My investing muse - How should we invest during market corrections or crashes (04Nov2021)

Market dips or corrections are part of the journey of investing.

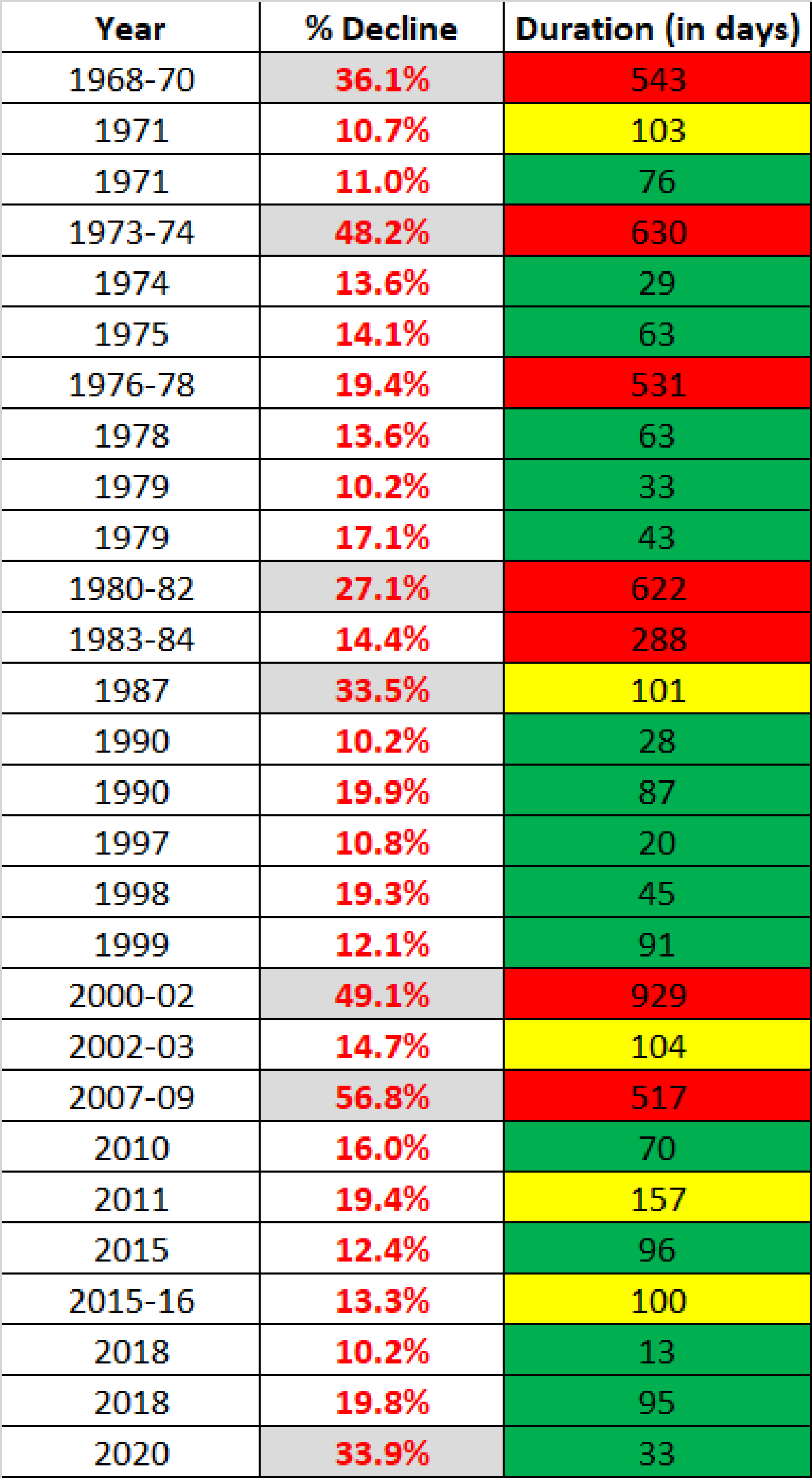

Peter Lynch shared that in 93 years, the market saw about 50 market corrections (or dips that are more than 10%) and out of these 50 corrections, 15 of them will be more than 25% in drop. Thus, this implies that in an average of every 2 years, we should experience a market correction of more than 10% and every 6 years, a crash of more than 25%. From another source, a correction is generally agreed to be a 10% to 20% drop in value from a recent peak. This can happen to a single company or market as a whole. A market crash is usually a more than a 20% drop in value in the market.

