My investing muse - They share what they want us to see (25Feb2022)

Whenever I review earnings reports or news, I prefer to approach all things with a pinch of salt.

Humans - we tend to see what we want to see and hear what we want to hear. Thus, coming to reports, we may end up picking up details of what we want (or hope) to read.

Coming to investment, it is important for us to be neutral. I used to buy stocks because I loved a company for example Levi's Jeans. However, such love may not always be repaid with profits. We should not forget that we invest with the purpose of profits (first). In such cases, I have learnt that it is best for me to remain as a customer instead of an investor of the business. We cannot mistake our love for their product & services against the intent of profits.

Ideally, we should invest in businesses where we share their purpose. After qualifying the business, I invest into $TSLA because I want to be part of a better and more sustainable future. On top of sustainability, I have faith in the competitive advantages that continue to deliver both value and profits.

In fact, I will prefer to be more critical of the companies that I have invested in. If these are businesses that have been qualified through years of solid financial performances, strong moat (competitive advantages), management with integrity and trending growth, these businesses should be able to withstand the scrutiny that we put the company through. Let us not forget the reports are written by the business to "paint a certain perception and outlook".

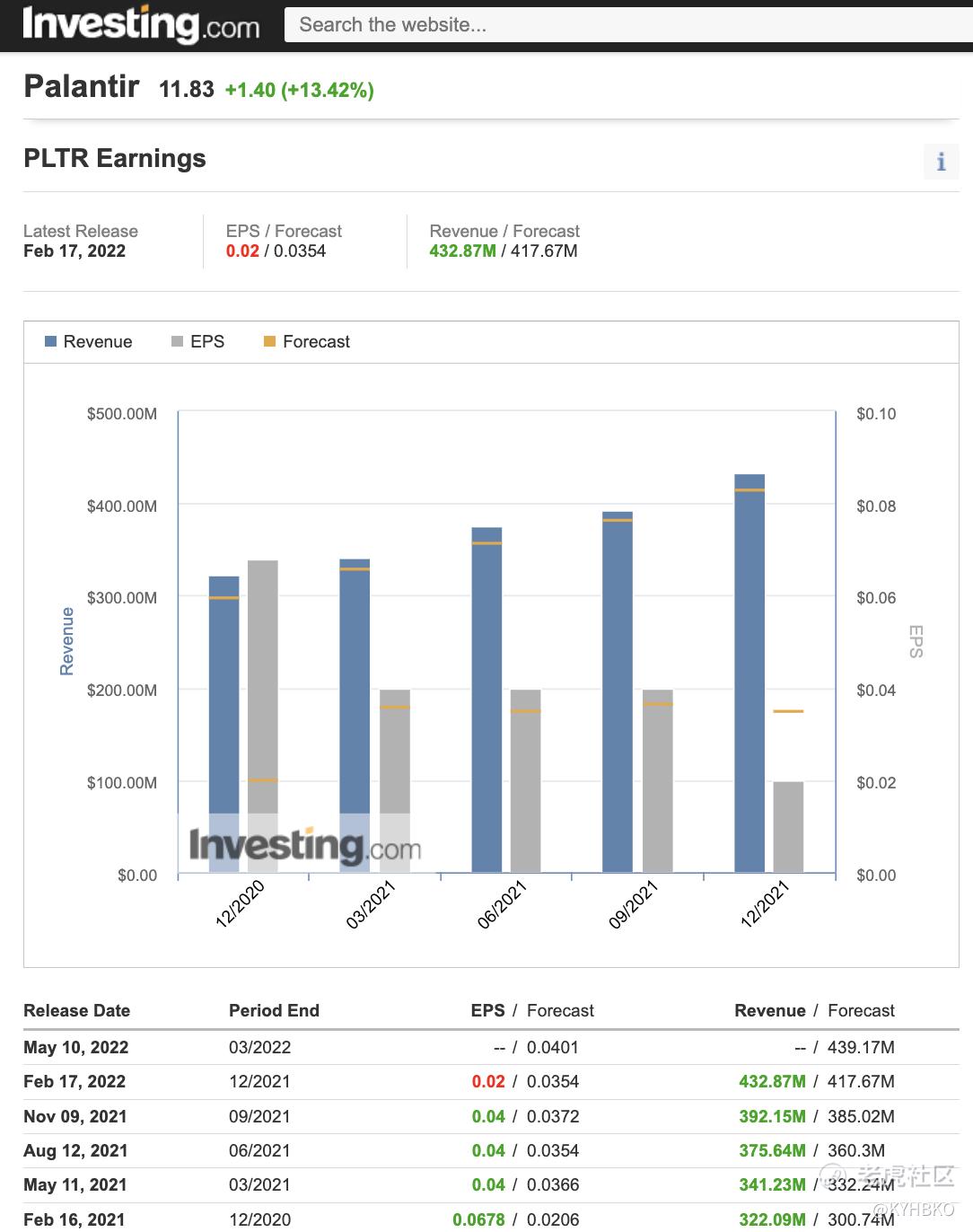

During my recent review of $PLTR, it was reported that the last quarter's EPS was $0.02. This is something I find amiss as the Q4/2021 earnings reported a net loss of $148 million - which should translate to negative EPS. Upon more digging, I found that GAAP net loss per share, diluted of $(0.08) whereas adjusted net earnings per share, diluted was $0.02. I can't help feeling a sense of misrepresentation.

While the financial statements alone do not paint the full picture, it is a good place for us to start reviewing the business through the lens of its financial performance. Let us also look into the performance of their industry and competitors. When I was researching for $FDX (Federal Express), I have taken time into $UPS too.

I do not see myself as a stock buyer. I prefer to see myself as a shareholder who drills into the reports to identify gaps and opportunities for improvements. After all, I have invested my hard-earned money into the business, the least I need is to understand what I have bought. Every earnings report is a chance for me to "re-assess" the business. Do they continue to be on track (leading to me holding the stock) or they are losing their edge (leading me to sell the stock)? These will form the basis of my confidence to hold, add more should prices fall or my rationale to sell. This due diligence helps us to remain disciplined during our investment journey.

Let us do our own due diligence. Happy investing.

Comments

Post a Comment