Beware of Creative Accounting & Management of Earnings Estimation (29Aug2023)

In my latest preview of the week article, I have covered the company NIO whose earnings will be released this week. Can a business beat the earnings and be doing worse? This can be done via earnings estimate management and some “creative” accounting.

The following is an extract from my recent article about NIO

Performance of NIO

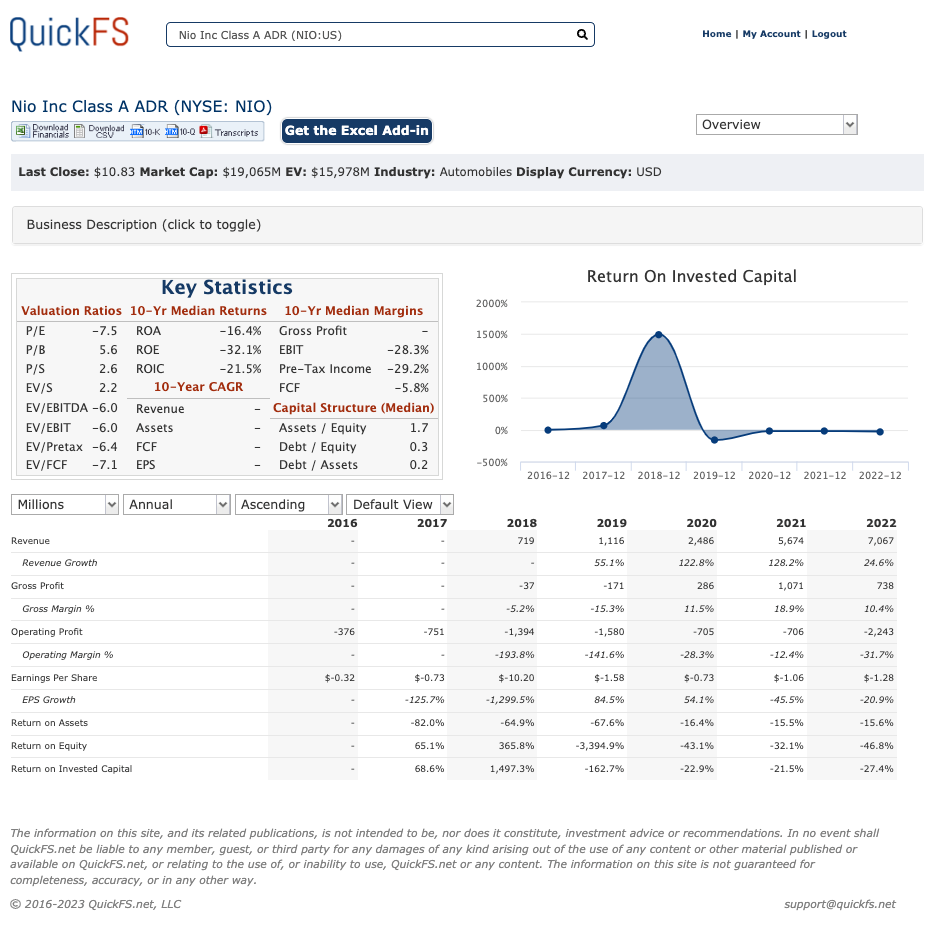

Personally, I have already sold out my positions in NIO years back. Despite rising annual revenue, there has been no operating profit as the company has suffered losses since 2016. Losses in 2022 have surged to over $2.243B from the region of $706 in 2020 and 2021.

As such, I prefer to monitor the business and hope to see them achieving profits soon.

