My investing muse - Delisting of $DIDI, the impact, OTC & ADS (04Dec2021)

$DiDi Global Inc.(DIDI)$ made the following announcement to delist their stock from the US stock exchange on 2nd Dec 2021.

DIDI announcement 02 Dec 21

BEIJING--(BUSINESS WIRE)-- DiDi Global Inc. (the “Company”) (NYSE: DIDI), the world’s leading mobility technology platform, today announced that its board of directors (the “Board”) has authorized and supports the Company to undertake the necessary procedures and file the relevant application(s) for the delisting of the Company’s ADSs from the New York Stock Exchange, while ensuring that ADSs will be convertible into freely tradable shares of the Company on another internationally recognized stock exchange at the election of ADS holders. The Company will organize a shareholders meeting to vote on the above matter at an appropriate time in the future, following necessary procedures. The Board has also authorized the Company to pursue a listing of its class A ordinary shares on the Main Board of the Hong Kong Stock Exchange.

Investing.com explain ADS as the following:

An American depositary share (ADS) is an equity share of a non-U.S. company that is held by a U.S. depositary bank and is available for purchase by U.S. investors. The entire issuance of shares by a foreign company is called an American Depositary Receipt (ADR), while the individual shares are referred to as ADSs.

For companies to be listed as ADR, there are requirements as extracted from www.fidelity.com:

Level 2 ADRs can be listed on a US stock exchange. But shares must be registered with the SEC, and the company is required to file an annual report (on Form 20-F, not Form 10-K) that conforms to the US generally accepted accounting principles (GAAP) standards. It must also meet the exchange's listing requirements.

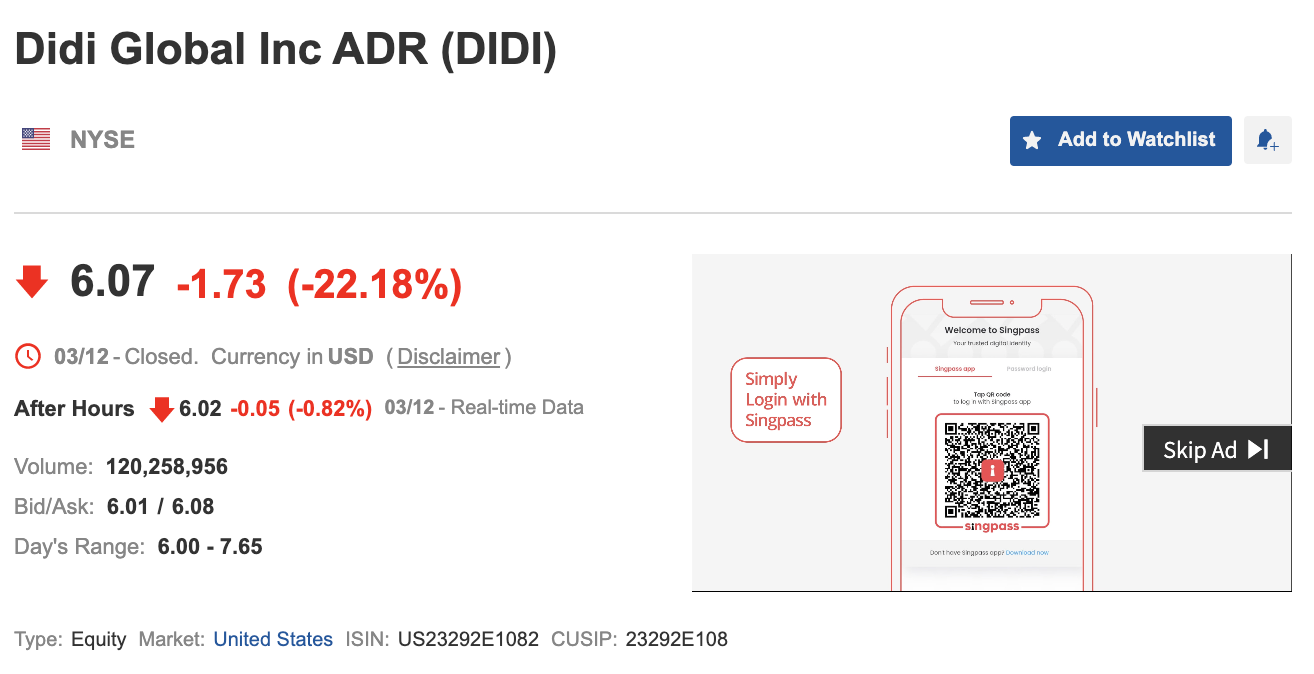

Screenshot from investing.com where you can find DIDI listed as ADR

Back to the case of DIDI

DIDI’s management has advised that they will delist from NYSE and will register instead of in HKSE. DIDI management has assured that the ADS DIDI stocks will be converted into freely traded shares on another internationally recognised stock exchange. In the end, existing DIDI shares will be transferred and traded in a different (non-US) stock exchange. Using HSBC bank as an example, we can purchase shares of the company from international exchanges in US, UK & Hong Kong.

For due diligence, let us check on the different taxes, fees, regulations from the different stock exchanges. In the end, we will still own DIDI stocks if we hold on to them. For investors from Singapore, this may be better especially, there is no withholding tax for HKSE stock dividends if DIDI issues dividends in the future.

With this information, we should avoid panic selling especially if our research leads us to believe in the fundamentals & profitability of DIDI. Thus, if other China stocks are delisted, similar arrangements should follow. Let us remember that DIDI will be delisted due to the government's data security concerns - which may not apply for all Chinese companies listed in US stock exchanges. Let us do our due diligence before we invest.

Additional info about OTC stocks and the differences with ADR:

Over-the-counter (OTC) securities are those that are not listed on an exchange like the New York Stock Exchange (NYSE) or Nasdaq. Instead of trading on a centralized network, these stocks trade through a broker-dealer network. ... They are also low-priced and are thinly traded. These OTC companies are not required to file annual reports, audits or meet SEC listing requirements.

Difference between ADR & OTC shares (as per from www.schwab.com)

American depositary receipts (ADRs) are negotiable securities issued by a bank that represent shares in a non-U.S. company. These can trade in the U.S. both on national exchanges and in the over-the-counter (OTC) market, are listed in U.S. dollars, and generally represent a number of non-U.S. shares to one ADR.

Comments

Post a Comment