Weekly preview as of 07 Nov 2022 - has growth left Tech stocks?

Public Holidays

No public holidays for Singapore, Hong Kong, China & the USA

Earnings Calendar

|

| Earnings for the week starting 7th Nov 2022 |

For this coming week, there are a few earnings of personal interest, starting with Palantir, Disney, DuPont, Occidental and NIO. For Disney, its outlook will be a good reference on the re-opening and people going out for more service/experience after 2 years of Covid19. NIO is one of the famous China EV brands that is challenging in the luxury end. DuPont is one of the top speciality chemicals whose outlook can be a good reference for future consumption. Occidental's investment by Berkshire has propelled the stock into fame. Its outlook can also be a good indicator of the economy's future consumption.

Palantir's stock has fallen from its 52-week high of 27.11 and is currently at 7.93 (just above the 52-week low of 6.44. The stock price has fallen 69.5% from a year ago.

For the coming earnings, investing has put out the estimate of 0.0251 and 474.66M for its EPS and revenue respectively. Will Palantir be able to rebound from its recent decline?

Economic Calendar

|

| Economic Calendar for the week starting 7th Nov 2022 |

These are some of the implications for this economic calendar:

|

| Screenshot from ABC news dated 20th Oct 22 about Freeze Warning for 70 million Americans |

- EIA short-term energy outlook is important as this presents a preview of the energy situation for the coming winter months. With the cold snap hitting parts of the US, winter has arrived for some of them. With winter, there will be more demand on the energy grid. With the recent energy concerns, the USA hopes to get some good news about energy and the costs associated with keeping our houses warm.

- Crude Oil inventory - these can be seen as forward indicators for the economy. The last crude oil inventory was bullish as the drawdown was more than expected. This can be seen as a preview of market consumption. Thus, a more-than-expected reduction of inventory can be seen as bullish for the market.

- CPI (Oct) should probably be the highlight of the week following the mid-term election. This is an important reference that will lay the path for the coming interest rate adjustments. If CPI remains heightened or stubborn, the Fed is expected to continue its hawkish approach to interest rate adjustment. Should the CPI be "stubborn", the Fed will maintain its hawkish stand with the coming interest rate hikes. This should be bearish for the markets as it gets more expensive to service their loans and credit card balances.

- Initial jobless claims will be the next data point that the Fed will incorporate for their new rate hike. A favourable (less than expected) jobless claim may persuade the Fed to ease their interest rate hike.

News and my muse (for the week ending 06 Nov 2022)

- <FOX> Silicon Valley insider warns hiring freezes and layoffs among big tech could impact most Americans

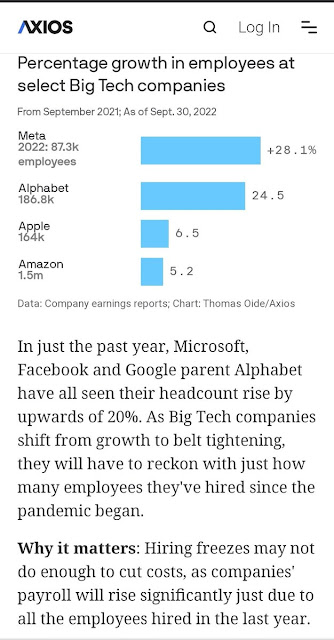

- <AXIOS> Big tech's hiring over the last 12 months (as of September 2022)

- BRICS - Brazil, Russia, India, China & South Africa has an estimated total population of 3.21 billion (41.5% of the world population, 26.2% of the world's Gross World Product.

- <CNBC> Diesel prices have increased 33% for November deliveries & are expected to go higher. Diesel supply in the Northeast, the drought-stricken Mississippi River, and a potential rail strike are contributing to higher fuel demand.

- <BIzjournals> $AMZN & $MSFT staff layoffs.

- Food for thought. While it is impossible to time the market, the appropriate entry time is also crucial to compounding.

- Food for thought. The pivot which will eventually happen may have its own share of side effects. If the economy needs a reset, I rather it is done quickly so that the rebuild can commence. But building over a broken foundation is dangerous.

- Spend within our means. Some governments won't do it. Some businesses don't do it. Some families can't do it. This leads to a cycle of debts that will burden the future generation.

- <Crunchbase> As of late October, more than 52,000 workers in the U.S. tech sector have been laid off in mass job cuts so far in 2022, according to a Crunchbase News tally.

- If Twitter is successful following the re-organization of resources, what does this speak of the other tech companies? Can we be more lean?

- The growth stocks of yesterday may not be the growth stocks of tomorrow.

- While there is no guarantee that the #Republicans will win the coming mid term? For me, it is more of how much the #democrats will lose. We will know in a few more days.