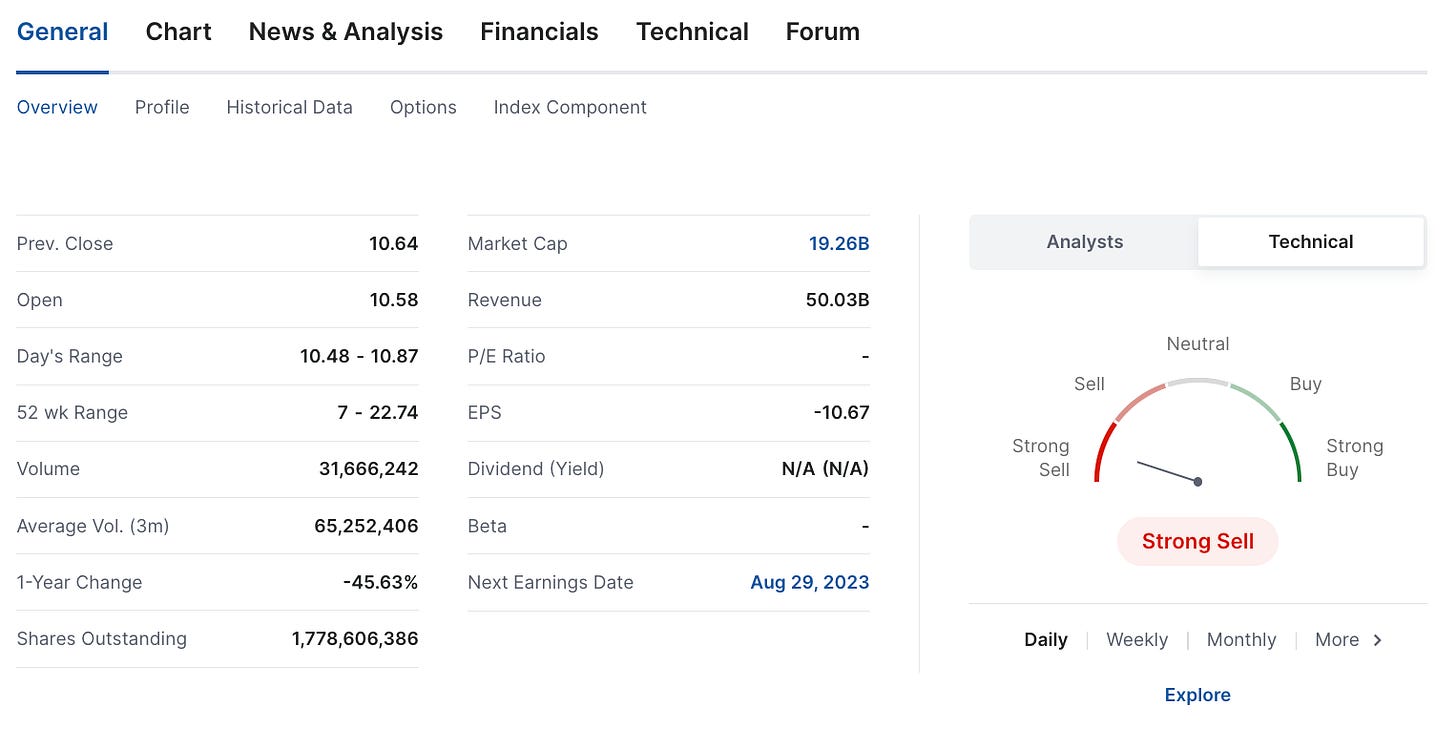

NIO has fallen by over 45% from a year ago. The last price of $10.83 (as of 25 Aug 2023) is above the 52-week low of 7 but remains a distance from the 52-week high of 22.74.

For the coming earnings, Investing has a forecast of -2.96 and 9.16B for its EPS and revenue respectively. We should note that Investing’s forecast expects a bigger EPS loss and a drop of over $2.8B in revenue compared to the previous quarter. For the EPS, it is expected to be the biggest EPS loss in recent quarters. This is not trending in the right direction. Personally, I would prefer to monitor instead of investing in NIO.

Earnings Estimate Management

From the earnings forecast by Investing above, we can note the following:

- The coming EPS forecast (for the period ending 06/2023) is worse than the previous period ending 03/2023.

- In fact, the EPS forecast is expected to be the worst at record -2.96 since 06/2022.

- For the revenue forecast, it is expected to be lower than the previous quarter. It stands at 9.16B compared to the forecast of 11.93B from the previous quarter ending 03/2023.

- This is in fact the lowest revenue forecast since 06/2022.

- In the event that NIO beats both EPS & revenue forecast in the coming earnings, is the company doing better? In my opinion, it is a “NO”.

- Beating such an estimate is not something to brag about as the company remains unprofitable with “falling” sales. It can be too early to call this a falling trend but the quarterly signs are there.

- Before we embrace any content from news agencies or investing portals, let us do our due diligence.

- One quarter does not define a trend and thus, looking at the business as a whole from afar can help to put some objectivity and remove the impact of seasonality. This will help to put things in a better context as we even out peaks from new launches and service offerings.

Now, let us look at an example of how creative accounting can be used to direct their narratives.

