Preview of a volatile week starting 25 July 2022

Public Holidays (Singapore, USA, China & Hong Kong)

Nil

Earnings Calendar

This is a big week of earnings, especially when it involves the Big Tech. I would pay close attention to Alphabet (Google), Microsoft, Apple and Amazon especially.

As per the CNBC news article dated 11th July 2022 (above), the Tech companies will have much impact on both the market and the USD due to their global footprint.

For the automotive makers, General Motors & Ford are due to report their progress. ExxonMobil and Chevron are due to update their earnings for the energy players. Apart from these, pharmaceutical players of Pfizer, Merck and AbbVie are due to update too. A close look at P&G will reveal how the typical household is spending to navigate in such circumstances. The outlook can provide a glimpse as these cover the consumption

In essence, this is an important week for the earnings for the entire US market with key market players. During the earnings, it is not just about the earnings per share (EPS) and revenue but also the outlook that will be key to how the market will respond. If the general sentiments remain bearish, the whole economy could tank or continue its decline.

Google

Google has tasted a challenging year with a 21.38% drop from a year ago. It seems to be hanging around a strong support zone around 138. Despite the recent split, Google is still on the decline.

From the investing dot com, the forecast of EPS and revenue for Google (C) stands at 1.28 and 70.04B respectively. The fall of EPS from over 25 (Q4/2021) to 1.23 (Q1/2022) remains an area of concern for some investors.

Microsoft

Microsoft has suffered a drop of over 10% from a year ago. As the stock continues to range sideways of the 260 price zone, a wedge seems to be forming. Historically, we can expect a breakout but will it be higher or lower.

For Microsoft, the forecast of EPS and Revenue (for Q2/2022) stands at 2.29 and 52.43B respectively following quarters of beating market estimates. Hopefully, Microsoft can help to lift the sentiment of the market.

Economic Calendar

There are various important events in the coming week of the economic calendar. Personally, there are two of significant importance:

A. Fed Interest Rate Decision

The last Fed interest rate hike was 75 basis points in June. However, this interest rate hike did not curb the raging inflation rate that peaked at 9.1%. While 50 or 75 basis points is what the market expected, we should not be surprised if this goes to 100 basis points.

Fed policymakers continued to anticipate that ongoing increases in the fed funds rate would be appropriate, and backed a 50 or 75 basis points hike in July, FOMC minutes from the June meeting showed. Officials also noted that the US economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.

Typically interest rate increase is negative for the stock market (except for the financial sector). Below is an extract from Investopedia:

|

| Extract from Investopedia about the impact of the interest rate |

Using real estate as an example, the impact of the rise in interest rates can be seen in the following chart (for those who do not have a fixed-rate mortgage repayment scheme):

B. GDP (QoQ) Q2

Gross domestic product (GDP) is the standard measure of the value added created through the production of goods and services in a country during a certain period. As such, it also measures the income earned from that production or the total amount spent on final goods and services (less imports). (Definition from OECD Data)

Source: U.S. Bureau of Economic Analysis:The American economy contracted an annualized 1.6% on quarter in Q1 2022, slightly worse than a 1.5% drop in the second estimate. It is the first contraction since the pandemic-induced recession in 2020 as record trade deficits, supply constraints, worker shortages and high inflation weigh. Imports surged more than anticipated (18.9% vs 18.3% in the second estimate), led by nonfood and nonautomotive consumer goods and exports dropped less (-4.8% vs -5.4%). Also, consumer spending growth was revised lower (1.8% vs 3.1%), as an increase in spending on services, led by housing and utilities was partly offset by a decrease in spending on goods, namely groceries and gasoline. Meanwhile, private inventories subtracted 0.35 percentage points from growth, much less than a 1.09 percentage points drag in the second estimate. Fixed investment growth remained robust (7.4%) but housing investment was subdued (0.4%, the same as in the second estimate).