- MACD indicator - looks to have peaked but in absence of a crossover, the reversal has yet to happen. It is still on an uptrend.

- Stochastic indicator - looks to be on a downtrend.

- Moving Averages (MA). The candle is below both MA50 & MA200 lines. Thus, the current trend remains downwards. At the same time, both MA50 & MA200 lines are pointing downwards, thus, bearish for both the mid & long-term.

- Exponential Moving Averages (EMA). The EMA lines look to be converging but in absence of a crossover, it remains uptrend.

Given the above, it looks like the market should take a turn downward in the coming days.

My investing muse

US mid-term election

The US mid-term will be hogging the headlines at the beginning of the week. At this point, there are a couple of toss-up states but I am expecting the democrats to be losing a few seats in both their governor and senate races. With President Biden's low approval rating in the 40s, some news agency has reported that some of the political leadership are not in touch with issues closest to the ground. This may bring about some volatility in the market. Let us await the votes of the US citizens. Some states may drag out their fight beyond the 8th Nov 2022. The bigger concern is that there seems to be a greater political divide. Hopefully, we can have a more cohesive government to lead the US through the trying times.

Ukraine

Ukraine's conflict with Russia continues to drag on. There does not seem to be an end in sight though there were talks about a truce. With Russian hitting the energy infrastructure, parts of Ukraine may have to go through winter in the dark, in the cold. While this may indirectly add to the resolve of Ukraine, the winter can bring her fair share of challenges. When resilient & determined troops fight unwilling Russians, the result is not unexpected. With the ongoing conflict, we can expect more destruction of lives & livelihoods in Ukraine. The support towards Ukraine must not stop at bullets and weapons but will need to continue into the rebuilding and restoration of this nation. While there were talks of a "dirty" bomb, the media claims that there is no such facility from Ukraine.

There are some investors who have advised that the market can continue to dip should the war drag out. Ukraine will be paying the highest price but the US & her European allies would need to finance this as the war drags on. However, the ending of this world is expected to bring a big rally in the global market.

Grains and Harvest

Though there is some relief in the naval blockade, let us not forget that Ukraine's expected harvest for this year is about 50 million tons of grains compared to 86 million tons a year ago. There is still some shortfall in the total supply of grains. With Russian fertilizer under sanction, hopefully, this does not affect the harvest too much though many regions have been affected by extreme weather. Be it the heat wave hitting Europe and the USA, or drought affecting the Mississippi River, Yangtze River, or River Rhine, this year's crops harvest looks to be challenging. With weather-led supply chain challenges, there will be more inflation being passed to consumers.

Tech

Following the recent earnings of Big Tech (FAANG+), most of these companies have dipped following their recent Q3 earnings. One of the questions asked was whether these Tech companies remain capable of leading the recovery of the economy. We are seeing more news about hiring freeze, and layoffs following a less than favourable market outlook for the coming quarters. It seems like most of the market has accepted the recession.

Macro

When we look into macro, we are looking into factors that will affect inflation, economic growth (GDP) and also unemployment. With inflation remaining heightened, unemployment seemed low and the latest GDP showed 2.6% growth, these will empower Fed to continue their hawkish stand. There is still more room in the downside for the market:

- mortgage hitting 7+% has stopped the red-hot property market. But this has also made property out of reach for many families.

- household debt hit a record high of over USD$8,500 per household. when default starts, we should be expecting the impact to spread into financial sectors and more.

- The US continues to fund the Ukraine war front with their allies. There are some politicians who have called for a review of this financial "blackhole". While they want the US to continue to support Ukraine, they are concerned about the financial impact it makes to US and how it will affect its internal needs.

- China and President Xi's new cabinet,

- the diesel shortage in USA,

- the LNG situation in Europe,

- the Nord Stream pipeline update,

- Elon's Twitter takeover & retrenchment

- Europe zone hitting an inflation rate of 10.7%

- UK's political challenges

- Israel's war with her neighbours and a new "old" government

- The pending strike at the US railway works

- The supply chain challenges caused by drought-hit Mississippi River

- The approaching winter and its impact on energy in the US and Europe

- Food insecurity for about 1.3 billion ~ IMF

- 69++ countries facing food, fuel & financial insecurities

In conclusion, I agree with Mr David Sacks that until the Ukraine war has ended, the market should remain bearish. There is always money to be made in the bull or bear market. Personally, I do think that the macro would continue its price & earnings compression. At this rate, some asset classes of the economy may eventually give way - currently, real estate looks to be a candidate. As always, let us spend within our means, invest with what we can afford to lose & do not leverage. Let us identify great companies at good discounts. When the sale starts, may we be brave to buy, hold and allow time sufficient runway to do her compounding magic.

Comments

Post a Comment