Websites I use for my trade setup - Part 4 of 4 (03Dec2021)

After I got into investing, I started to research various investing gurus. It is no surprise that I found myself attracted to value investors like Warren Buffett, Charlie Munger, Li Lu, Mohnish Pabrai, Guy Spier and Nick Sleep. I have also read up on Chamath Palihapitiya and Ray Dalio. Over time, I saw the success of their investments and started to follow their investments, learning their investing philosophies along the way.

We should not be following the investors blindly just because they are successful. We need to find an investing strategy that fit our goals, our personality, our investment time horizon and risk-reward ratio. If we are willing to research before we buy our mobile phone, car or homes, let us be willing to do the necessary research coming to investments. With managed risks, we would be able to invest with better confidence.

4. Dataroma.com

Dataroma is a website that tracks the 13F filings of the top 73 super investors.

<From Investopedia> The Securities and Exchange Commission's (SEC) Form 13F is a quarterly report that is required to be filed by all institutional investment managers with at least $100 million in assets under management. It discloses their equity holdings and can provide insights into what the smart money is doing in the market.

Do note that this website list only equities listed in the USA and does not include their international (non-USA) positions.

How to apply the information from Dataroma?

In this case, I will be using Mr Charlie Munger (Daily Journal Corp) as an example and focusing on Alibaba as the stock.

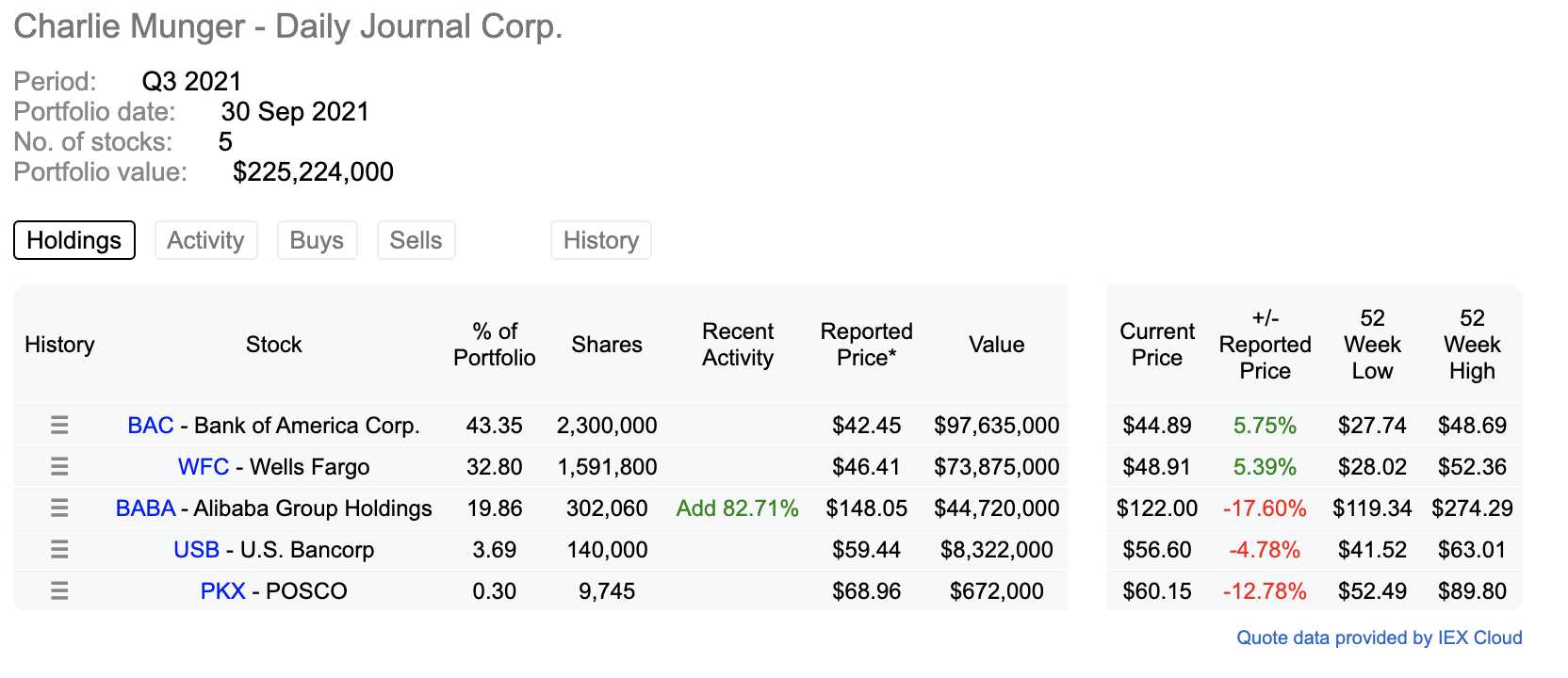

After selecting the super investor, we will be brought to the screen above that shows the last quarterly holdings (as per 30 Sep 2021 in this case of Charlie Munger, Daily Journal Corp). We can see that Mr Munger added 82.7% of $BABA to his portfolio with the “reported” price to be $148.05. This is an estimated price as on the last closing price of the quarter and not necessarily the price paid for his position.

