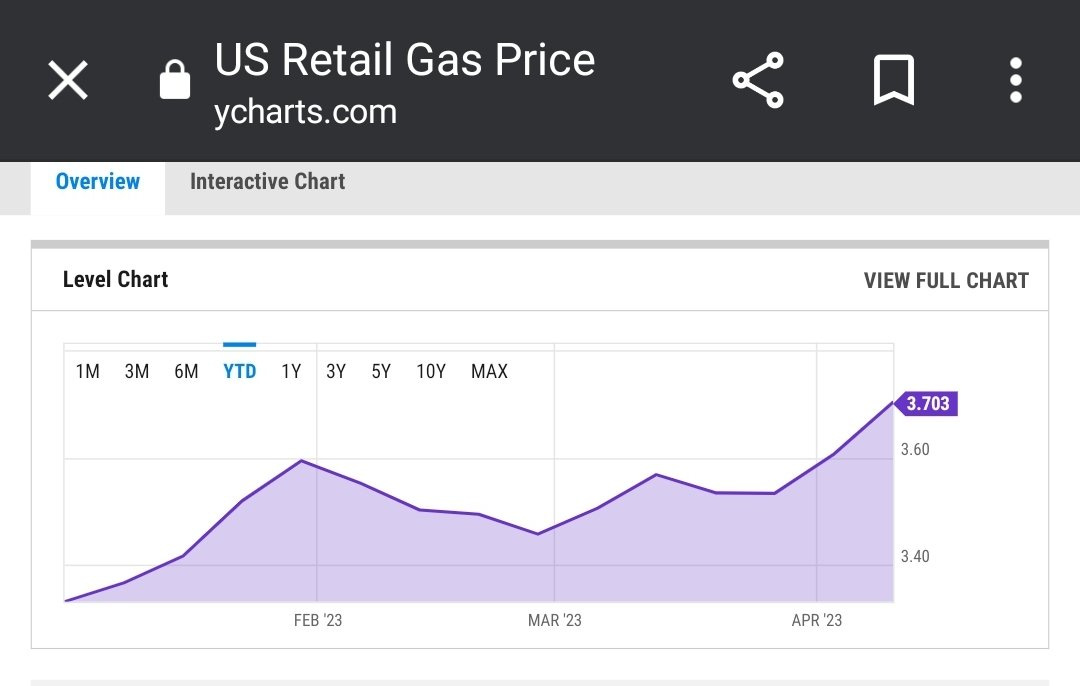

Fuel price is trending up, too. This will affect goods & services, transport and utilities. Let's monitor. A strong job report implies that the Fed can remain hawkish too.

What is more of a concern is the debt, increasing interest rate, coming debt default, and resumption of student loan repayment after suspension. With de-dollarization, it is not trending in the right direction for the US. Let's monitor.

To get a more comprehensive understanding, let us look at the various asset classes. These include real estate, equities (shares), bonds, cold hard cash, commodities like gold & silver and alternative assets like cryptocurrency.

I am following several key considerations:

commercial real estate vacancy/occupancy - with some of these due for re-financing over the coming months, the elevated interest rates could affect

banks have reported that they are making losses from the various mortgages as per the news below:

Independent mortgage banks & mortgage subsidiaries of chartered banks lost an average $301 per loan, largely to the increased cost of financing a loan and decreased housing demand

Savings are reduced as inflation forced people to dig into their savings. Refer to the Personal Savings rate provided by FRED (St Louis Fed)

US household debt hits record USD$16.9 Trillion as per Q4/2022.

Conclusion

When we add up the above to the aftermath of the recent SVB and SBNY banking crisis, the US is trending in the wrong direction. As the reserved global currency, some argued that the US is able to print its way out of its problems. But this “okay for me, but not for you” mentality could be the downfall of this currency. Once, it was 73% of all global reserve currency, USD now stands at 55%.

The US CPI will be released in a few hours and the market has been nervy about this for the last few days. At the end of the weeks, some of the leading US banks will be sharing their earnings from Q1/2023 where we will understand the collateral impact of the recent banking meltdown.

Ms Yellen came out to assure the market as per the tweet above. Maybe we are not seeing her point. One of us could be right eventually. For now, I recommend considering post-news trading and perhaps adding some hedging to our positions.

It is safer to be hopeful of the best but prepared for the worst. Yet with such data above, we need more good news to lift up the sentiment of the market.

Comments

Post a Comment