My investing muse - What causes stock prices to drop - black swan “omicron" (26Nov2021)

On 26 Nov 2021, the global stock market took a hit due to concerns of a new Covid19 variant from Africa that was reported in South Africa, Europe, Japan & Hong Kong. WHO has named this variant “omicron". This has led to Dow dropping 900 points on Black Friday, the single biggest day drop this year. The good news reported was that this variant can be detected using PCR testing. Vaccine makers are already checking the effectiveness of their vaccine with $Moderna, Inc.(MRNA)$ looking into variant-specific treatments/vaccines.

The stock market did not take the news too well and the drop in price of crude oil was a clear sentiment about how this can affect the spending. With concerns, countries imposing lockdowns & limiting air travel, there has spooked the market, causing what is typically known as a "black swan event".

As per the supply and demand curve above (from Britannica), price (of stock) is the result of supply (quantity) and demand (buying & selling). With a drop in demand, the price drops typically. Likewise, the increase in demand (with the assumption of the same quantity of shares available) will typically lead to an increased price.

However, we need to understand what causes the drop in price so that we can make better decisions coming to selling and holding a stock. Essentially, if the company continues to have good fundamentals, a durable competitive advantage, the drop of prices into “fair value” can turn out to be buying opportunities instead of selling.

A drop in prices in individual companies can be affected by a mixture of reasons:

- Overall market decline as an unfavourable trend?

- Sector decline caused by rotation - when investors turn to value stock instead of growth due to foreseeable interest rates increase?

- Competition winning over market shares?

- Disruptive technologies - for example, affordable sustainable energy versus fossil fuels?

- Political event - trade war, sanctions, etc?

- Regulatory changes - like China banning crypto mining?

- Profit-taking?

- Black swan event - weather event, pandemic, war,?

- Fundamental changes - total addressable market size, revenue, profit, net assets, free cash flow?

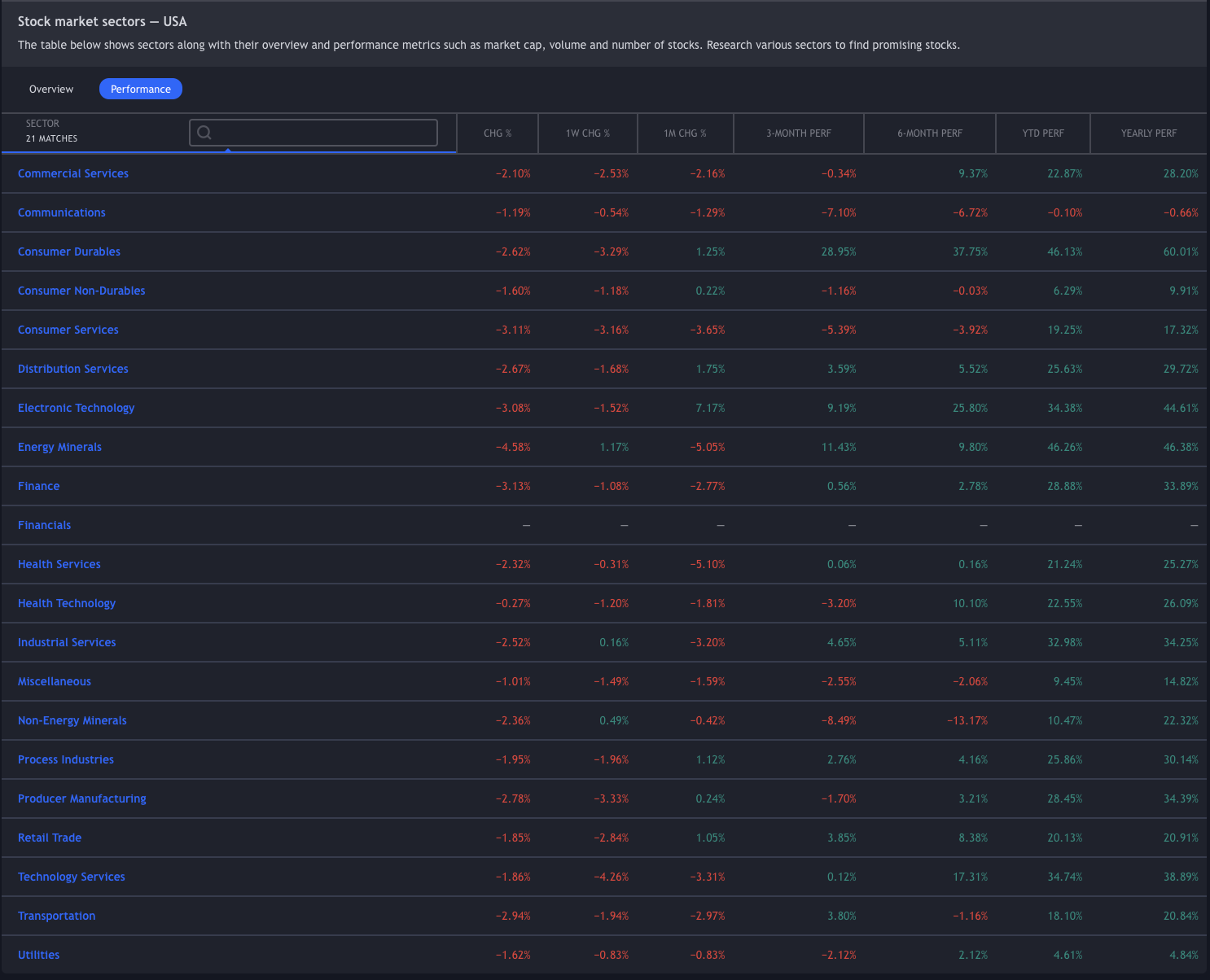

The table above is extracted on 27 Nov 2021, 9.50am Singapore local time. As per the table, the whole US market is down, with EVERY sector suffering drop. This is a typical “market-wide” drop caused by the black swan event of omicron. If it is a typical drop across the entire market, holding the stock is recommended.

For cyclical stocks, their prices typically follow the rise and fall of the economy and this typically affects most/all companies in the same sector where car makers, travel & entertainment are examples.

Black swan events have different duration and severity of impact. For long term traders, it is not an issue for us as these are just some blips in the short term. Thus, there is no need for concerns if we have invested in good companies - whose fundamentals would have no issues dealing with such matters. While there are opportunities for bargain hunting, I recommend first qualifying the fundamentals before we use technicals to enter positions. Personally, I look at 1 Day or 1 Week charts so that the short term volatility is taken out. However, I will keep a lookout for my “list of good companies” to buy new positions should they reach “fair value”.

Sometimes, not buying stocks can be the best decision for the day. Sometimes, we should just watch the black swans fly in and out and hold on to the investments of the good businesses.

Comments

Post a Comment