There are different camps pertaining to the forecast of the Q2 GDP results. As per above, there is a market consensus of 0.4% and TradingEconomics has put out a more bullish estimate of 0.6%. Personally, we should not be surprised if negative GDP growth is reported. If there are 2 quarters of GDP decline (negative growth), this can be deemed as a technical recession. However, the definition of recession in the US has other criteria. SeekingAlpha explained the US recession in the following extract:

A US recession is not defined as two consecutive quarters of negative growth. Rather it is determined by the Business Cycle Dating Committee of the National Bureau of Economic Research, a private non-profit research institution. The NBER looks at a variety of indicators, rather than following a mechanical two-quarter-GDP rule. This comes as a surprise to most people. It is true that the rule-of-thumb of two consecutive quarters of falling GDP is used as the criterion for a recession in most advanced countries. But not in all countries. In the US, the BEA officially recognizes the role of the NBER. This shouldn’t be that surprising. Private non-profit institutions also produce such important economic indicators as Consumer Confidence and the Purchasing Managers Index.

Taking away the definition, the market sentiment is most important. As this does drive (at least) the short-term market response.

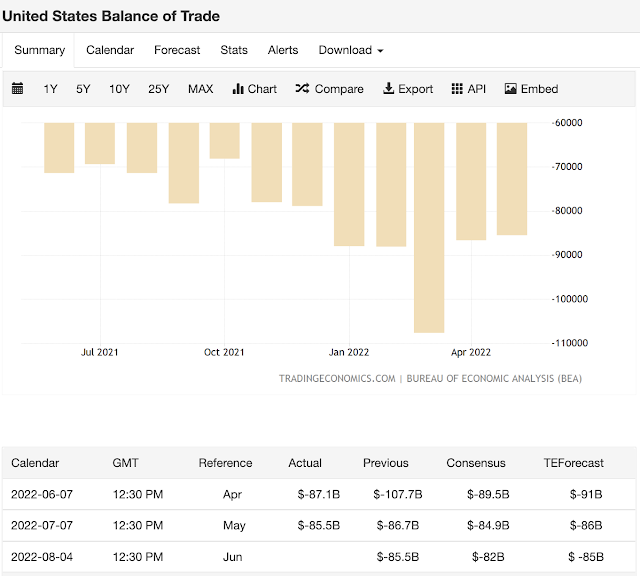

With China's limited export in Q2, the world's factories' disrupted production due to the Covid19 lockdown has caused ripples into other parts of the world. While the amount of trade deficit has decreased, it remained at an elevated level of above $85 billion per month. Currently, the US is consuming much more than its exports.

News & my muse

In the coming macro environment (with coming GDP & interest rate hikes announcements in the coming days), the performance of great companies can be dragged down by macro and market sentiments.

Stocks Waver After Three-Day Rally. The week looks to end in green but a volatile week awaits with an interest rate hike and GDP update.

Shanghai enforces new Covid19 testing as lockdown is extended to various parts of China.

Market Outlook

- The stochastic indicator looks to peak in the overbought region and we could expect the market to decline in the coming week

- The MACD indicator showed an uptrend still. However, interest rate and GDP figures would cause a change in trend if the fears of the recession continue to rise.

- What is of concern is also the dwindling volume. From Yahoo Finance, S&P500 has an average trading volume of 3.9B. In the past week, the volume was between 3.1B and 3.6B (a good 10% to 30% difference from its average).

- Referring to EMA, there has shown a reversal from the recent downtrend.

- Using MA, there is some optimism as the candles have cut the MA50 line from below.

While most of the technical indicators point to an uptrend, it is prudent for us to consider the impact of the coming interest rate hike and GDP announcements. Being one who is more "bearish", there is a chance for the market to respond negatively to the news. Thus, I would recommend caution for this week as I personally will be taking a "watch and hold" status for most positions. I wish that the market can prove me wrong and continue its uptrend.

These are my concerns:

- Russia is "backtracking" from its "truce" with the missile attack on Odesa port (Ukraine) - affecting the grain export

- Monkeypox being declared a global health concern (not pandemic)

- A resurgence of Covid cases in most countries

- Fuel, food & financial duress are affecting many countries (especially developing countries).

- Air travel nightmare - will the re-opening industries of travel, F&B & hotels be affected.

- Fuel price remains elevated though the price has dropped from the recent record high

- Weather extremities of earthquakes, heat waves, fire and more affect the various countries and their agricultural produce.

- Property prices in a record high though there is some cooling of interest following the recent rate hikes

- More news of retrenchment in the market even though the unemployment rate remains low.

Weighing this news and factors, these could weigh heavy on the market, leading to a market decline though we can also expect pockets of brief rallies.

As always, let us research before investing. This is a good time to shortlist companies which we can add to our portfolios. I would remain a spectator (mostly) for this week and am not expecting to take up any new positions.

Comments

Post a Comment