AFFIRM

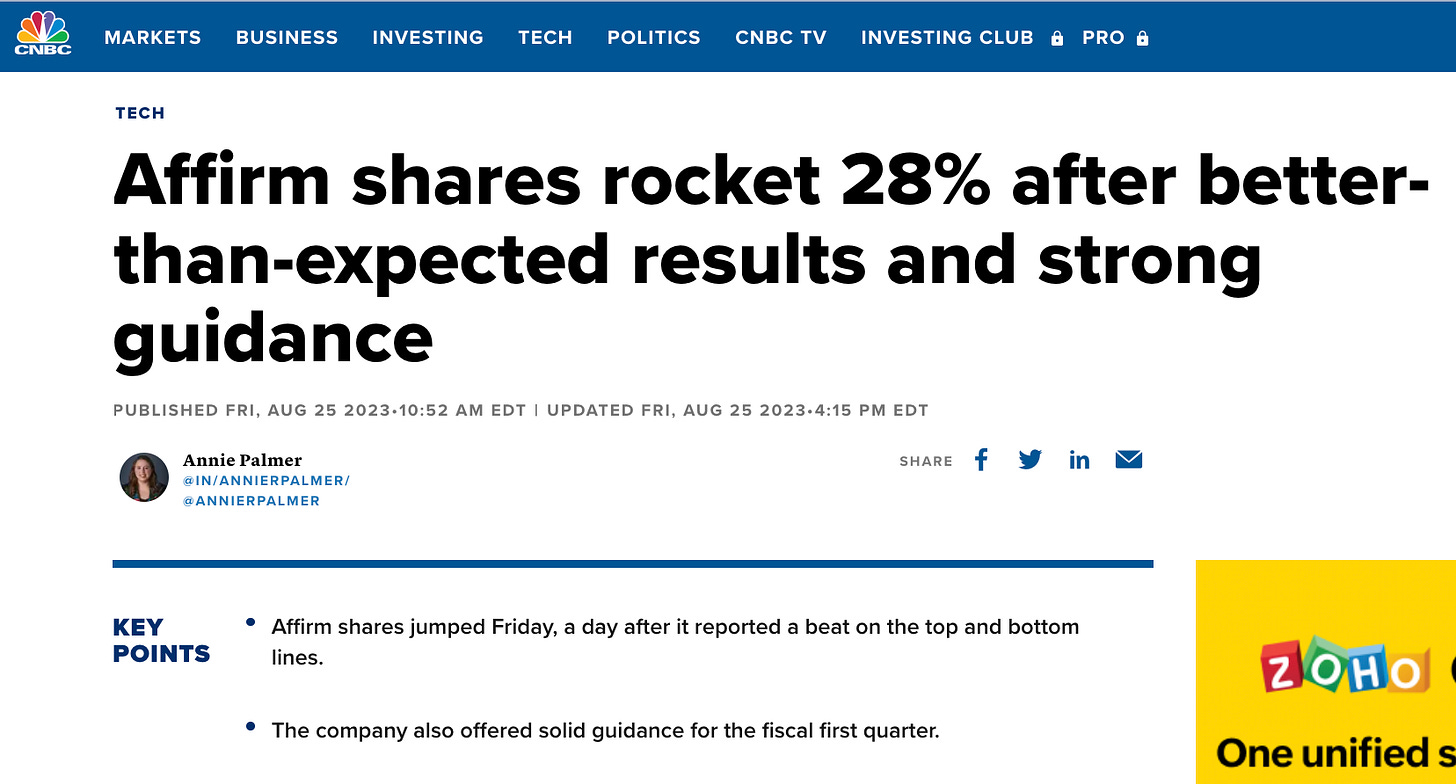

CNBC has reported the surge of AFFIRM shares after better-than-expected results as per the screenshot above. More details can be found in the link below.

