Review of Alibaba Q4/2021 earnings (26Feb2022)

One of the tech darlings of China

$Alibaba(BABA)$ / $Alibaba(09988)$ has shared their quarterly earnings for the quarter ending 31 Dec 2021 on 24 Feb 2022. This is my review.

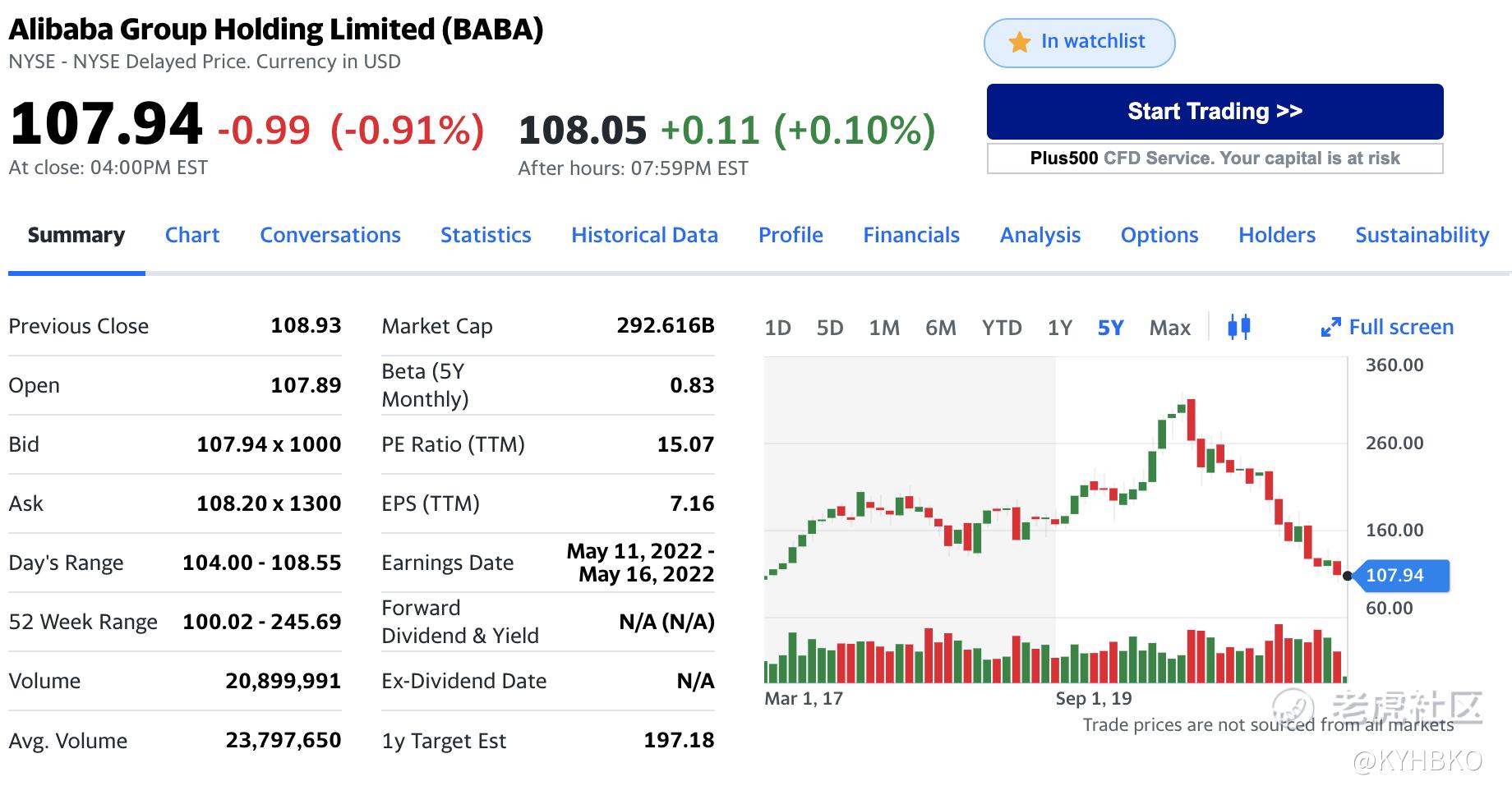

From a 52 week high of 245.69, the stock (last traded at $107.94) is trying to break the downtrend as per the chart above. With a TTM PE ratio of 15.07, is this stock greatly undervalued or is this something that we need to skip?