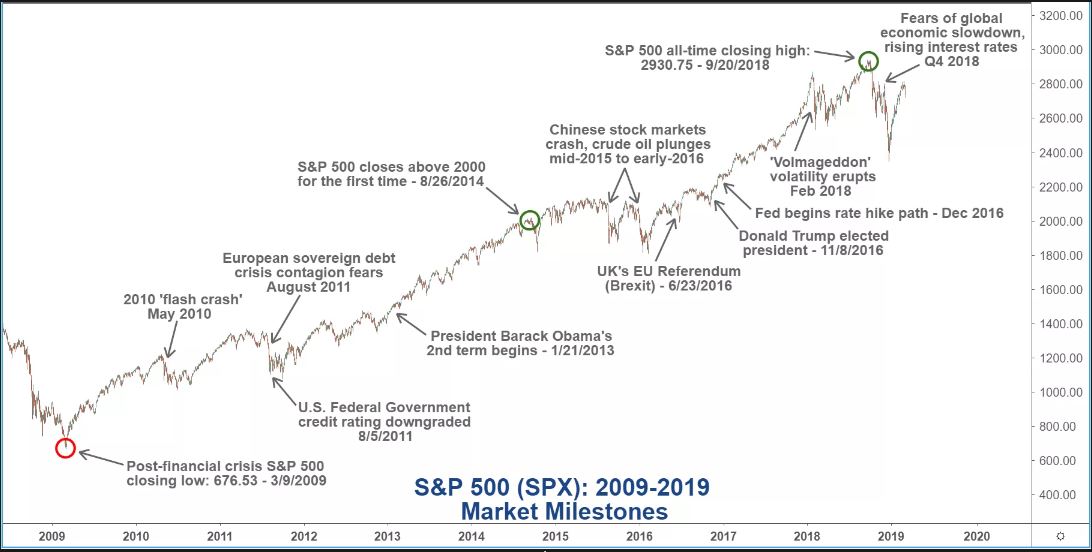

The chart above shows an important element - the market always recovers after such corrections (listed by the various corrections from 2009 to 2018). As per 4th Nov 2021 (GMT+8hrs), S&P500 stands at 4660 is way beyond the 2800+ seen on the chart ending Q4/2018.

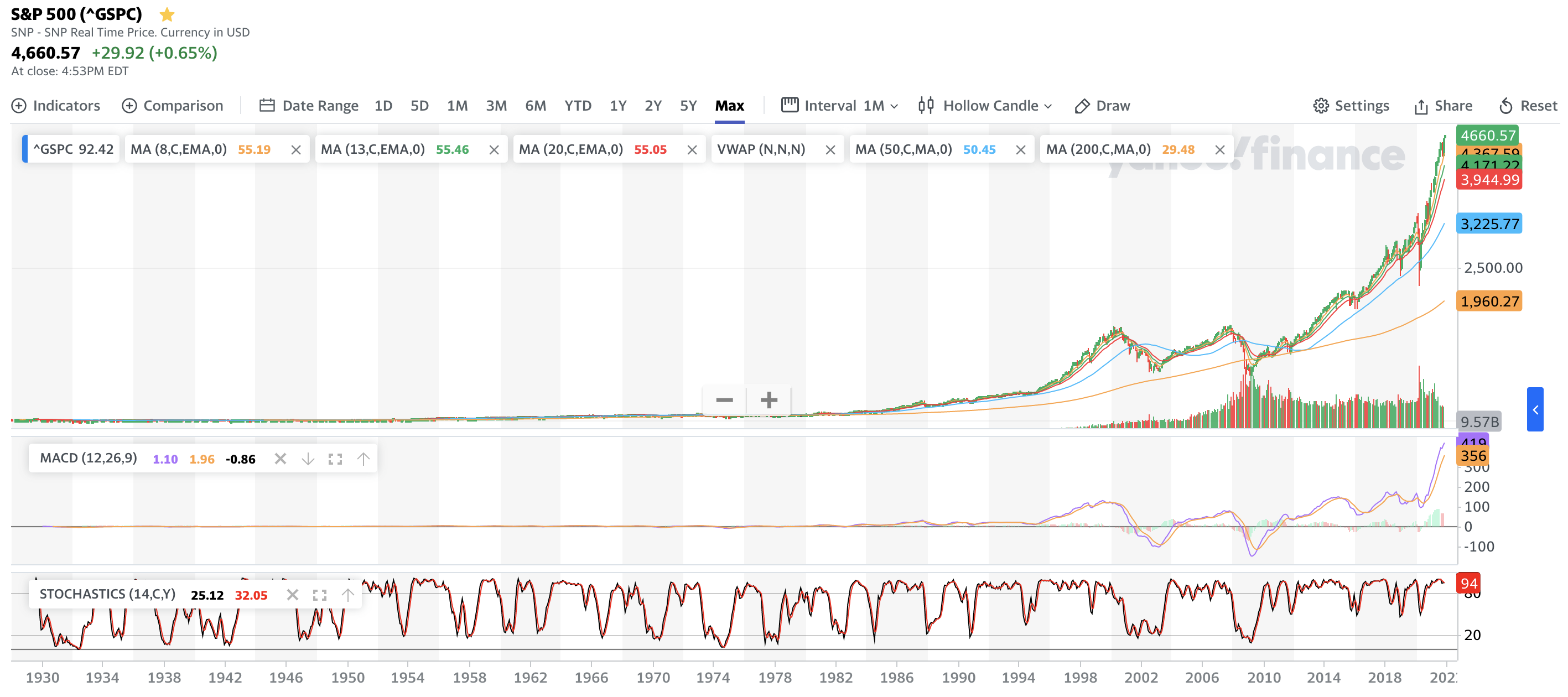

From the chart above (1930 to 2021), we see a strong uptrend of the S&P 500 despite the various market corrections.

The table above is taken from www.fool.com which shows the extent of the drop in value and the duration of such drops in a number of days. The longest recent DOT.COM crash took 929 days for the market to recover but eventually, the market did recover.

If we are holding on to stocks from companies with good fundamentals, holding on to them during corrections or crashes is vital. We should not sell in panic. If we have excess funds, market corrections and crashes are good opportunities for us to add to them. Let us be patient to add to the positions - do not be in a hurry to add to the positions. Mr Warren Buffett said that it is wise for "investors to be fearful when others are greedy, and greedy when others are fearful”.

For part-time investors, we should invest with what we have on hand and what we can afford to lose. Thus, investing using leverage is not prudent and would require much risk management. Let us remember: time in the market is more important than timing the market. Here is wishing all Happy Diwali and investing safely.

Comments

Post a Comment