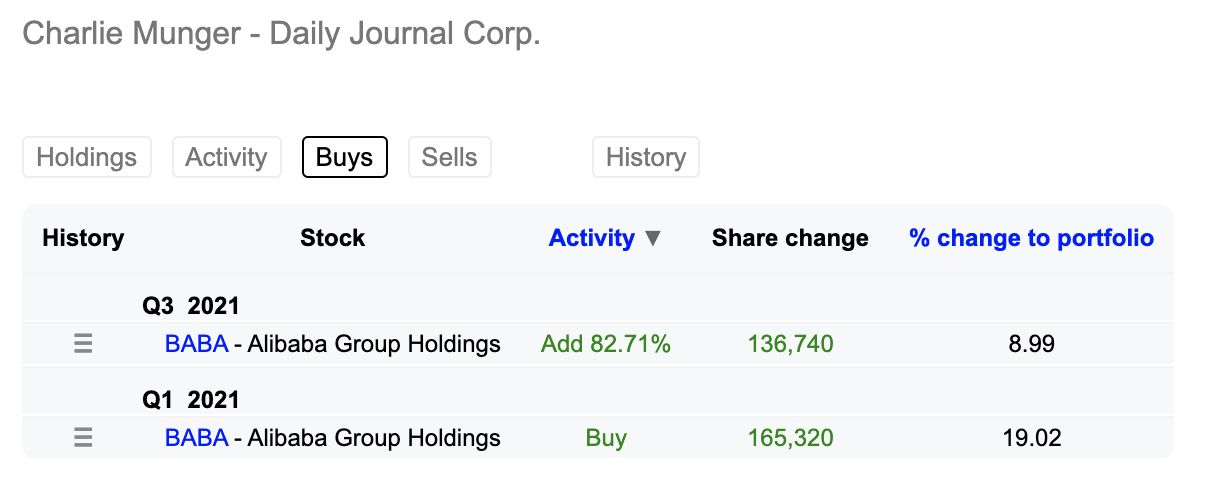

While we do not know the exact price of the transaction, we can find a range of estimated prices of when Mr Munger could purchase the stock. Being a value investor, Mr Munger would pay for “great companies” at “fair value”. This means that $BABA has reached a range deemed “fair price” since Q1/2021. In fact, Mr Munger doubled down on $BABA in Q3/2021, adding 82.71% more into his positions. The range of prices is $214~$270 (Q1/2021) and $141~$216 (Q3/2021). We can deduce that these are the prices deemed to be “fair” to Mr Munger. Personally, a “fair” value is under $226 per Alibaba share.