Some Notable highlights:

- Global annual active consumers reached 1.28 billion as of 31 Dec 2021 with quarterly growth of 43 million. This implied a 27% year over year increase for local customers and 18% for international customers.

- This is made up of 979 million consumers in China and 301 million consumers international (outside of China).

- Alibaba aims to reach carbon neutrality by 2030 and has committed to an additional 1.5 gigatons of decarbonization by 2035, partnering with consumers, customers and partners in their ecosystem

- Revenue Growth of 10% year on year for last quarter of 2021.

- Income from operations came to USD$1.109 billion which included a USD$3.945 billion impairment of goodwill (which may be treated as an exception, not part of the norm). The drop in profits is also caused by increased investment in growth initiatives, merchant support and increased spending for user growth.

- Share re-purchased of USD$1.4 billion in the last quarter (about 10.1 million of ADS)

Let us take a look at the earnings in detail as go into details of the Financial report.

From the table above (for 9 months ending 31 Dec 2021), we can establish the following:

- Growth in all sectors (China commerce, international commerce, local consumer services, Cainiao (logistics services), Cloud, Digital media and entertainment, innovation initiatives and others compared to the same period one year ago.

- for 9 months ending 31 Dec 2020, only China commerce was making profits (using adjusted EBITA). But for 9 months ending 31 Dec 2021, we see profit in both China commerce and Cloud (adjusted EBITA) though the profit margin made by China commerce has dropped from 47% in 2020 to 33% in 2021

- One of the pluses from this report is the reduction of share-based compensation expense from RMB$41.488B (2020) to RMB$27.708B (2021), a reduction of over RMB$11B. Good effort. Good to see efforts to better manage their costs.

- However, all the other sectors (except China commerce and Cloud) continued to make a loss in 9 months ending 31 Dec 2021

Their investment gain reached RMB$5.666 billion. They will need to better manage their expenses. Increasing revenue will not lead to profitability if the expenses that increase proportionately more. With Covid, we have grounds for increase of expenses. The companies who can emerge better are the ones which we need to pay attention to. For Alibaba, their income statement displayed some concerns in their expenses. We need to see improved profitability and margin in the coming earnings.

For the balance sheet, it is good to see an increase in current assets at USD$105 billion and total assets at USD$276 billion as of 31 Dec 2021 whereas total liabilities stood at USD$100 billion. It is healthy that the current assets of USD$105 billion are sufficient to cover both current and long term liabilities totalling USD$100 billion - this implies that there are no concerns about debt repayment. Retained earnings RMB of $554 billion for last quarter compared to $581 billion for last 9 months also implied a positive surge of retained earnings. Retained earnings (RE) is the amount of net income left over for the business after it has paid out dividends to its shareholders. Their investments' values (under noncontrolling interest) saw a small drop to $135 billion from $137 billion (quarter ending 31 March 2021).

Though 9 months ending Dec 31 saw a decrease of RMB$23.295 billion in cash and cash equivalents, the last quarter ending Dec 31 saw a positive increase of RMB$21.955 billion in the same category. Hopefully, this is a reversal of this downtrend.

HOW SHOULD WE INVEST IN ALIBABA

It is hard the disappointment, especially when we see one of the lowest growth for the business. the recent concerns of government measures on the tech companies have led to the slide in prices before the earnings. There are also some positive components. I am left feeling contented, but I wished that I can be more "excited". With the world managing the Ukraine crisis, recovering from Covid and battling the global inflationary pressures, the path ahead can be challenging but hopefully, we have seen the worst of the company. I would continue to add shares (dollar costs average), hopeful for a "rocky" uptrend.

Please do your due diligence before you invest.

#myinvestingmuse #alibaba #earnings #review

Comments

Post a Comment