CPI and inflation - is the economy getting better?

Latest CPI News as of 10 Nov 2022

|

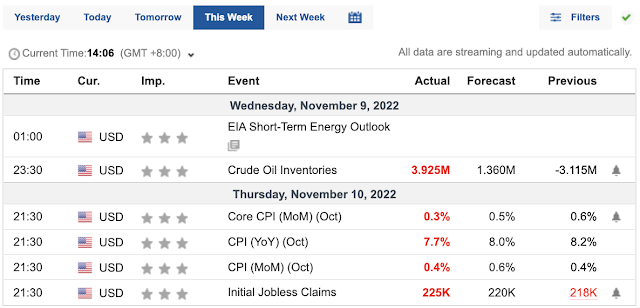

| Latest CPI data from investing dot com |

The market moves easily from oversold to overbought in a volatile environment. Following the CPI news on 10th Nov 2022, the market embarked on a record single day rally. The market was expecting a MoM increase of 0.5% and the actual CPI amount arrived a lesser 0.3%.

Data and narratives

To put CPI into context, let's use an example of us expect a total of 8 fatalities from an industrial accident. Eventually, we end up with 7 deaths. Depending on how the news paints the perspective, we can focus on the 1 survivor or 7 lives that were lost. In this way, the facts are presented in a different light, offering a different perspective. Using this as the background, the news agency can choose to report the news in the following fashion:

- Heartbreaking tragedy where 7 lives were lost

- Miracle - 1 survivor found after an accident has claimed 7 lives

While both presented factual information, however, the "aftertaste" and emotions invoked are different with one ending on a negative note and the other on a positive one. Let us not forget to check the delivery, content and intent so that we can have objectivity for the various topics and events.

Back to CPI, the market had a rally because they were expecting a worse inflation but it seems that we have ignored the fact that the inflation remains. The inflation has continued to grow. The inflation is not backing down despite the previous interest rate hikes by the Federal Reserve (aka "the Fed).

|

| Yahoo Finance - breakdown of inflation on various items |

The CPI of 7.7% YoY (over 12 months) is still a high inflation figure. Looking at the various sectors, we see a YoY 10.9% increase for food and a 17.6% increase for energy. At a MoM level, inflation food has increased by 0.6% and energy has gained 1.8%.

Far from the 2% inflation target, the Federal Reserve has a tough balancing act to manage unemployment, interest rates and inflation. If we look at the cumulative inflation over the months since Covid, it is revealing of the impact of the various policies to the economy.

To see a better and longer history of CPI, we need to look at the data from a much longer timeframe. Using 1984 as the base year, CPI has cumulatively reached 298, almost 300% since 1984.

To see a better and longer history of CPI, we need to look at the data from a much longer timeframe. Using 1984 as the base year, CPI has cumulatively reached 298, almost 300% since 1984.

Cumulative CPI

|

| Cumulative CPI for one last year using 1984 as the base year - hitting 298.06 since 1984 |

<Using 1984 as the base year (at 100)>

From Jan 2022 till Oct 2022, the inflation went from 281.148 to 298.012, this is a nearly 17% rise in inflation within 10 months (using 1984 as a base), much lesser as a percentage. When we talk about 7.7% (YoY), we "ignored" the inflation that happened before. We were only talking about the inflation based on the last 12 months. This may cause us to "discount" the previous months of inflation that have taken place. This understanding offers a different perspective coming to inflation. Looking at YoY of 7.7%, the current inflation runs almost 4x over the target of 2%.

|

| Table showing the inflation since Jan 2020 on a monthly accumulation (with 1984 being the base at 100 on the index) |

Conclusion

In essence, this rally is not due to the absence of inflation but rather a lesser magnitude. Looking at cumulative inflation, the extent of inflation becomes more evident & prevalent. Let us not be distracted by the narratives. Maintaining an objective outlook can help us to navigate better during volatile times.

Comments

Post a Comment