https://www.cnbc.com/2023/08/25/affirm-afrm-earnings-report-q4-2023.html

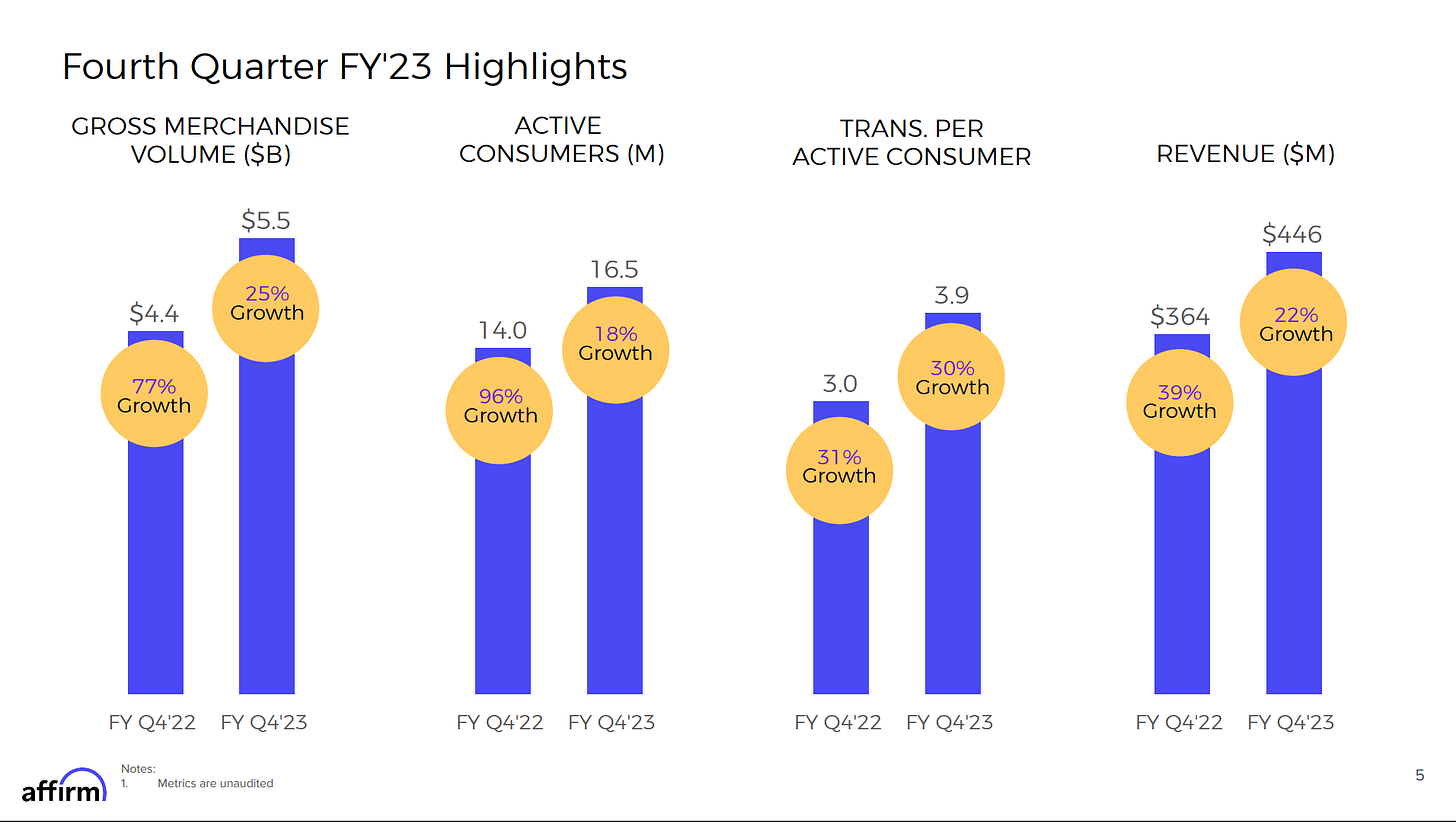

AFFIRM (a buy now pay later business) has published some exciting highlights.