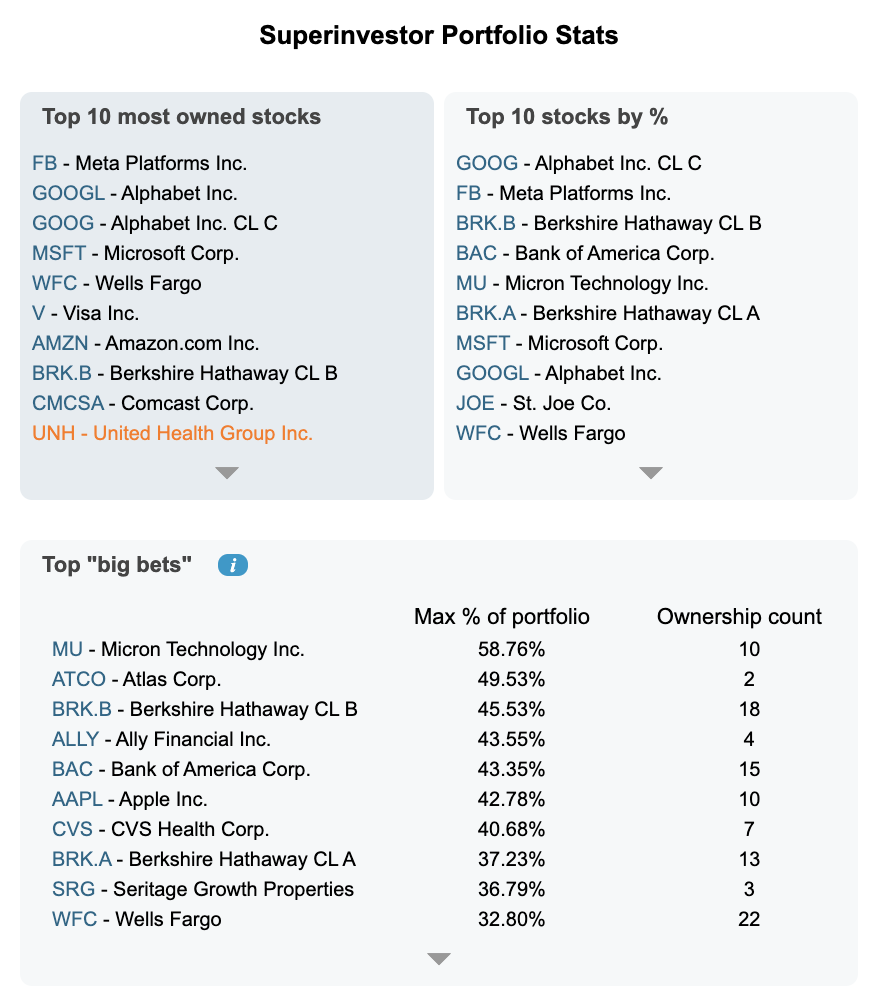

The list above shows the top 10 most stocks of the super investors and their top 10 stocks by 10%. It also lists the stocks with the highest “weightage” in the portfolios of the super investors and the number of super investors who also own these stocks.

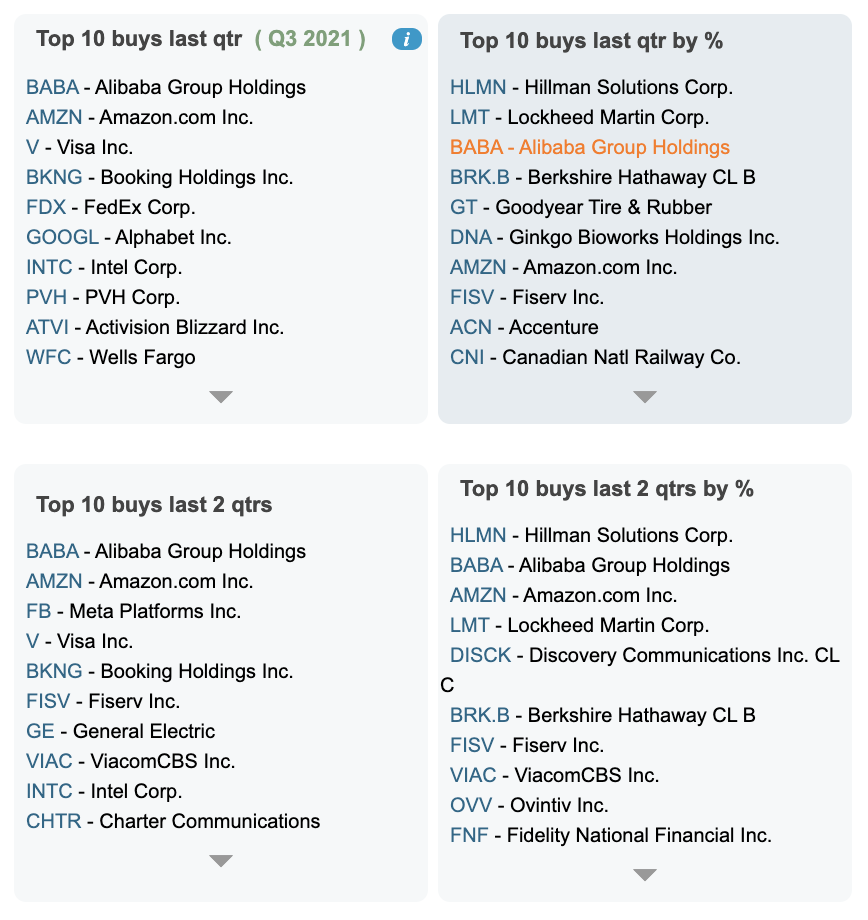

The above shows the top buys from last quarter and also from last 2 quarters. as we see, $Alibaba(BABA)$ is a top purchase for the last 2 quarters.

We need to come to our own conclusion for the fundamentals, the potential of the stocks that we buy. If we are losing sleep over our positions, it is likely that the amount is too big. We can consider a smaller quantum for the next position. Personally, I do not know enough of the 73 super investors but I am following a few as I understand and concur with their investing approach.

Please do not consider this as financial advice. Please do your own due diligence before investing.

Comments

Post a Comment