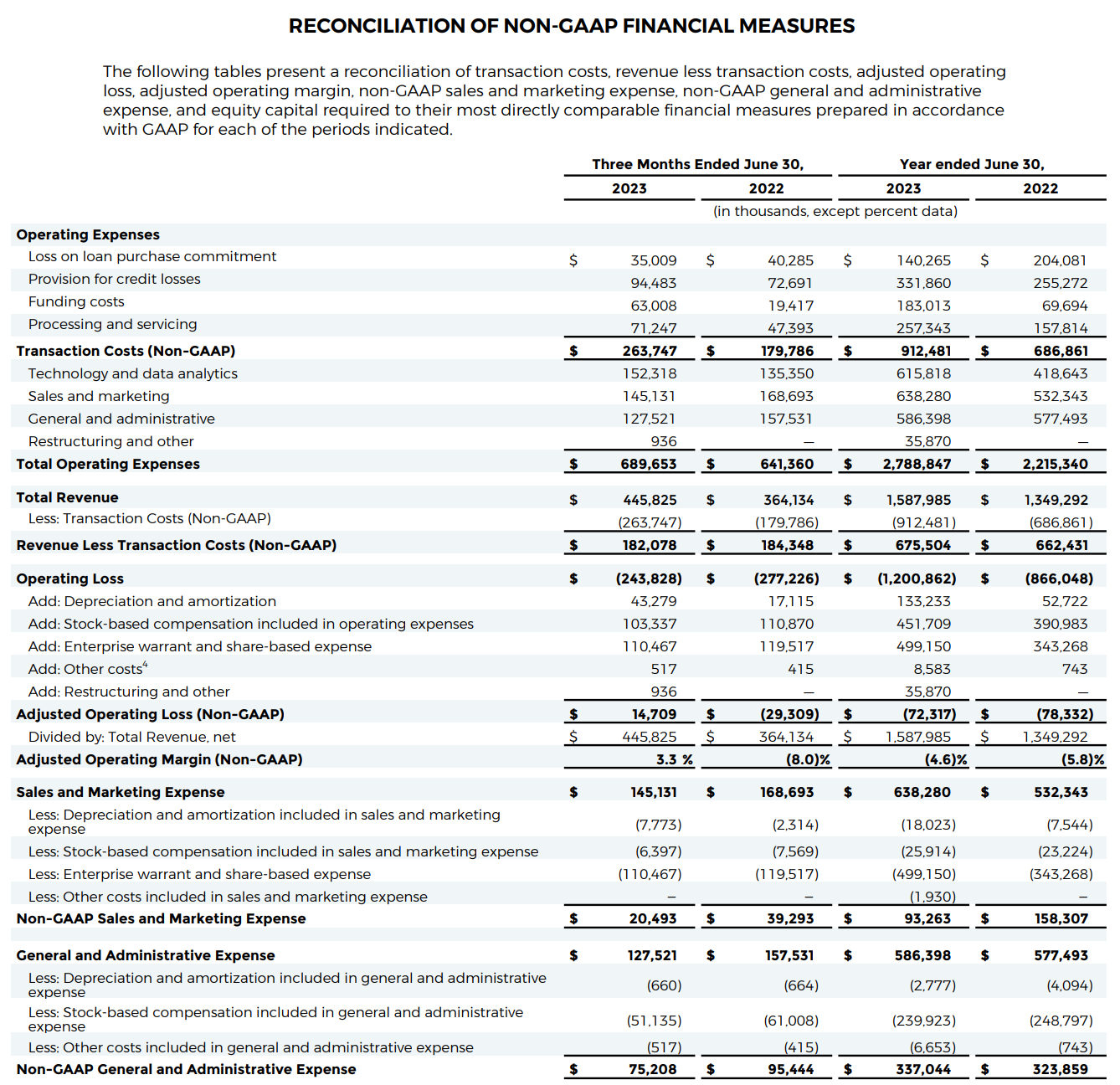

Let us look at their GAAP and non-GAAP reconciliation in detail:

AFFIRM makes a profit in the most recent quarter by using non-GAAP measurements. Using the whole year results ending 30 June 2023, total revenue is $1.587B and total operating costs are $2.788B, representing an operating loss of $1.2B.

Yet through the lens of non-GAAP, the last quarter was profitable with $14.7M because non-GAAP does not include the costs of depreciation & amortization, stock-based compensation, enterprise warrant, restructuring and other costs. Going forward, I recommend all to focus more on the GAAP figures as that gives a better view of the financials. Creative accounting and business narratives can distract us from having a realistic view of the business.

The need to probe further into the financials is necessary so that we can better appreciate the financial fundamentals of the business. After 1 year, AFFIRM suffered a loss of $1.2B, compared to the loss of $0.866B from the same period a year ago.

This seems to be somewhat contrary to the CNBC headline.

Conclusion

Let us perform the due diligence necessary so that we can filter out great companies. It is possible that some of the media focus on certain good parts and omit other “necessary” portions.

No one should care more about our money than ourselves. The due diligence will be the leverage we have. Should the price plunge, this will give us the confidence to hold or buy even more.

Comments

Post a Comment